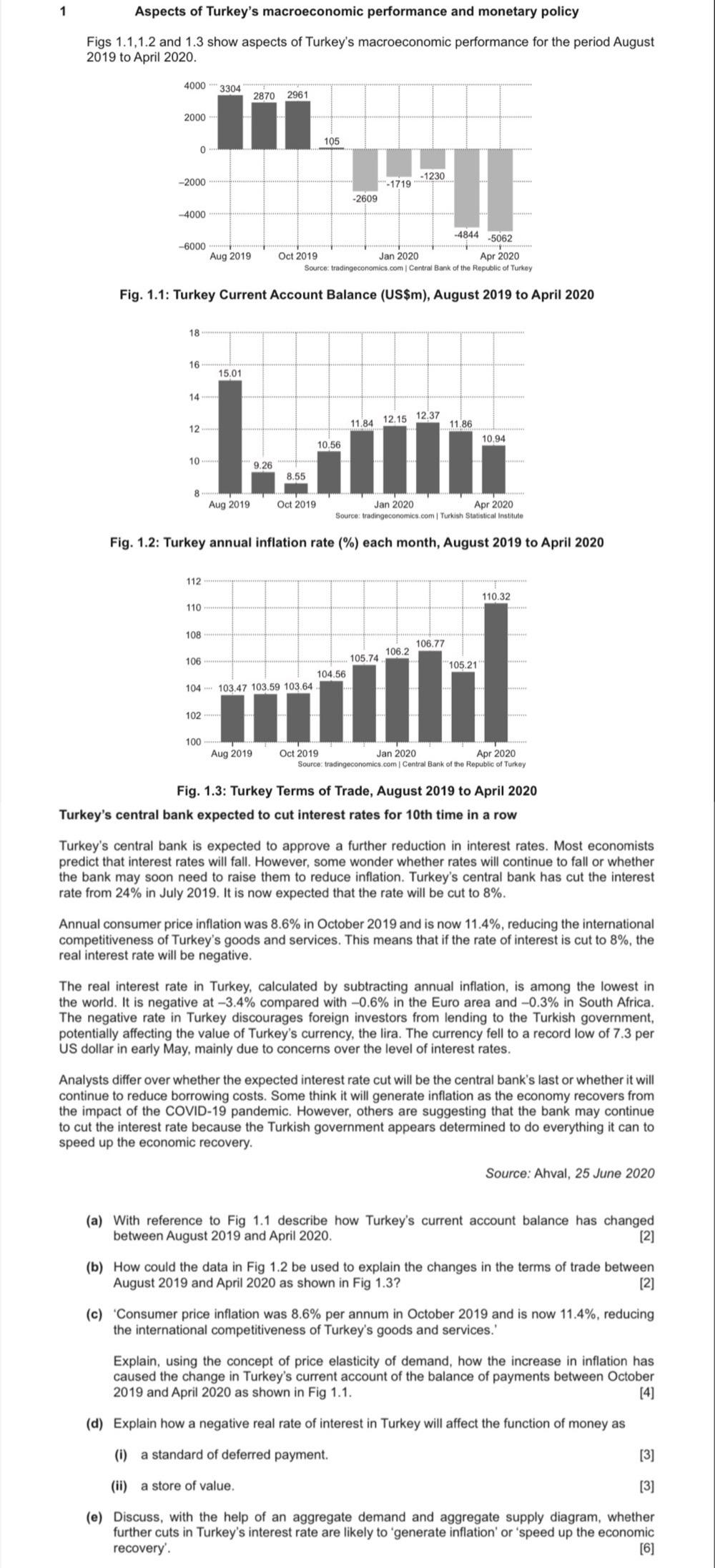

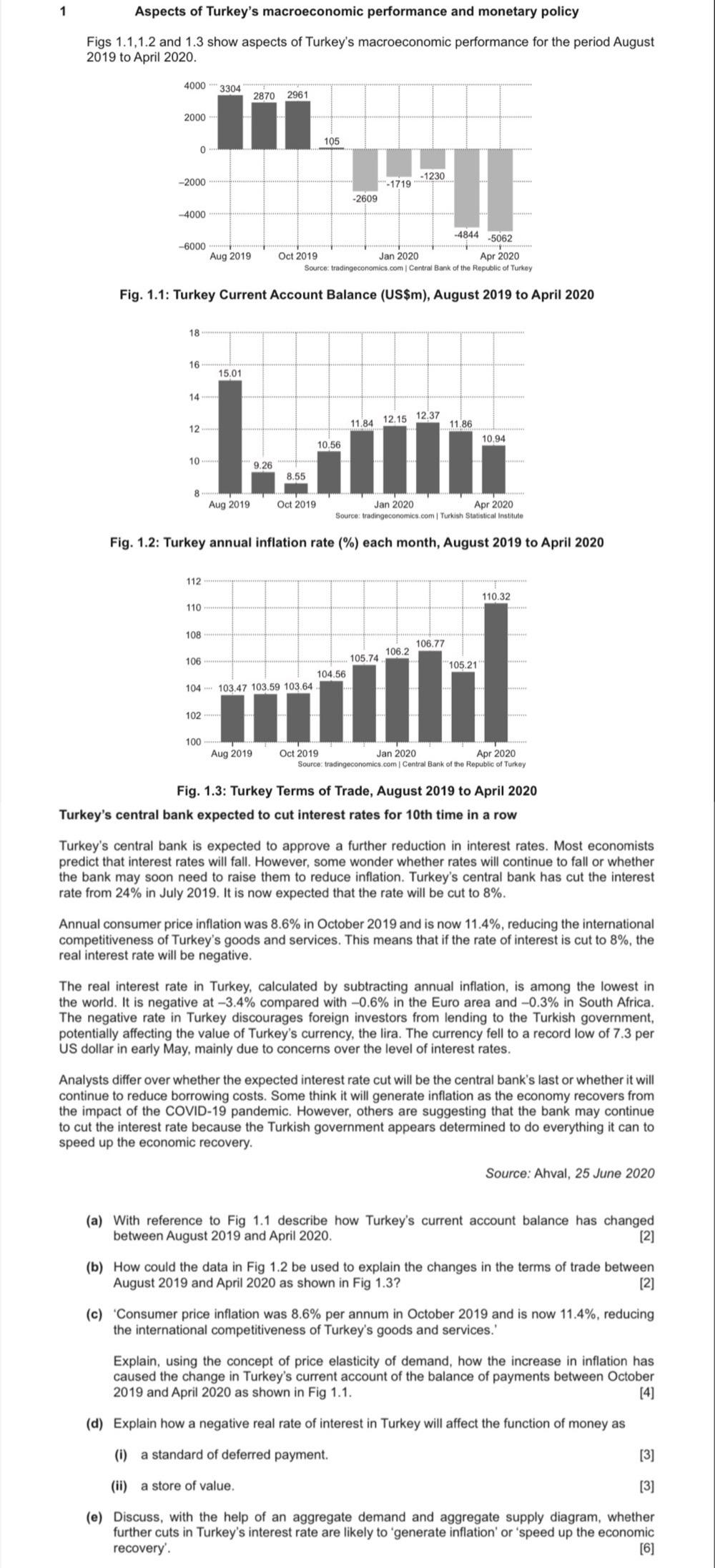

Aspects of Turkey's macroeconomic performance and monetary policy Figs 1.1,1.2 and 1.3 show aspects of Turkey's macroeconomic performance for the period August 2019 to April 2020. Fig. 1.1: Turkey Current Account Balance (US\$m), August 2019 to April 2020 Fig. 1.2: Turkey annual inflation rate (\%) each month, August 2019 to April 2020 Fig. 1.3: Turkey Terms of Trade, August 2019 to April 2020 Turkey's central bank expected to cut interest rates for 10 th time in a row Turkey's central bank is expected to approve a further reduction in interest rates. Most economists predict that interest rates will fall. However, some wonder whether rates will continue to fall or whether the bank may soon need to raise them to reduce inflation. Turkey's central bank has cut the interest rate from 24% in July 2019 . It is now expected that the rate will be cut to 8%. Annual consumer price inflation was 8.6% in October 2019 and is now 11.4%, reducing the international competitiveness of Turkey's goods and services. This means that if the rate of interest is cut to 8%, the real interest rate will be negative. The real interest rate in Turkey, calculated by subtracting annual inflation, is among the lowest in the world. It is negative at 3.4% compared with 0.6% in the Euro area and 0.3% in South Africa. The negative rate in Turkey discourages foreign investors from lending to the Turkish government, US dollar in early May, mainly due to concerns over the level of interest rates. Analysts differ over whether the expected interest rate cut will be the central bank's last or whether it will continue to reduce borrowing costs. Some think it will generate inflation as the economy recovers from the impact of the COVID-19 pandemic. However, others are suggesting that the bank may continue to cut the interest rate because the speed up the economic recovery. Source: Ahval, 25 June 2020 (a) With reference