Answered step by step

Verified Expert Solution

Question

1 Approved Answer

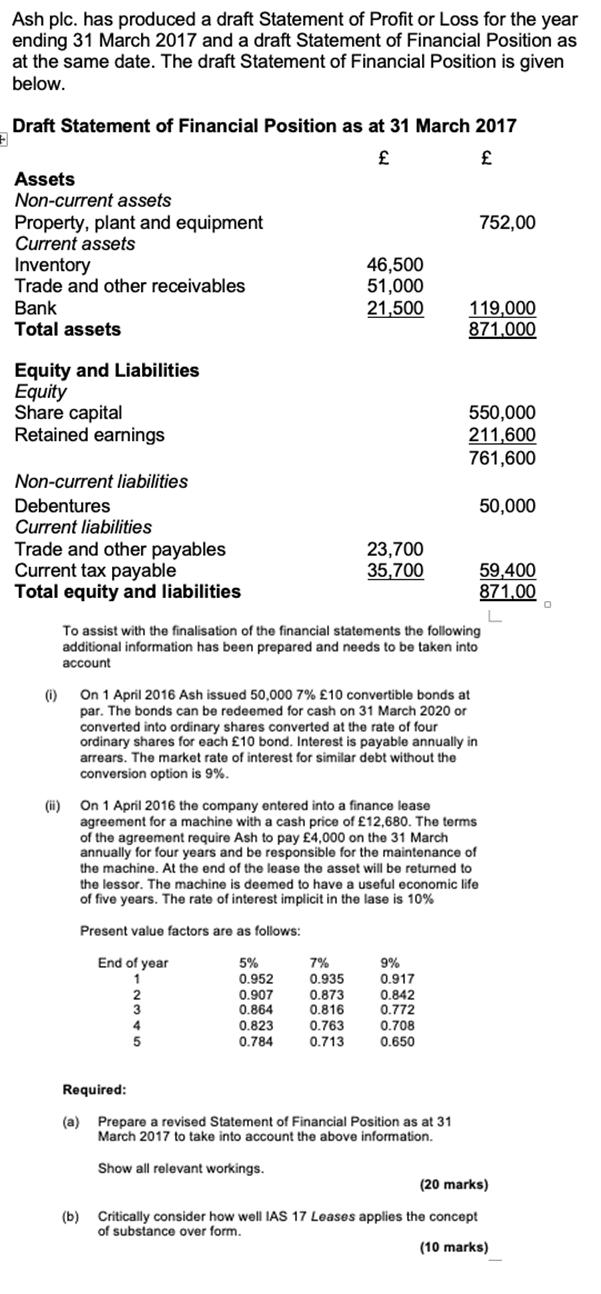

Ash plc. has produced a draft Statement of Profit or Loss for the year ending 31 March 2017 and a draft Statement of Financial

Ash plc. has produced a draft Statement of Profit or Loss for the year ending 31 March 2017 and a draft Statement of Financial Position as at the same date. The draft Statement of Financial Position is given below. Draft Statement of Financial Position as at 31 March 2017 F Assets Non-current assets Property, plant and equipment Current assets Inventory Trade and other receivables Bank Total assets Equity and Liabilities Equity Share capital Retained earnings Non-current liabilities Debentures Current liabilities Trade and other payables Current tax payable Total equity and liabilities (0) 2 3 46,500 51,000 21,500 4 5 23,700 35,700 On 1 April 2016 Ash issued 50,000 7% 10 convertible bonds at par. The bonds can be redeemed for cash on 31 March 2020 or converted into ordinary shares converted at the rate of four ordinary shares for each 10 bond. Interest is payable annually in arrears. The market rate of interest for similar debt without the conversion option is 9%. 5% 0.952 0.907 0.864 0.823 0.784 To assist with the finalisation of the financial statements the following additional information has been prepared and needs to be taken into account 7% 0.935 0.873 0.816 0.763 0.713 (ii) On 1 April 2016 the company entered into a finance lease agreement for a machine with a cash price of 12,680. The terms of the agreement require Ash to pay 4,000 on the 31 March annually for four years and be responsible for the maintenance of the machine. At the end of the lease the asset will be returned to the lessor. The machine is deemed to have a useful economic life of five years. The rate of interest implicit in the lase is 10% Present value factors are as follows: End of year 1 9% 0.917 0.842 752,00 119,000 871,000 0.772 0.708 0.650 550,000 211,600 761,600 50,000 Required: (a) Prepare a revised Statement of Financial Position as at 31 March 2017 to take into account the above information. Show all relevant workings. 59,400 871,00 L (20 marks) (b) Critically consider how well IAS 17 Leases applies the concept of substance over form. (10 marks)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Revised Statement of Financial Position as at 31 March 2017 Assets Noncurrent assets Property plan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started