Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: 1. Read and reflect on the discussion question below. 2. Write an Original Post of at least 100 words in response to the

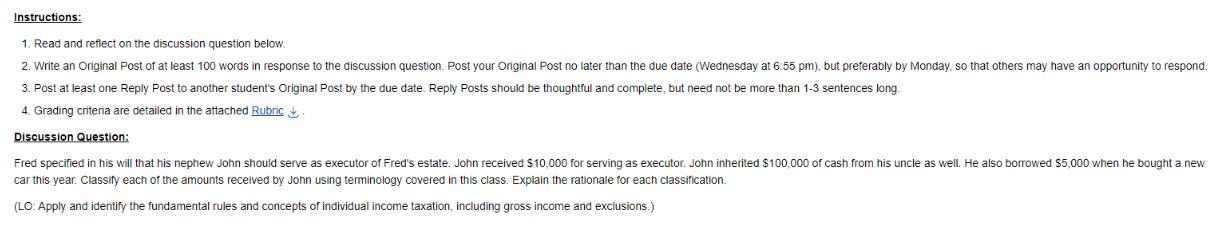

Instructions: 1. Read and reflect on the discussion question below. 2. Write an Original Post of at least 100 words in response to the discussion question. Post your Original Post no later than the due date (Wednesday at 6:55 pm), but preferably by Monday, so that others may have an opportunity to respond. 3. Post at least one Reply Post to another student's Original Post by the due date. Reply Posts should be thoughtful and complete, but need not be more than 1-3 sentences long. 4. Grading criteria are detailed in the attached Rubric Discussion Question: Fred specified in his will that his nephew John should serve as executor of Fred's estate. John received $10,000 for serving as executor. John inherited $100,000 of cash from his uncle as well. He also borrowed $5,000 when he bought a new car this year. Classify each of the amounts received by John using terminology covered in this class. Explain the rationale for each classification. (LO: Apply and identify the fundamental rules and concepts of individual income taxation, including gross income and exclusions.)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Original Post Johns receipt of 10000 for serving as the executor of his uncle Freds estate is classi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started