Answered step by step

Verified Expert Solution

Question

1 Approved Answer

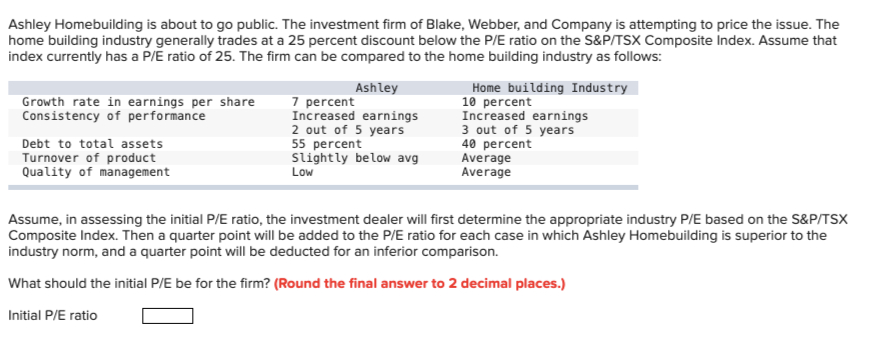

Ashley Homebuilding is about to go public. The investment firm of Blake, Webber, and Company is attempting to price the issue. The home building industry

Ashley Homebuilding is about to go public. The investment firm of Blake, Webber, and Company is attempting to price the issue. The

home building industry generally trades at a percent discount below the PE ratio on the S&PTSX Composite Index. Assume that

index currently has a PE ratio of The firm can be compared to the home building industry as follows:

Assume, in assessing the initial PE ratio, the investment dealer will first determine the appropriate industry PE based on the S&PTSX

Composite Index. Then a quarter point will be added to the PE ratio for each case in which Ashley Homebuilding is superior to the

industry norm, and a quarter point will be deducted for an inferior comparison.

What should the initial PE be for the firm? Round the final answer to decimal places.

Initial PE ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started