to Fig 1.1 describe how Turkey's current account balance has changed between August 2019 and April 2020. [2] between August 2019 and April 2020. (b) How could the data in Fig 1.2 be used to explain the changes in the terms of trade between August 2019 and April 2020 as shown in Fig 1.3? [2] (c) 'Consumer price inflation was 8.6% per annum in October 2019 and is now 11.4%, reducing the international competitiveness of Turkey's goods and services.' Explain, using the concept of price elasticity of demand, how the increase in inflation has caused the change in Turkey's current account of the balance of payments between October 2019 and April 2020 as shown in Fig 1.1. (d) Explain how a negative real rate of interest in Turkey will affect the function of money as (i) a standard of deferred payment. [3] (ii) a store of value. (e) Discuss, with the help of an aggregate demand and aggregate supply diagram, whether further cuts in Turkey's interest rate are likely to 'generate inflation' or 'speed up the economic recovery'. [6] Aspects of Turkey's macroeconomic performance and monetary policy Figs 1.1,1.2 and 1.3 show aspects of Turkey's macroeconomic performance for the period August 2019 to April 2020. Fig. 1.1: Turkey Current Account Balance (US\$m), August 2019 to April 2020 Fig. 1.2: Turkey annual inflation rate (\%) each month, August 2019 to April 2020 Fig. 1.3: Turkey Terms of Trade, August 2019 to April 2020 Turkey's central bank expected to cut interest rates for 10 th time in a row Turkey's central bank is expected to approve a further reduction in interest rates. Most economists predict that interest rates will fall. However, some wonder whether rates will continue to fall or whether the bank may soon need to raise them to reduce inflation. Turkey's central bank has cut the interest rate from 24% in July 2019 . It is now expected that the rate will be cut to 8%. Annual consumer price inflation was 8.6% in October 2019 and is now 11.4%, reducing the