Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ashley and Son had the following information before preparing their bank reconciliation. 1. Balance of Cash account on company's books at March 31, $6,459.

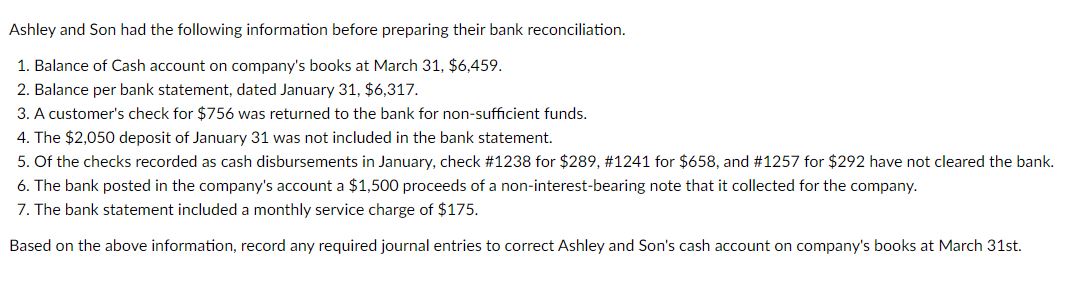

Ashley and Son had the following information before preparing their bank reconciliation. 1. Balance of Cash account on company's books at March 31, $6,459. 2. Balance per bank statement, dated January 31, $6,317. 3. A customer's check for $756 was returned to the bank for non-sufficient funds. 4. The $2,050 deposit of January 31 was not included in the bank statement. 5. Of the checks recorded as cash disbursements in January, check #1238 for $289, #1241 for $658, and #1257 for $292 have not cleared the bank. 6. The bank posted in the company's account a $1,500 proceeds of a non-interest-bearing note that it collected for the company. 7. The bank statement included a monthly service charge of $175. Based on the above information, record any required journal entries to correct Ashley and Son's cash account on company's books at March 31st.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To correct Ashley and Sons cash account on the companys books at March 31st we need to make journal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started