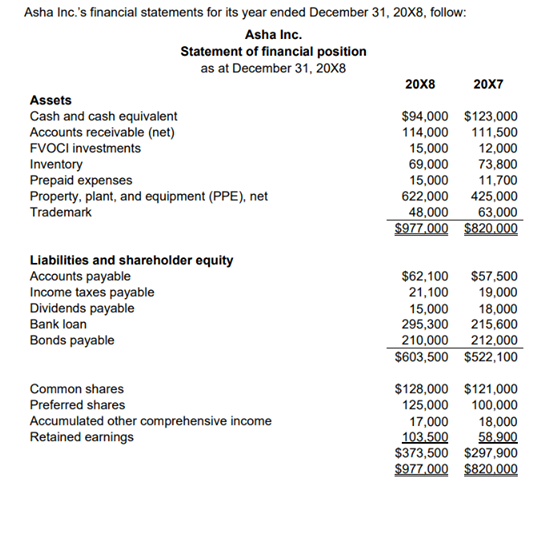

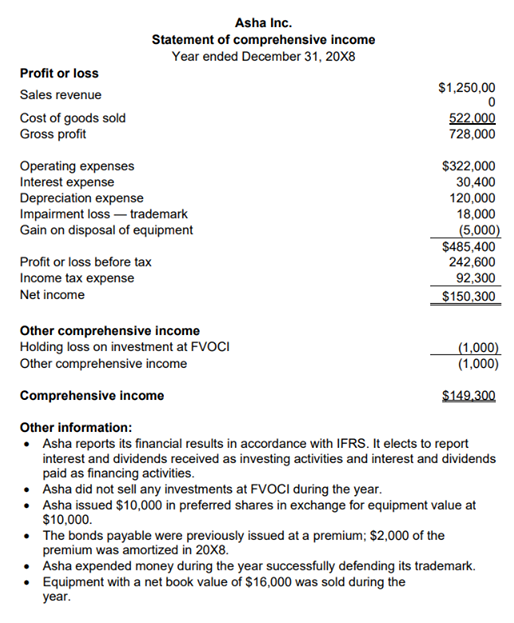

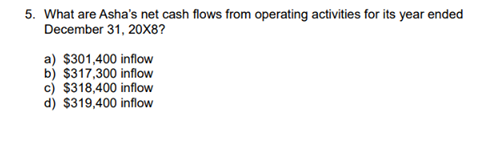

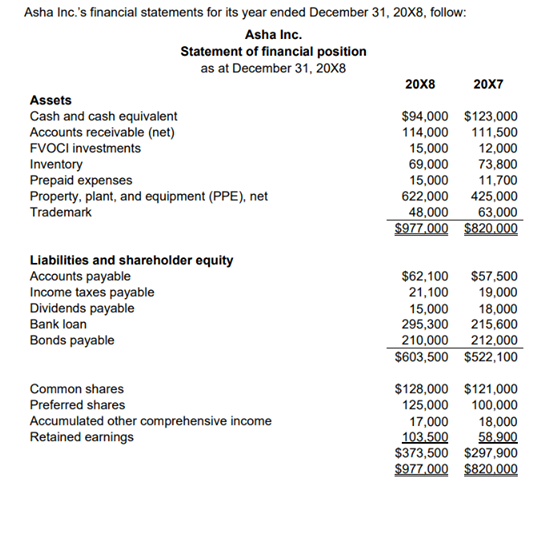

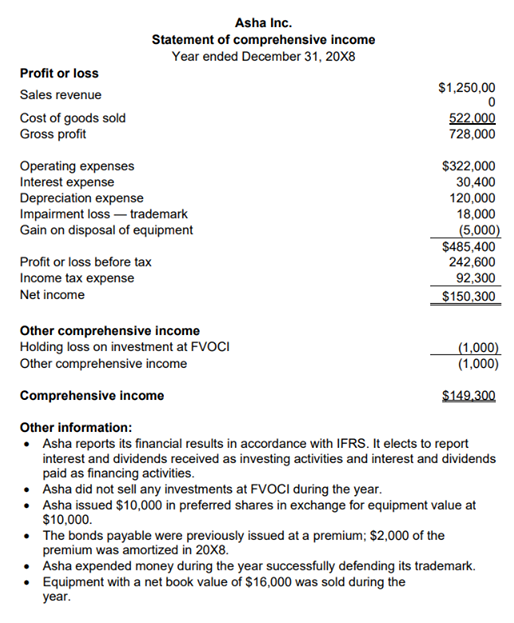

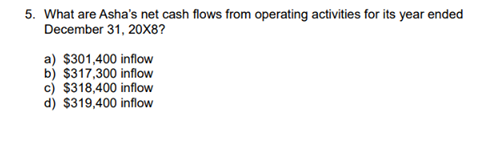

Asha Inc.'s financial statements for its year ended December 31, 20X8, follow: Asha Inc. Statement of financial position as at December 31, 20x8 20x8 20X7 Assets Cash and cash equivalent $94,000 $123,000 Accounts receivable (net) 114,000 111,500 FVOCI investments 15,000 12,000 Inventory 69,000 73,800 Prepaid expenses 15,000 11.700 Property, plant, and equipment (PPE), net 622,000 425,000 Trademark 48,000 63,000 $977.000 $820.000 Liabilities and shareholder equity Accounts payable $62,100 $57,500 Income taxes payable 21,100 19,000 Dividends payable 15,000 18,000 Bank loan 295,300 215,600 Bonds payable 210,000 212,000 $603,500 $522,100 Common shares Preferred shares Accumulated other comprehensive income Retained earnings $128,000 $121,000 125,000 100,000 17,000 18,000 103,500 58.9 $373,500 $297,900 $977,000 $820.000 Asha Inc. Statement of comprehensive income Year ended December 31, 20x8 $1,250,00 Profit or loss Sales revenue Cost of goods sold Gross profit 522.000 728,000 Operating expenses Interest expense Depreciation expense Impairment loss - trademark Gain on disposal of equipment $322,000 30,400 120,000 18,000 (5,000) $485,400 242,600 92,300 $150,300 Profit or loss before tax Income tax expense Net income Other comprehensive income Holding loss on investment at FVOCI (1,000) Other comprehensive income (1,000) Comprehensive income $149.300 Other information: Asha reports its financial results in accordance with IFRS. It elects to report interest and dividends received as investing activities and interest and dividends paid as financing activities. Asha did not sell any investments at FVOCI during the year. Asha issued $10,000 in preferred shares in exchange for equipment value at $10,000. The bonds payable were previously issued at a premium; $2,000 of the premium was amortized in 20X8. Asha expended money during the year successfully defending its trademark. Equipment with a net book value of $16,000 was sold during the year. 5. What are Asha's net cash flows from operating activities for its year ended December 31, 20X8? a) $301,400 inflow b) $317,300 inflow c) $318,400 inflow d) $319,400 inflow