international competitiveness of Turkey's goods and services. This means that if the rate of interest is cut to 8%, the real interest rate will be negative. The real interest rate in Turkey, calculated by subtracting annual inflation, is among the lowest in the world. It is negative at 3.4% compared with 0.6% in the Euro area and 0.3% in South Africa. The negative rate in Turkey discourages foreign investors from lending to the Turkish government, US dollar in early May, mainly due to concerns over the level of interest rates. Analysts differ over whether the expected interest rate cut will be the central bank's last or whether it will continue to reduce borrowing costs. Some think it will generate inflation as the economy recovers from the impact of the COVID-19 pandemic. However, others are suggesting that the bank may continue to cut the interest rate because the speed up the economic recovery. Source: Ahval, 25 June 2020 (a) With reference to Fig 1.1 describe how Turkey's current account balance has changed between August 2019 and April 2020. [2] between August 2019 and April 2020. (b) How could the data in Fig 1.2 be used to explain the changes in the terms of trade between August 2019 and April 2020 as shown in Fig 1.3? [2] (c) 'Consumer price inflation was 8.6% per annum in October 2019 and is now 11.4%, reducing the international competitiveness of Turkey's goods and services.' Explain, using the concept of price elasticity of demand, how the increase in inflation has caused the change in Turkey's current account of the balance of payments between October 2019 and April 2020 as shown in Fig 1.1. (d) Explain how a negative real rate of interest in Turkey will affect the function of money as (i) a standard of deferred payment. [3] (ii) a store of value. (e) Discuss, with the help of an aggregate demand and aggregate supply diagram, whether further cuts in Turkey's interest rate are likely to 'generate inflation' or 'speed up the economic recovery'. [6]