Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASP PLEASE 10% Off AND No Payments For 6 Months: Why Not? would receive a 10% discount off the purchased items and not have to

ASP PLEASE

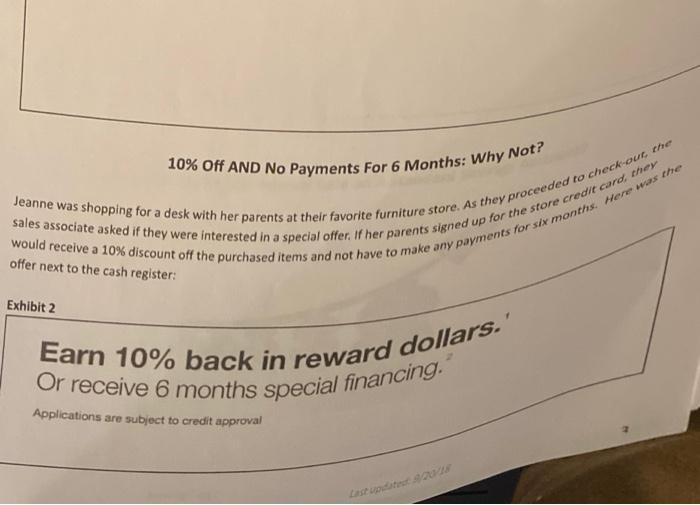

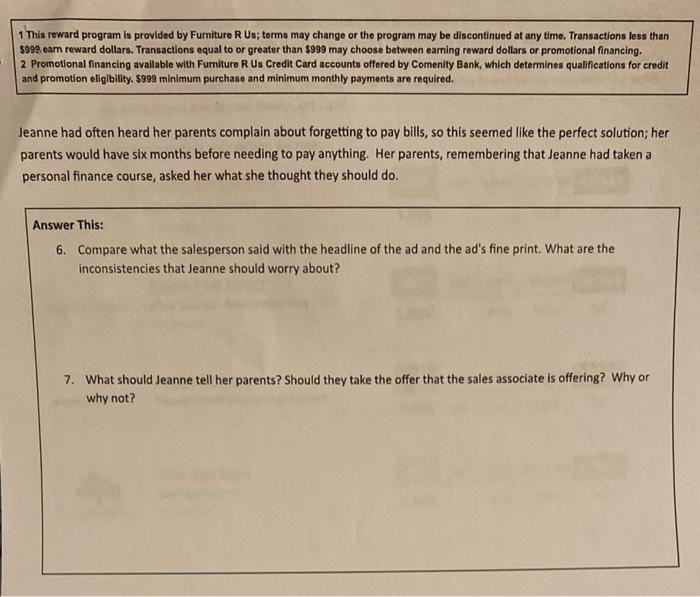

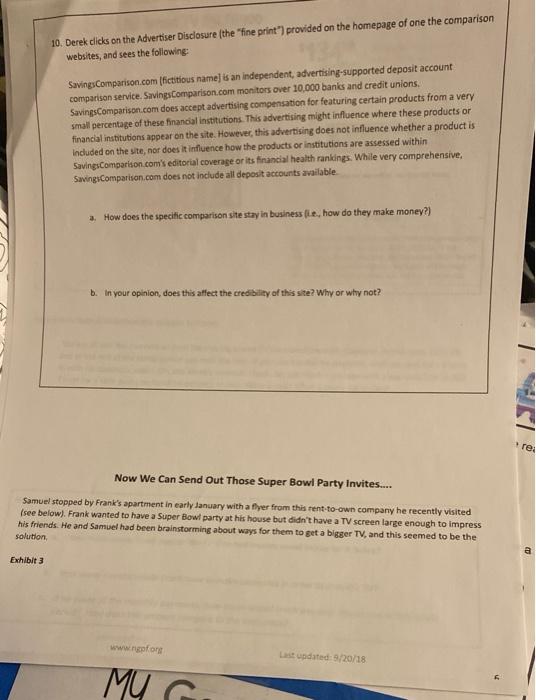

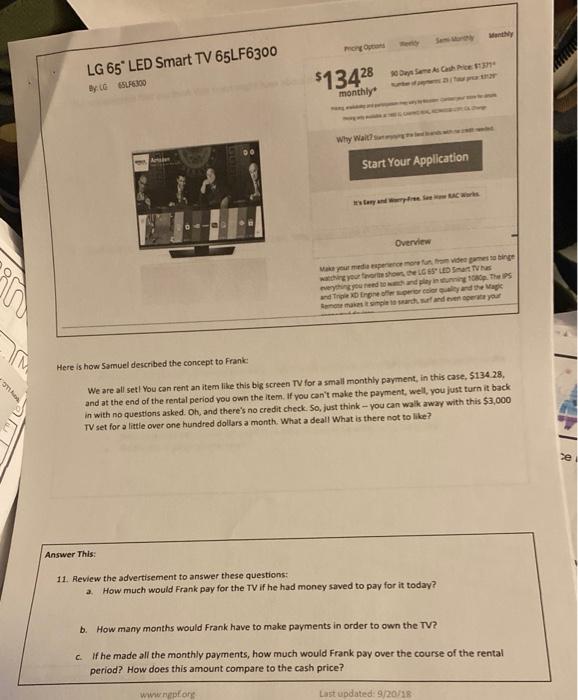

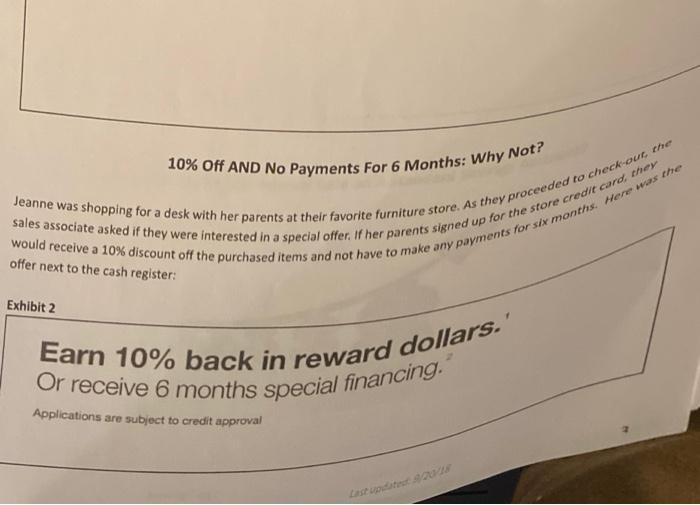

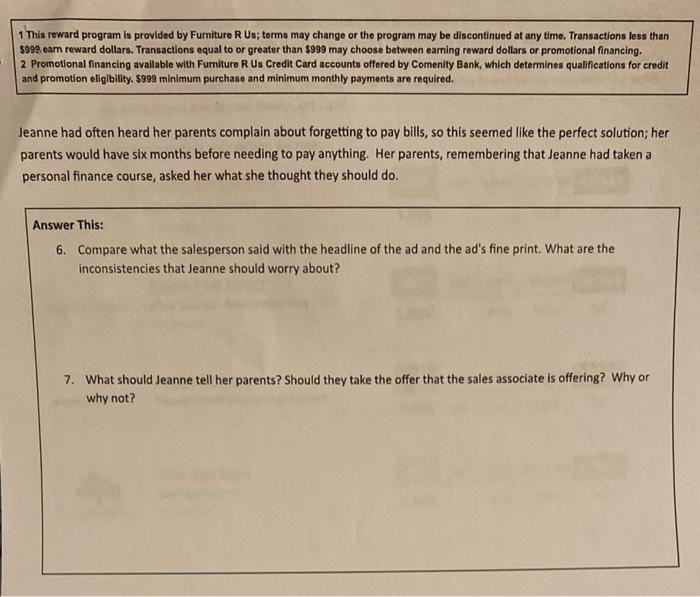

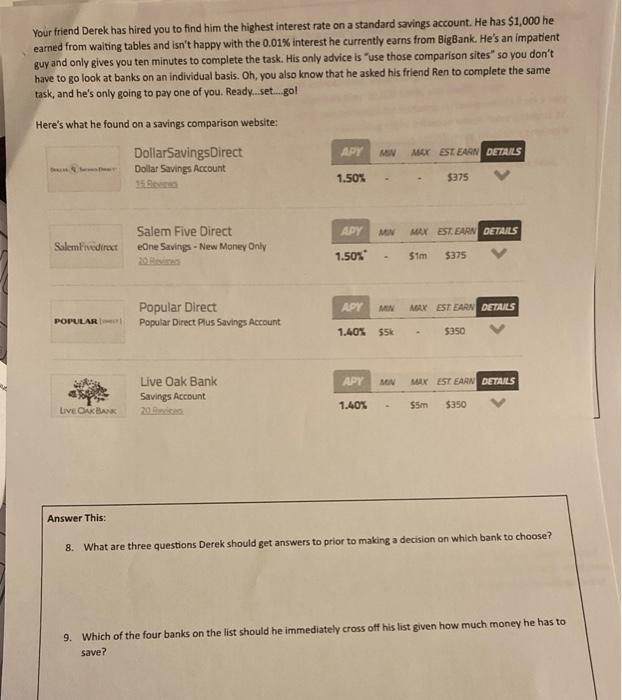

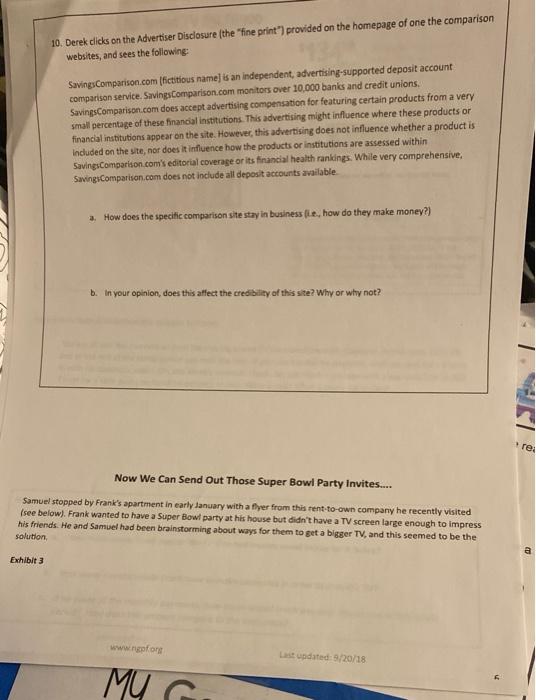

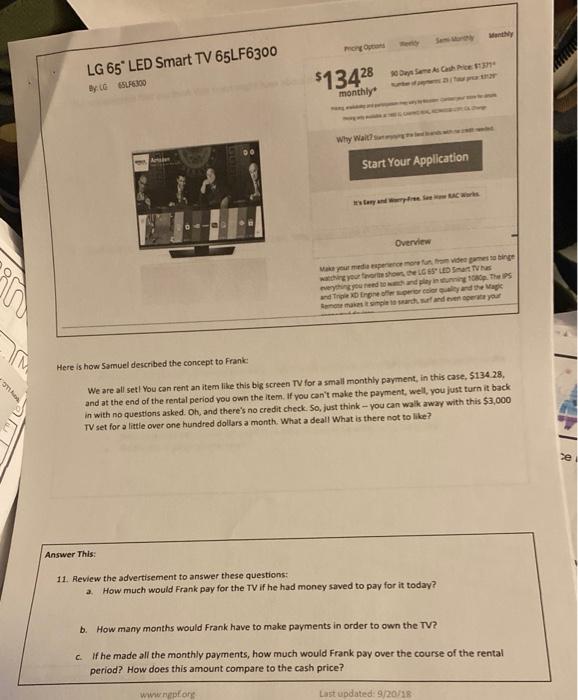

10% Off AND No Payments For 6 Months: Why Not? would receive a 10% discount off the purchased items and not have to make any payments for six months. Here was the sales associate asked if they were interested in a special offer. If her parents signed up for the store credit card, they Jeanne was shopping for a desk with her parents at their favorite furniture store. As they proceeded to check-our, the offer next to the cash register: Exhibit 2 Earn 10% back in reward dollars.' Or receive 6 months special financing. Applications are subject to credit approval 1 This reward program is provided by Furniture R Us; terms may change or the program may be discontinued at any time. Transactions less than $999 earn reward dollars. Transactions equal to or greater than $999 may choose between earning reward dollars or promotional financing. 2 Promotional financing available with Furniture R Us Credit Card accounts offered by Comenity Bank, which determines qualifications for credit and promotion eligibility. $999 minimum purchase and minimum monthly payments are required. Jeanne had often heard her parents complain about forgetting to pay bills, so this seemed like the perfect solution; her parents would have six months before needing to pay anything. Her parents, remembering that Jeanne had taken a personal finance course, asked her what she thought they should do. Answer This: 6. Compare what the salesperson said with the headline of the ad and the ad's fine print. What are the inconsistencies that Jeanne should worry about? 7. What should Jeanne tell her parents? Should they take the offer that the sales associate is offering? Why or why not? Your friend Derek has hired you to find him the highest interest rate on a standard savings account. He has $1,000 he earned from waiting tables and isn't happy with the 0.01% interest he currently earns from BigBank. He's an impatient guy and only gives you ten minutes to complete the task. His only advice is use those comparison sites" so you don't