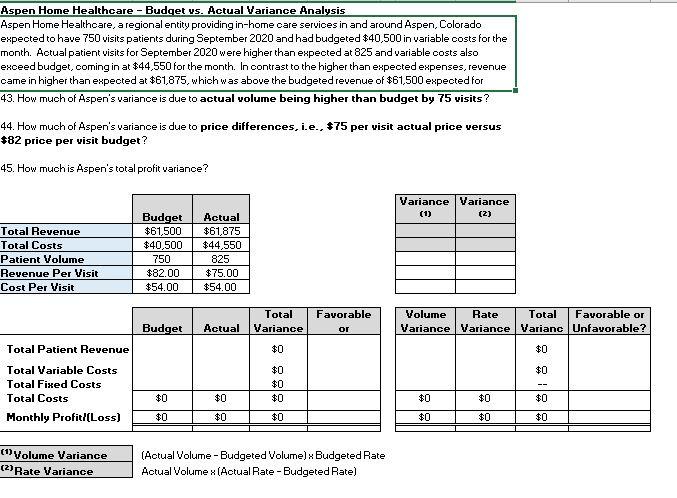

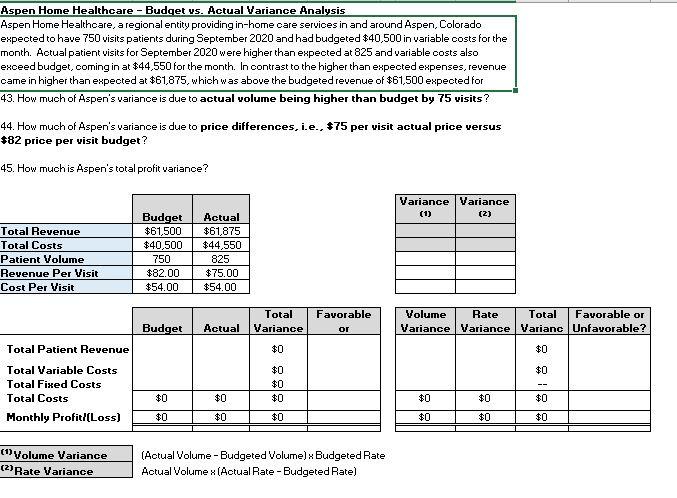

Aspen Home Healthcare - Budget vs. Actual Variance Analysis Aspen Home Healthcare, a regional entity providing in-home care services in and around Aspen, Colorado expected to have 750 visits patients during September 2020 and had budgeted $40,500 in variable costs for the month. Actual patient visits for September 2020 were higher than expected at 825 and variable costs also exceed budget, coming in at $44,550 for the month. In contrast to the higher than expected expenses, revenue came in higher than expected at $61,875, which was above the budgeted revenue of $61,500 expected for 43. How much of Aspen's variance is due to actual volume being higher than budget by 75 visits? 44. How much of Aspen's variance is due to price differences, i.e., $75 per visit actual price versus $82 price per visit budget? 45. How much is Aspen's total profit variance? Variance Variance (1) (2) Total Revenue Total Costs Patient Volume Revenue Per Visit Cost Per Visit Budget $61,500 $40,500 750 $82.00 $54.00 Actual $61,875 $44,550 825 $75.00 $54.00 Total Variance Favorable or Budget Actual Volume Rate Total Favorable or Variance Variance Varianc Unfavorable? $0 $0 $0 Total Patient Revenue Total Variable Costs Total Fixed Costs Total Costs Monthly Profit/(Loss) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 (1) Volume Variance (2) Rate Variance (Actual Volume -Budgeted Volume) x Budgeted Rate Actual Volume x (Actual Rate - Budgeted Rate) Aspen Home Healthcare - Budget vs. Actual Variance Analysis Aspen Home Healthcare, a regional entity providing in-home care services in and around Aspen, Colorado expected to have 750 visits patients during September 2020 and had budgeted $40,500 in variable costs for the month. Actual patient visits for September 2020 were higher than expected at 825 and variable costs also exceed budget, coming in at $44,550 for the month. In contrast to the higher than expected expenses, revenue came in higher than expected at $61,875, which was above the budgeted revenue of $61,500 expected for 43. How much of Aspen's variance is due to actual volume being higher than budget by 75 visits? 44. How much of Aspen's variance is due to price differences, i.e., $75 per visit actual price versus $82 price per visit budget? 45. How much is Aspen's total profit variance? Variance Variance (1) (2) Total Revenue Total Costs Patient Volume Revenue Per Visit Cost Per Visit Budget $61,500 $40,500 750 $82.00 $54.00 Actual $61,875 $44,550 825 $75.00 $54.00 Total Variance Favorable or Budget Actual Volume Rate Total Favorable or Variance Variance Varianc Unfavorable? $0 $0 $0 Total Patient Revenue Total Variable Costs Total Fixed Costs Total Costs Monthly Profit/(Loss) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 (1) Volume Variance (2) Rate Variance (Actual Volume -Budgeted Volume) x Budgeted Rate Actual Volume x (Actual Rate - Budgeted Rate)