Answered step by step

Verified Expert Solution

Question

1 Approved Answer

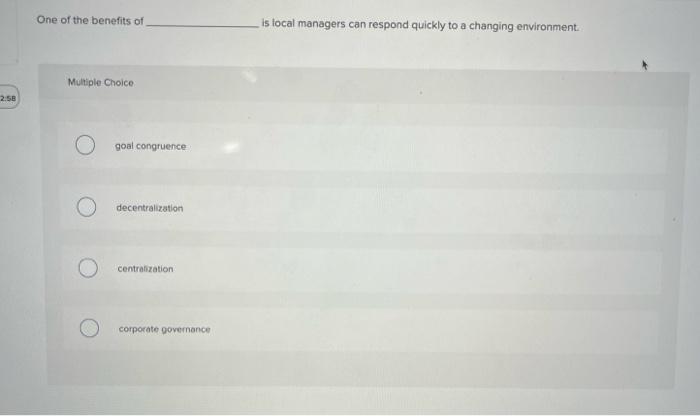

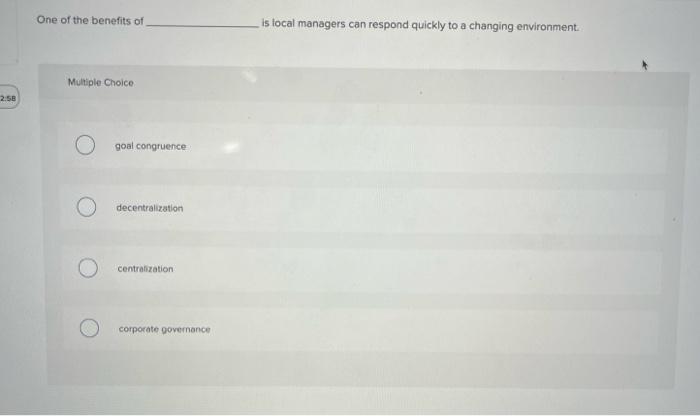

ASAPPP!!!!! One of the benefits of is local managers can respond quickly to a changing environment Multiple Choice 2.58 goal congruence decentralization centralization corporate governance

ASAPPP!!!!!