have to go look at banks on an individual basis. Oh, you also know that he asked his friend Ren to complete the same task, and he's only going to pay one of you. Ready.se...go! Here's what he found on a savings comparison website: DollarSavings Direct Dollar Savings Account 15. APY Mr EST EARN DETAILS 1.50% $375 APY MX EST EARN DETAILS Salem Fivedirect Salem Five Direct eOne Savings - New Money Only 1.50% Sim $375 APY MAX EST EARN DETAILS Popular Direct Popular Direct Plus Savings Account POPULAR 1.40% 55k $350 APY MON MAX EST EARN DETAILS Live Oak Bank Savings Account 200 1.40% 55m $350 LIVE ORKA Answer This: 8. What are three questions Derek should get answers to prior to making a decision on which bank to choose? 9. Which of the four banks on the list should he immediately cross off his list given how much money he has to save? 10. Derek click on the Advertiser Disclosure (the "fine print") provided on the homepage of one the comparison websites, and sees the following: Savingscomparison.com (fictitious name) is an independent, advertising-supported deposit account comparison service. Savingscomparison.com monitors over 10,000 banks and credit unions. Savings Comparison.com does accept advertising compensation for featuring certain products from a very small percentage of these financial institutions. This advertising might influence where these products or financial institutions appear on the site. However, this advertising does not influence whether a product is Included on the site, nor does it influence how the products or institutions are assessed within Saving Comparison.com's editorial coverage or its financial health rankings. While very comprehensive. Saving Comparison.com does not include all deposit accounts available 3. How does the specific comparison site stay in business (ie, how do they make money?) b. In your opinion, does this affect the credibility of this site? Why or why not? re: Now We Can Send Out Those Super Bowl Party Invites..... Samuel stopped by Frank's apartment in early January with a flyer from this rent to own company he recently visited (see below). Frank wanted to have a Super Bowl party at his house but didn't have a TV screen large enough to impress his friends. He and Samuel had been brainstorming about ways for them to get a bigger TV, and this seemed to be the solution Exhibit 3 www.gofort Last updated 9/20/18 M Monthly LG 65" LED Smart TV 65LF6300 By: GSFERO Dames Gashi $13428 monthly Why Waits Start Your Application are was Overview your media pencer de este binge way to the LES LED TV mething you