Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP

ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT ASAP URGENT

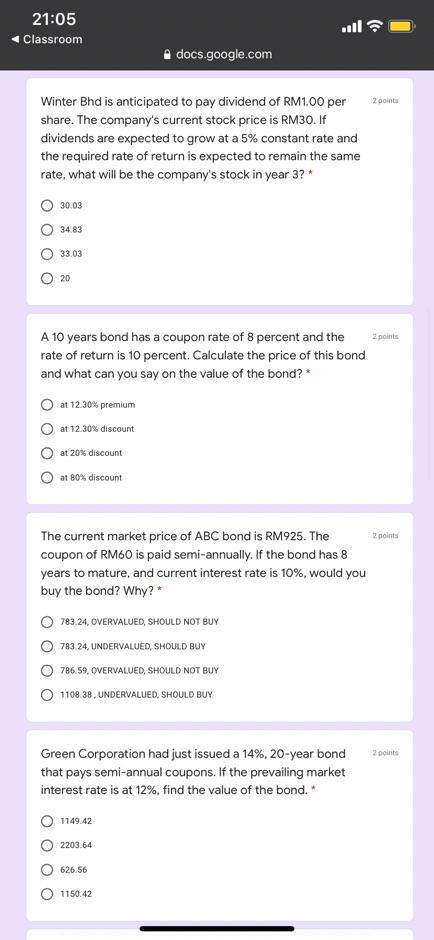

21:05 Classroom docs.google.com 2 pointe Winter Bhd is anticipated to pay dividend of RM1.00 per share. The company's current stock price is RM30. If dividends are expected to grow at a 5% constant rate and the required rate of return is expected to remain the same rate, what will be the company's stock in year 3? * 30.03 34.83 33.03 20 2 points A 10 years bond has a coupon rate of 8 percent and the rate of return is 10 percent. Calculate the price of this bond and what can you say on the value of the bond? at 12.30% premium at 12.30% discount at 20% discount at 80% discount 2 points The current market price of ABC bond is RM925. The coupon of RM60 is paid semi-annually. If the bond has 8 years to mature, and current interest rate is 10%, would you buy the bond? Why?* 783.24, OVERVALUED, SHOULD NOT BUY 783 24, UNDERVALUED, SHOULD BUY 786.59, OVERVALUED, SHOULD NOT BUY 1108.38, UNDERVALUED, SHOULD BUY 2 points Green Corporation had just issued a 14%, 20-year bond that pays semi-annual coupons. If the prevailing market interest rate is at 12%, find the value of the bond. 1149.42 2203.64 626 56 0115042Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started