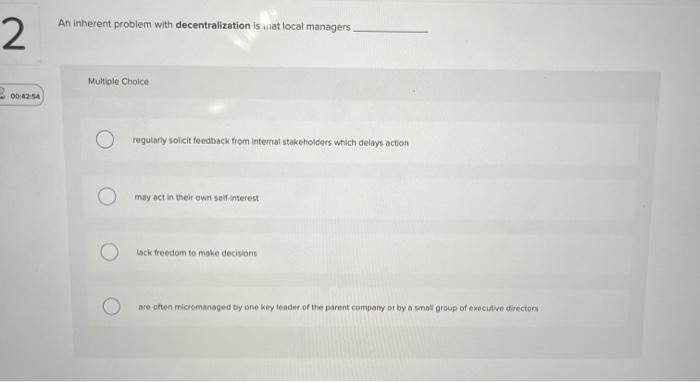

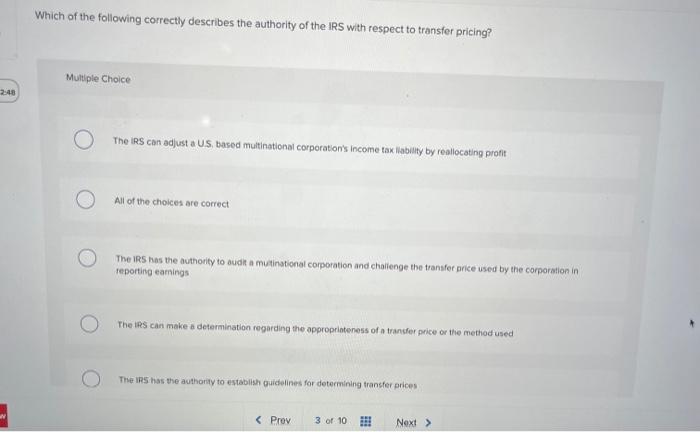

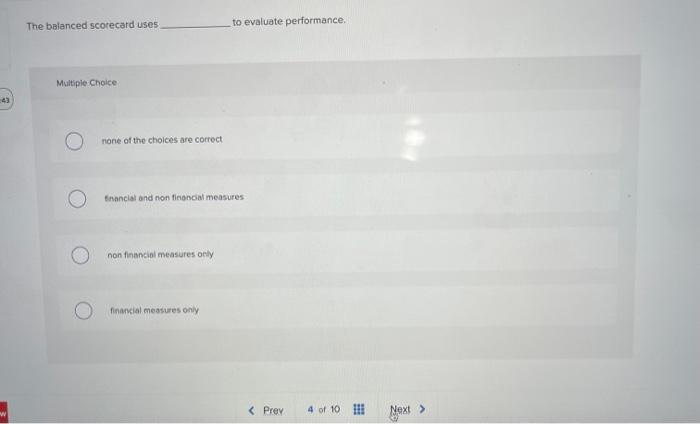

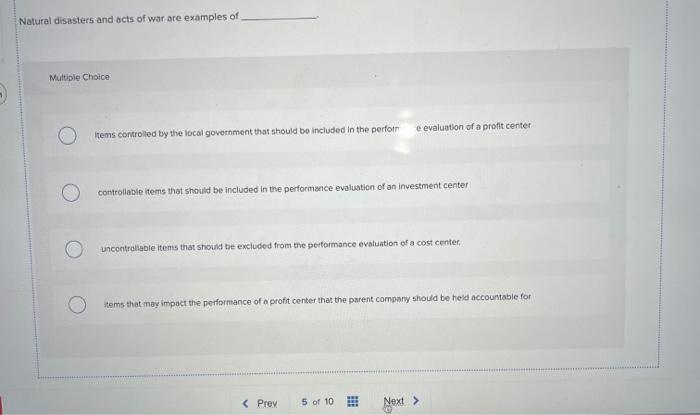

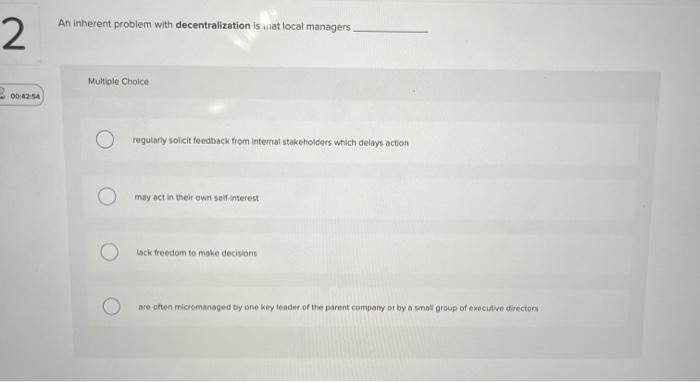

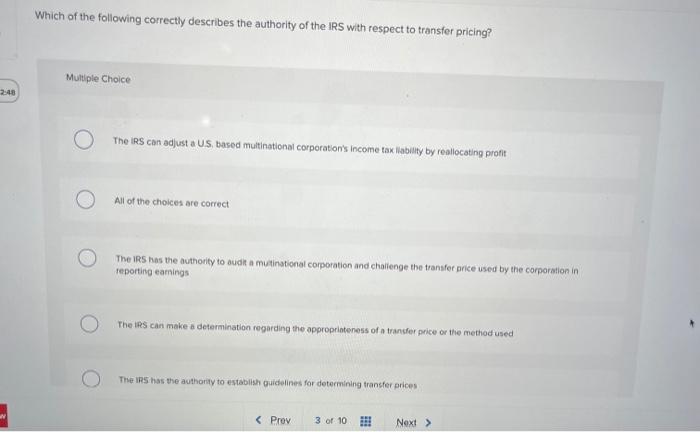

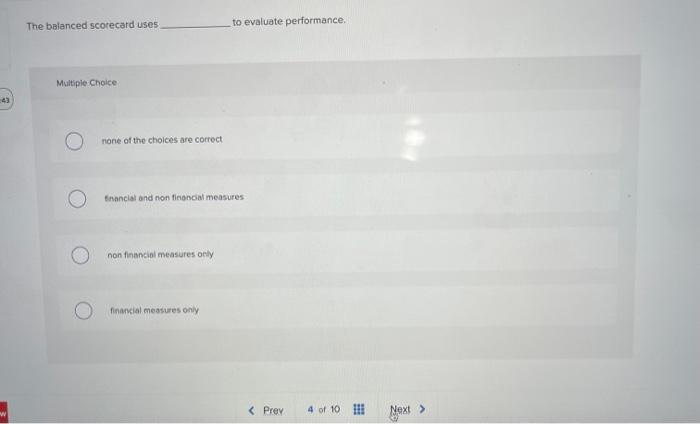

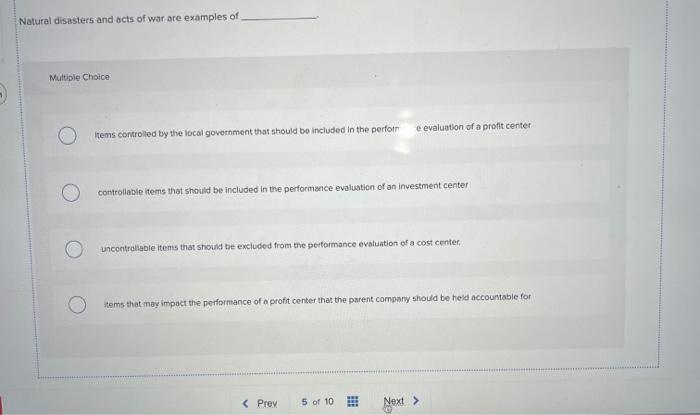

One of the benefits of is local managers can respond quickly to a changing environment Multiple Choice 2.58 goal congruence decentralization centralization corporate governance An inherent problem with decentralization is wat local managers 2 Multiple Choice 2 00:42:54 regularly solicit feedback from internal stakeholders which delays action may act in their own self interest lack freedom to make decisions Bro otton micromanaged by one key leader of the parent company or by a small group of executive directors Which of the following correctly describes the authority of the IRS with respect to transfer pricing? Multiple Choice 2:48 O The IRS can adjust a US based multinational corporation's income tax liability by reallocating profit All of the choices are correct The IRS has the authority to audit a multinational corporation and challenge the transfer price used by the corporation in reporting earings The IRS can make a determination regarding the appropriateness of a transfer price or the method used The IRS has the authority to establish guidelines for determining transfer prices The balanced Scorecard uses to evaluate performance. Multiple Choice none of the choices are correct financial and non financial measures non financial measures only financial measures only Natural disasters and acts of war are examples of Multiple Choice e evaluation of a profit center items controlled by the local government that should be included in the perform controllable items that should be included in the performance evaluation of an investment center uncontrollable items that should be excluded from the performance evaluation of a cost center, stems that may impact the performance of a profit center that the parent company should be held accountable for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started