need to and playing the and Triple Xpread shape mo maksimple towards and your Here is how Samuel described the concept to Frank: We are all set! You can rent an item like this big screen TV for a small monthly payment in this case, $134.28 and at the end of the rental period you own the item. If you can't make the payment, well, you just turn it back in with no questions asked. Oh, and there's no credit check. So, just think you can walk away with this $3,000 TV set for a little over one hundred dollars a month. What a deall What is there not to like? Answer this: 11. Review the advertisement to answer these questions: a How much would Frank pay for the TV if he had money saved to pay for it today? b. How many months would Frank have to make payments in order to own the TV? c. he made all the monthly payments, how much would Frank pay over the course of the rental period? How does this amount compare to the cash price? wwwreplong Last updated: 9/20/18 12. List any concerns that you think that Frank might have about this "deal." 13. Rent-to-own centers are a multi-billion dollar business. Why do you think their approach is so popular? 14. Extra Credit. While this isn't technically a loan, it might be fun to figure out what the implied interest on this rental arrangement is. a. Go to this Rent-To-Own Model (TV) spreadsheet'. b. Make a copy of the spreadsheet Enter Interest Rate guesses in cell B6. d. Keep guessing until you can get cell F31 as close to zero as possible (+/- $100 is ok) What is the implied interest rate? c. e. 10% Off AND No Payments For 6 Months: Why Not? would receive a 10% discount off the purchased items and not have to make any payments for six months. Here was the sales associate asked if they were interested in a special offer. If her parents signed up for the store credit card, they Jeanne was shopping for a desk with her parents at their favorite furniture store. As they proceeded to check-our, the offer next to the cash register: Exhibit 2 Earn 10% back in reward dollars.' Or receive 6 months special financing. Applications are subject to credit approval 1 This reward program is provided by Furniture R Us; terms may change or the program may be discontinued at any time. Transactions less than $999 earn reward dollars. Transactions equal to or greater than $999 may choose between earning reward dollars or promotional financing. 