Answered step by step

Verified Expert Solution

Question

1 Approved Answer

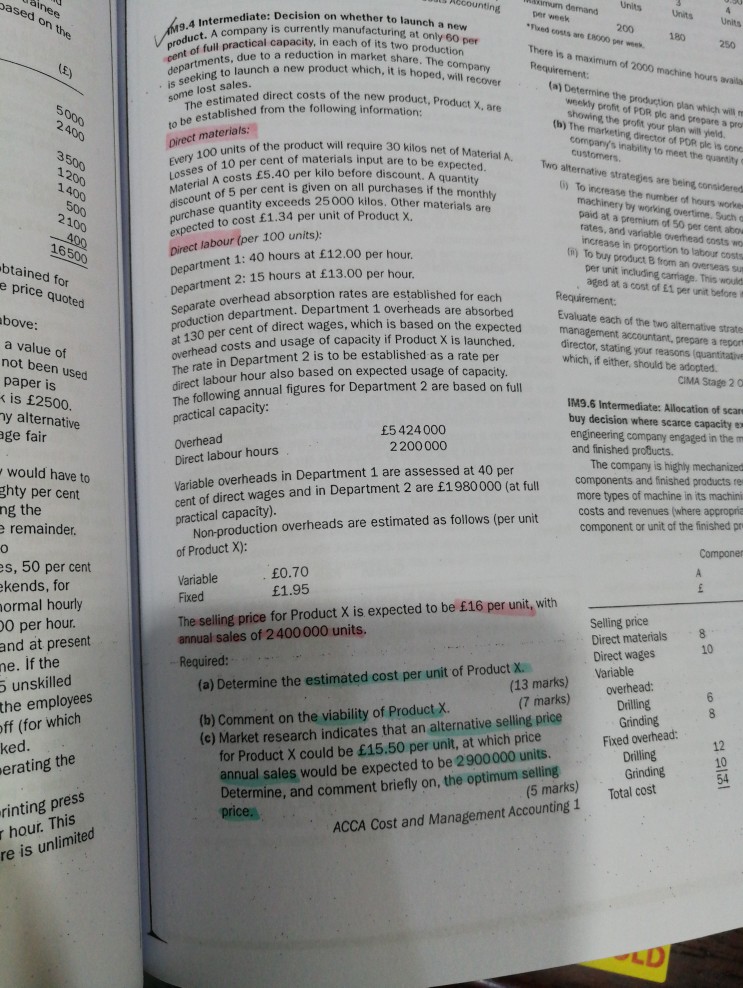

ased mediate: Decision on whether to launch a nev on the Flxed costs are EPO0O per week uct. A compary is currently manufacturing at on

ased mediate: Decision on whether to launch a nev on the Flxed costs are EPO0O per week uct. A compary is currently manufacturing at on of fuil practical capacity in each of its two prodi 180 There is a maximum of 2000 machine hours availa cetnts, due to a reduction in market share to launch a new product which, it is hoped, will recover (a) Determine the production plan which d direct costs of the new product, Product X, are weekfly profit of PDR ple and prepare a showing the profit your plan will yeid The marketing, director of POR ple is cone ished from the following information: to be pirect ma o the product will require 30 kilos net of Material A. customers. 10 per cent of materials input are to be expected count o st s 5.40 per kilo before discount. A quantity r cent is given on all purchases if the monthly )To increase the number of hours worke machinery by working, overtime. Such c paid at a premium of 50 per cent abou rates, and variable overhead costs wo increase in proportion to labour costs tn) To buy product B from an overseas su per unit including carriage. This would aged at a cost of E1 per unit before t uantity exceeds 25000 kilos. Other materials are abour (per 100 units): Department 1: 40 hours at 12.00 per hour btained for e price quoted Department 2: 15 hours at 13.00 per hour. e overhead absorption rates are established for each ction department. Department 1 overheads are absorbed produ at 130 per Evaluate each of the two strate management accountant, prepare a repon director, stating your reasons (quantitative cent of direct wages, which is based on the expected a value of not been used overhead costs and usage of capacity if Product X is launcmanagement accltemative strate e in Department 2 is to be established as a rate per which, if either, should be adopted. direct labour hour also based on expected usage of capacity. The following annual figures for Department 2 are based on ful practical capacity: CIMA Stage 2 is 2500 y alternative IM9.6 Intermediate: Allocation of scare buy decision where scarce capacity e engineering company engaged in the m 5 424000 2 200000 Direct labour hours Variable overheads in Department 1 are assessed at 40 per would have to ghty per cent remainder es, 50 per cent cent of direct wages and in Department 2 are 1980000 (at full components and finished products more types of machine in its machini costs and revenues (where appropri component or unit of the finished pr practical capacity). Non-production overheads are estimated as follows (per unit of Product X): for hourly ekends, Fixed The selling price for Product X is expected to be 16 per unit, with annual sales of 2400000 units. ormal ur. at present Direct materials 8 and 10 ire (a) Determine the estimated cost per unit of Product X. (b) Comment on the viability of Product X. o unskilled (13 marks) overhead: the employees ff (for which for Product X could be 15.50 per unit, at which price annual sales would be expected to be 2900000 units. Determine, and comment briefly on, the optimum seing (c) Market research indicates that an alternative selling price Fixed overhead: ked. 12 the erating 54 press rinting hour. This ACCA Cost and Management Accounting 1 r is unlimited re

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started