ASAP thx

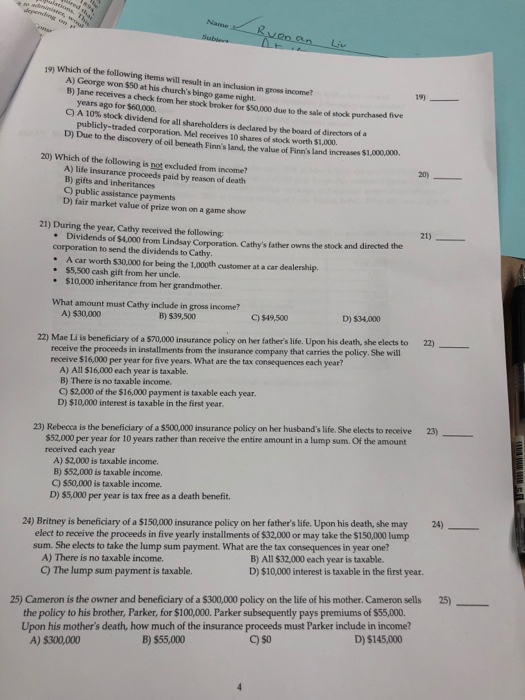

894 ared salatas T depending y Name J Kvon an Consr Liv Subiers 19 Which of the following items will result in an inclusion in gross income? A) George won $50 at his church's bingo game night B) Jane receives a check from her stock broker for $50.000 due to the sale of stock purchased five years ago for $60,000. 9A 10% stock dividend for all shareholders is declared by the board of directors of a publicly-traded corporation. Mel receives 10 shares of stock worth $1,000. D) Due to the discovery of oil beneath Finn's land, the value of Finn's land inCreases $1,000,000 19) 20) 20) Which of the following is not excluded from income? A) life insurance proceeds paid by reason of death B) gifts and inheritances C) public assistance payments D) fair market value of prize won on a game show 21) 21) During the year, Cathy received the following Dividends of $4.000 from Lindsay Cornoration, Cathy's father owns the stock and directed the corporation to send the dividends to Cathy. A car worth $30,000 for being the 1,000th customer at a car dealership. $5,500 cash gift from her uncle. $10,000 inheritance from her grandmother. What amount must Cathy include in gross income" A) $30,000 D) $34.000 C) $49,500 B) $39,500 22) receive the proceeds in installments from the insurance company that carries the policy. She will receive $16,000 per year for five years. What are the tax consequences each year? A) All $16,000 each year is taxable. B) There is no taxable income. C) $2,000 of the $16,000 payment is taxable each year. D) $10,000 interest is taxable in the first year. 22) Mae Li is beneficiary of a $70,000 insurance policy on her father's life. Upon his death, she elects to 23) Rebecca is the beneficiary of a $500,000 insurance policy on her husband's life. She elects to receive $52,000 per year for 10 years rather than receive the entire amount in a lump sum. Of the amount received each year A) $2,000 is taxable income. B) $52,000 is taxable income. C) $50,000 is taxable income. D) $5,000 per year is tax free as a death benefit. 23) 24) 24) Britney is beneficiary of a $150,000 insurance policy on her father's life. Upon his death, she may elect to receive the proceeds in five yearly installments of $32,000 or may take the $150,000 lump sum. She elects to take the lump sum payment. What are the tax consequences in year one? B) All $32,000 each year is taxable. D) $10,000 interest is taxable in the first year. A) There is no taxable income. C) The lump sum payment is taxable. 25) 25) Cameron is the owner and beneficiary of a $300,000 policy on the life of his mother. Cameron sells the policy to his brother, Parker, for $100,000. Parker subsequently pays premiums of $55,000. Upon his mother's death, how much of the insurance proceeds must Parker include in income? A) $300,000 D) $145,000 C) $0 B) $55,000