2 Promotional financing available with Furniture R Us Credit Card accounts offered by Comenity Bank, which determines qualifications for credit and promotion eligibility. $999 minimum purchase and minimum monthly payments are required. Jeanne had often heard her parents complain about forgetting to pay bills, so this seemed like the perfect solution; her parents would have six months before needing to pay anything. Her parents, remembering that Jeanne had taken a personal finance course, asked her what she thought they should do. Answer This: 6. Compare what the salesperson said with the headline of the ad and the ad's fine print. What are the inconsistencies that Jeanne should worry about? 7. What should Jeanne tell her parents? Should they take the offer that the sales associate is offering? Why or why not? Your friend Derek has hired you to find him the highest interest rate on a standard savings account. He has $1,000 he earned from waiting tables and isn't happy with the 0.01% interest he currently earns from BigBank. He's an impatient guy and only gives you ten minutes to complete the task. His only advice is use those comparison sites" so you don't have to go look at banks on an individual basis. Oh, you also know that he asked his friend Ren to complete the same task, and he's only going to pay one of you. Ready.se...go! Here's what he found on a savings comparison website: DollarSavings Direct Dollar Savings Account 15. APY Mr EST EARN DETAILS 1.50% $375 APY MX EST EARN DETAILS Salem Fivedirect Salem Five Direct eOne Savings - New Money Only 1.50% Sim $375 APY MAX EST EARN DETAILS Popular Direct Popular Direct Plus Savings Account POPULAR 1.40% 55k $350 APY MON MAX EST EARN DETAILS Live Oak Bank Savings Account 200 1.40% 55m $350 LIVE ORKA Answer This: 8. What are three questions Derek should get answers to prior to making a decision on which bank to choose? 9. Which of the four banks on the list should he immediately cross off his list given how much money he has to save? 10. Derek click on the Advertiser Disclosure (the "fine print") provided on the homepage of one the comparison websites, and sees the following: Savingscomparison.com (fictitious name) is an independent, advertising-supported deposit account comparison service. Savingscomparison.com monitors over 10,000 banks and credit unions. Savings Comparison.com does accept advertising compensation for featuring certain products from a very small percentage of these financial institutions. This advertising might influence where these products or financial institutions appear on the site. However, this advertising does not influence whether a product is Included on the site, nor does it influence how the products or institutions are assessed within Saving Comparison.com's