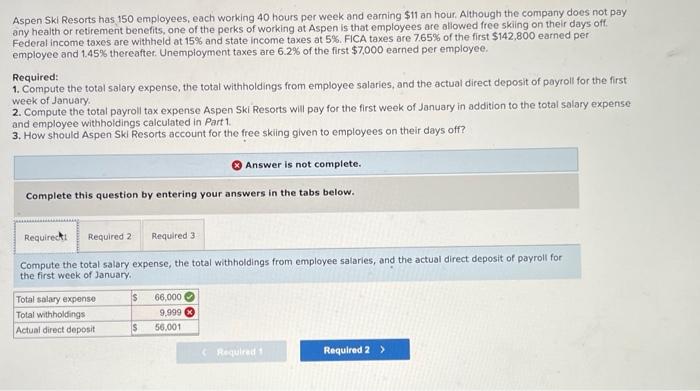

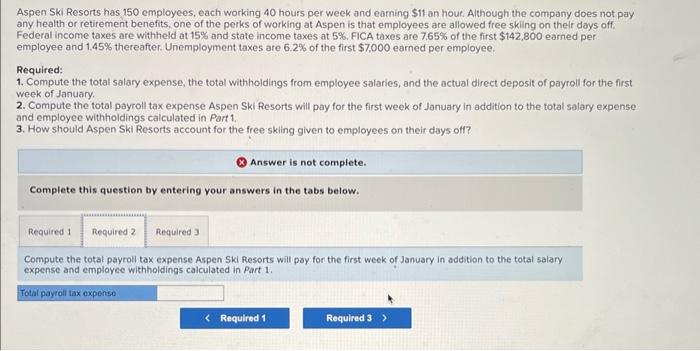

Aspen Ski Resorts has 150 employees, each working 40 hours per week and earning $11 an hour, Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days off. Federal income taxes are withheld at 15% and state income taxes at 5%. FiCA taxes are 7.65% of the first $142,800 earned per employee and 1.45% thereafter. Unempioyment taxes are 6.2% of the first $7,000 earned per employee. Required: 1. Compute the total salary expense, the total withholdings from employee salaries, and the actual direct deposit of payroll for the first week of January. 2. Compute the total payroll tax expense Aspen Ski Resorts will pay for the first week of January in addition to the total salary expense and employee withhoidings calculated in Part 1. 3. How should Aspen Ski Resorts account for the free sking given to employees on their days off? ( Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the total salary expense, the total withholdings from employee salaries, and the actual direct deposit of payroll for the first week of January. Aspen Ski Resorts has 150 employees, each working 40 hours per week and earning $11 an hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiling on their days off. Federal income toxes are withheld at 15% and state income taxes at 5%. FlCA taxes are 7.65% of the first $142,800 earned per employee and 1.45% thereafter. Unemployment taxes are 6.2% of the first $7,000 earned per employee. Required: 1. Compute the total salary expense, the total withholdings from employee salaries, and the actual direct deposit of payroli for the first week of January. 2. Compute the total payroll tax expense Aspen Ski Resorts will pay for the first week of January in addition to the total salary expense and employee withholdings calculated in Part 1. 3. How should Aspen Ski Resorts account for the free skiling given to employees on their days off? (x) Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the total payroll tax expense Aspen Ski Resorts will pay for the first week of January in addition to the total salary expense and employee withholdings calculated in