Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asnwer numbers 3 & 7 3. Sue Enterprises uses a normal job order costing system and a predetermined overhead rate based on machine hours. At

Asnwer numbers 3 & 7

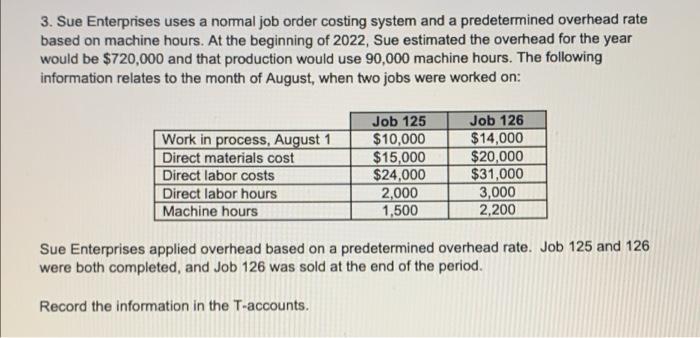

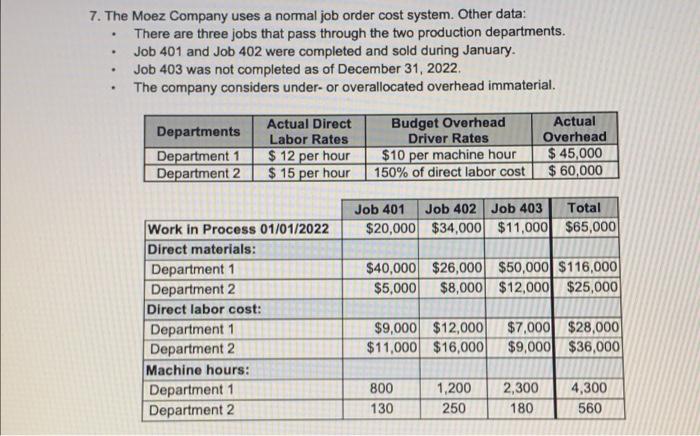

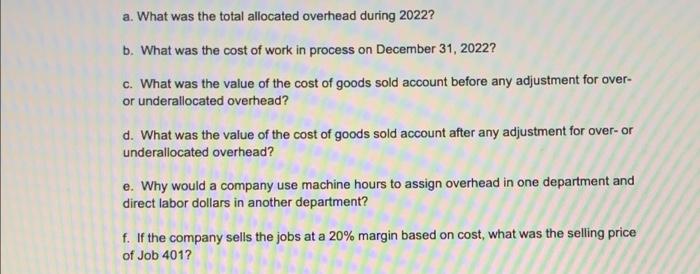

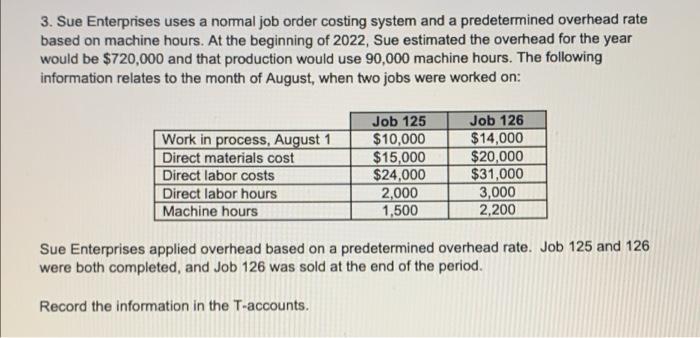

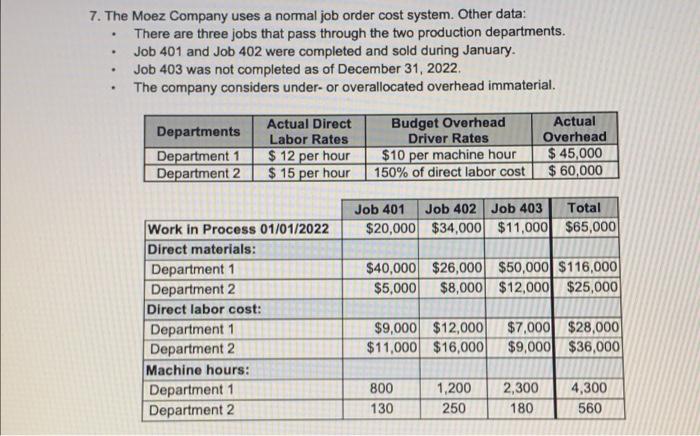

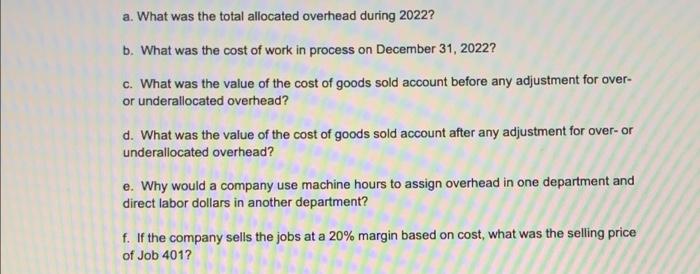

3. Sue Enterprises uses a normal job order costing system and a predetermined overhead rate based on machine hours. At the beginning of 2022, Sue estimated the overhead for the year would be $720,000 and that production would use 90,000 machine hours. The following information relates to the month of August, when two jobs were worked on: Job 125 Job 126 Work in process, August 1 $10,000 $14,000 Direct materials cost $15,000 $20,000 Direct labor costs $24,000 $31,000 Direct labor hours 2,000 3,000 Machine hours 1,500 2,200 Sue Enterprises applied overhead based on a predetermined overhead rate. Job 125 and 126 were both completed, and Job 126 was sold at the end of the period. Record the information in the T-accounts. 7. The Moez Company uses a normal job order cost system. Other data: . There are three jobs that pass through the two production departments. Job 401 and Job 402 were completed and sold during January. Job 403 was not completed as of December 31, 2022. The company considers under- or overallocated overhead immaterial. Actual Departments Overhead Actual Direct Labor Rates $ 12 per hour $15 per hour Budget Overhead Driver Rates $10 per machine hour 150% of direct labor cost Department 1 $ 45,000 Department 2 $ 60,000 Job 401 Job 402 Job 403 Total $20,000 $34,000 $11,000 $65,000 Work in Process 01/01/2022 Direct materials: Department 1 $40,000 $26,000 $50,000 $116,000 $5,000 $8,000 $12,000 $25,000 Department 2 Direct labor cost: Department 1 Department 2 $9,000 $12,000 $7,000 $28,000 $11,000 $16,000 $9,000 $36,000 Machine hours: Department 1. 800 1,200 2,300 4,300 Department 2 130 250 180 560 a. What was the total allocated overhead during 2022? b. What was the cost of work in process on December 31, 2022? c. What was the value of the cost of goods sold account before any adjustment for over- or underallocated overhead? d. What was the value of the cost of goods sold account after any adjustment for over- or underallocated overhead? e. Why would a company use machine hours to assign overhead in one department and direct labor dollars in another department? f. If the company sells the jobs at a 20% margin based on cost, what was the selling price of Job 401

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started