editorial coverage or its financial health rankings. While very comprehensive. Saving Comparison.com does not include all deposit accounts available 3. How does the specific comparison site stay in business (ie, how do they make money?) b. In your opinion, does this affect the credibility of this site? Why or why not? re: Now We Can Send Out Those Super Bowl Party Invites..... Samuel stopped by Frank's apartment in early January with a flyer from this rent to own company he recently visited (see below). Frank wanted to have a Super Bowl party at his house but didn't have a TV screen large enough to impress his friends. He and Samuel had been brainstorming about ways for them to get a bigger TV, and this seemed to be the solution Exhibit 3 www.gofort Last updated 9/20/18 M Monthly LG 65" LED Smart TV 65LF6300 By: GSFERO Dames Gashi $13428 monthly Why Waits Start Your Application are was Overview your media pencer de este binge way to the LES LED TV mething you need to and playing the and Triple Xpread shape mo maksimple towards and your Here is how Samuel described the concept to Frank: We are all set! You can rent an item like this big screen TV for a small monthly payment in this case, $134.28 and at the end of the rental period you own the item. If you can't make the payment, well, you just turn it back in with no questions asked. Oh, and there's no credit check. So, just think you can walk away with this $3,000 TV set for a little over one hundred dollars a month. What a deall What is there not to like? Answer this: 11. Review the advertisement to answer these questions: a How much would Frank pay for the TV if he had money saved to pay for it today? b. How many months would Frank have to make payments in order to own the TV? c. he made all the monthly payments, how much would Frank pay over the course of the rental period? How does this amount compare to the cash price? wwwreplong Last updated: 9/20/18 12. List any concerns that you think that Frank might have about this "deal." 13. Rent-to-own centers are a multi-billion dollar business. Why do you think their approach is so popular? 14. Extra Credit. While this isn't technically a loan, it might be fun to figure out what the implied interest on this rental arrangement is. a. Go to this Rent-To-Own Model (TV) spreadsheet'. b. Make a copy of the spreadsheet Enter Interest Rate guesses in cell B6. d. Keep guessing until you can get cell F31 as close to zero as possible (+/- $100 is ok) What is the implied interest rate? c. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started