Answered step by step

Verified Expert Solution

Question

1 Approved Answer

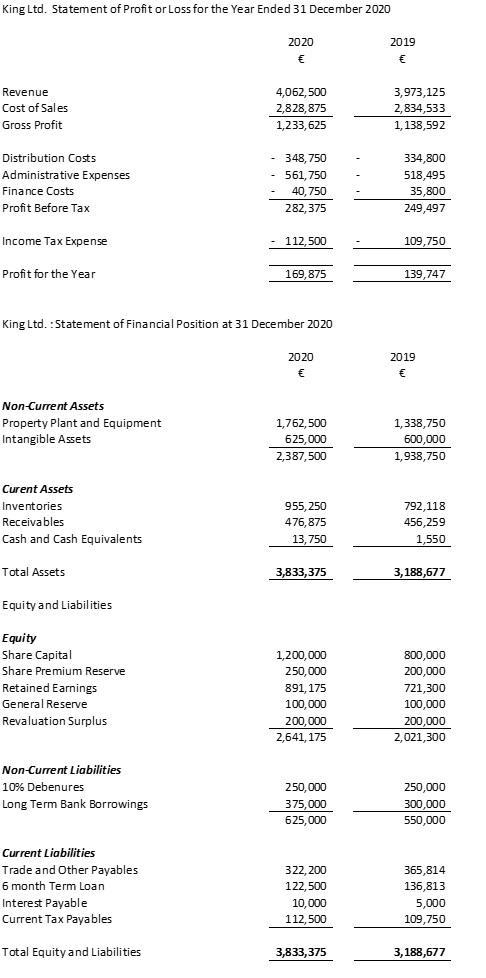

King Ltd. Statement of Profit or Loss for the Year Ended 31 December 2020 2020 2019 4,062,500 3,973,125 Revenue Cost of Sales 2,828,875 2,834,533

King Ltd. Statement of Profit or Loss for the Year Ended 31 December 2020 2020 2019 4,062,500 3,973,125 Revenue Cost of Sales 2,828,875 2,834,533 Gross Profit 1,233,625 1,138,592 Distribution Costs - 348,750 334,800 Administrative Expenses - 561,750 518,495 Finance Costs 40,750 35,800 Profit Before Tax 282,375 249,497 Income Tax Expense - 112,500 109,750 Profit for the Year 169,875 139,747 King Ltd. : Statement of Financial Position at 31 December 2020 2020 Non-Current Assets 1,762,500 Property Plant and Equipment Intangible Assets 625,000 2,387,500 Curent Assets Inventories 955,250 Receivables 476,875 Cash and Cash Equivalents 13,750 Total Assets 3,833,375 Equity and Liabilities Equity Share Capital 1,200,000 Share Premium Reserve 250,000 Retained Earnings 891, 175 General Reserve 100,000 Revaluation Surplus 200,000 2,641, 175 Non-Current Liabilities 10% Debenures 250,000 Long Term Bank Borrowings 375,000 625,000 Current Liabilities 322, 200 Trade and Other Payables 6 month Term Loan 122,500 Interest Payable 10,000 Current Tax Payables 112,500 Total Equity and Liabilities 3,833,375 2019 1,338,750 600,000 1,938,750 792,118 456,259 1,550 3,188,677 800,000 200,000 721,300 100,000 200,000 2,021,300 250,000 300,000 550,000 365,814 136,813 5,000 109,750 3,188,677 Note: - Included in Administration Casts is Depreciation of 100,000 all relating to tangible non-current assets. - No Non-Current Assets were disposed of during the reporting period. - All Sales are to customers receiving credit - All Purchases are on Credit: 2019 Credit Purchases 2,114,500 2,344,725 2020 Credit Purchases Required: (i) Prepare a statement of cash flows for the year to 31 December 2020 using the format laid out in IAS7. (30 Marks) (ii) Comment on why the trading profit reported differs from the net cash flows for the same accounting period. (10 Marks) (iii) Draft a report (1,000 words) comparing the results for 2020 and 2019 in relation to the changes in performance and position of the business. Your report should amake use of financial ratios to support your conclusions. Your report should also reference to the Cashflow Statement, commenting on any additional information this financial statement may offer to indicate how the business is performing and why cash is so important in achieving this. (60 Marks) ruy durs

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

King Ltd Statement of Cash Flow For the Year Ended December 31 2020 Cash Flow from Operating Acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started