asnwer all questions

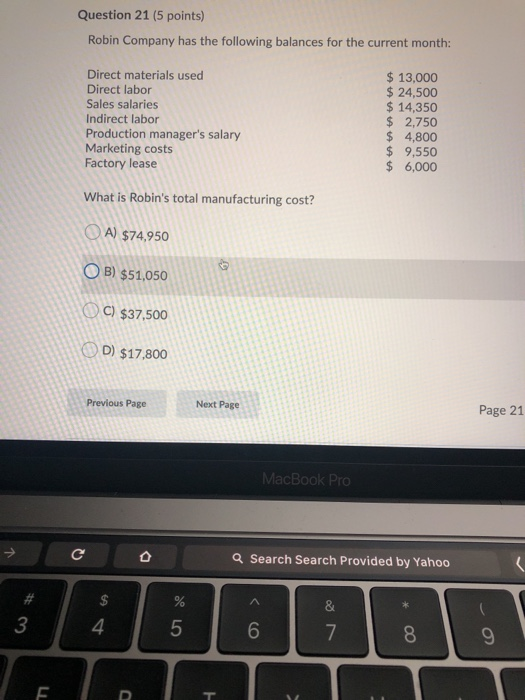

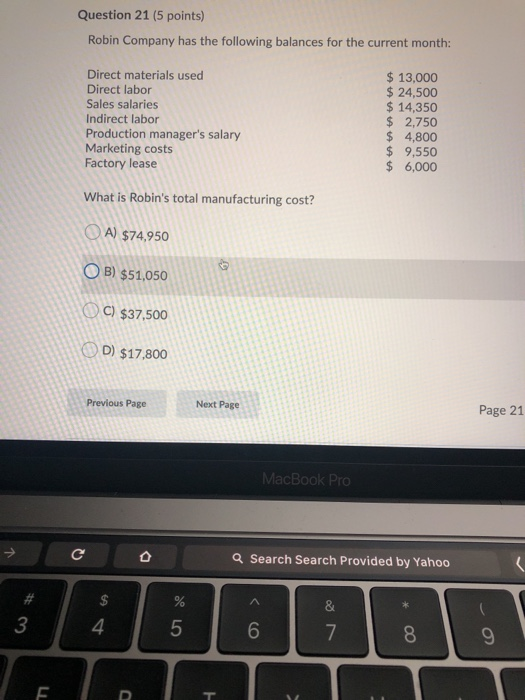

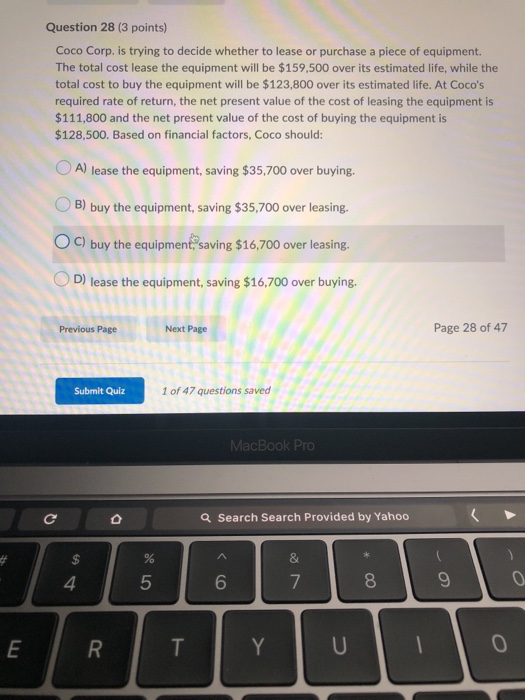

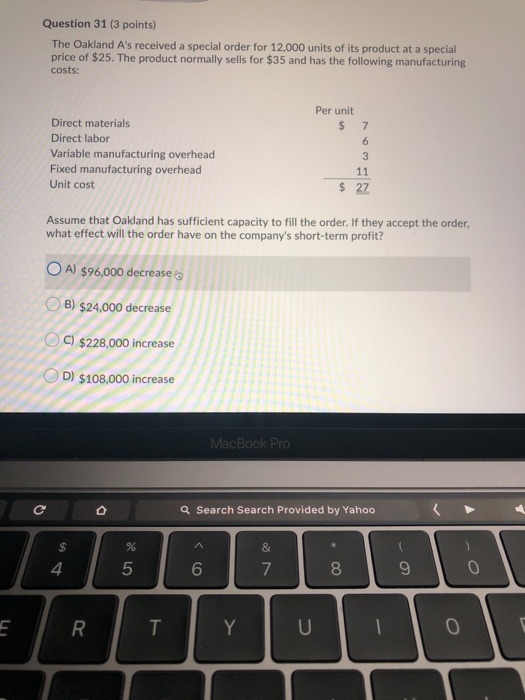

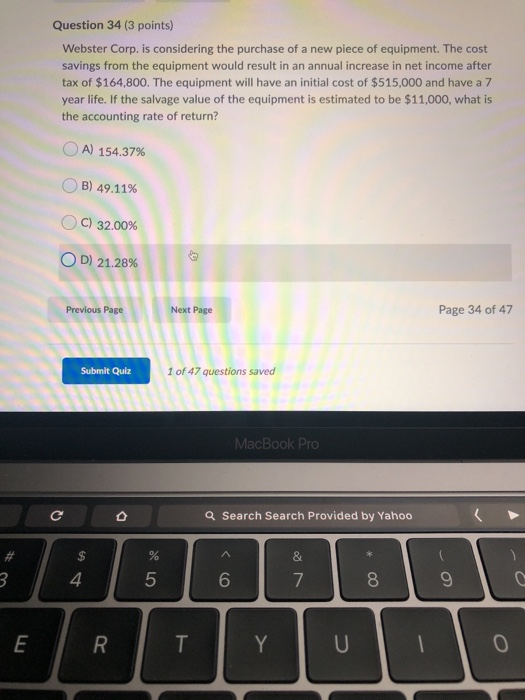

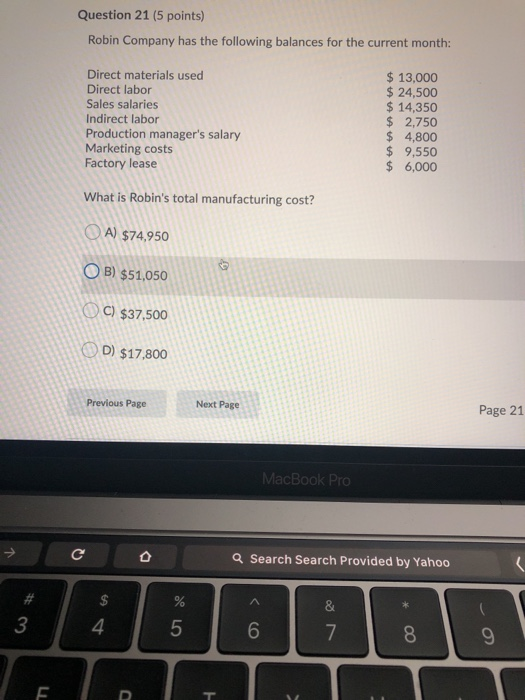

Question 21 (5 points) Robin Company has the following balances for the current month: Direct materials used Direct labor Sales salaries Indirect labor Production manager's salary Marketing costs Factory lease $ 13,000 $ 24,500 $ 14,350 $ 2,750 $ 4,800 $ 9,550 $ 6,000 What is Robin's total manufacturing cost? OA) $74,950 OB) $51,050 C) $37,500 D) $17,800 Previous Page Next Page Page 21 MacBook Pro Q Search Search Provided by Yahoo # $ 4 5 6 elem Question 28 (3 points) Coco Corp. is trying to decide whether to lease or purchase a piece of equipment. The total cost lease the equipment will be $159,500 over its estimated life, while the total cost to buy the equipment will be $123,800 over its estimated life. At Coco's required rate of return, the net present value of the cost of leasing the equipment is $111,800 and the net present value of the cost of buying the equipment is $128,500. Based on financial factors, Coco should: OA) lease the equipment, saving $35,700 over buying. OB) buy the equipment, saving $35,700 over leasing. OC) buy the equipment, saving $16,700 over leasing. O D) lease the equipment, saving $16,700 over buying. Previous Page Next Page Page 28 of 47 Submit Quiz 1 of 47 questions saved MacBook Pro Q Search Search Provided by Yahoo Question 31 (3 points) The Oakland A's received a special order for 12.000 units of its product at a special price of $25. The product normally sells for $35 and has the following manufacturing costs: Per unit $ 7 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit cost NWO Assume that Oakland has sufficient capacity to fill the order. If they accept the order, what effect will the order have on the company's short-term profit? OA) $96,000 decrease B) $24,000 decrease C) $228,000 increase D) $108,000 increase MacBook Pro Search Search Provided by Yahoo Question 34 (3 points) Webster Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $164,800. The equipment will have an initial cost of $515,000 and have a 7 year life. If the salvage value of the equipment is estimated to be $11,000, what is the accounting rate of return? OA) 154.37% OB) 49.11% OC) 32.00% OD 21.28% Previous Next Page Page 34 of 47 Submit Quiz 1 of 47 questions saved MacBook Pro Q Search Search Provided by Yahoo