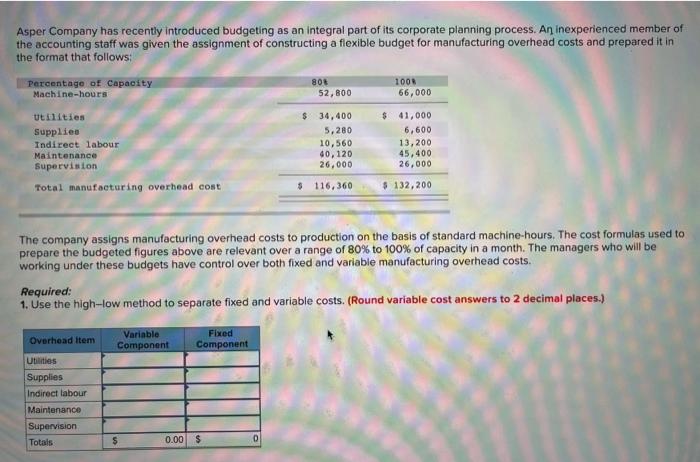

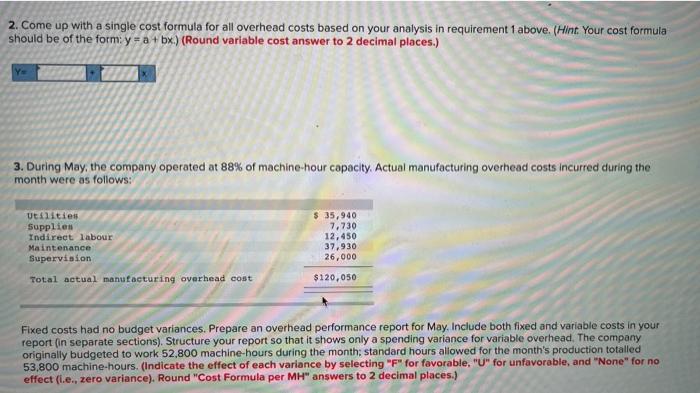

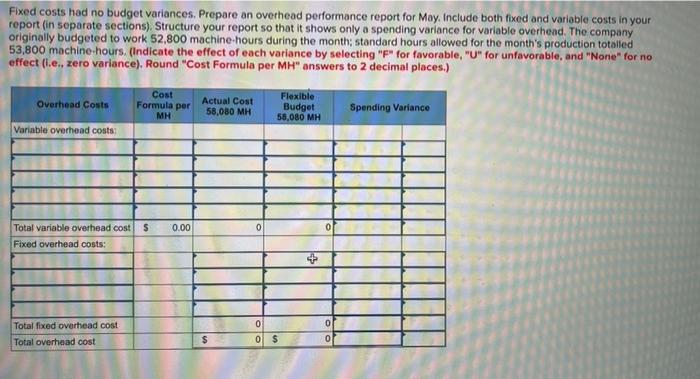

Asper Company has recently introduced budgeting as an integral part of its corporate planning process. An inexperienced member of the accounting staff was given the assignment of constructing a flexible budget for manufacturing overhead costs and prepared it in the format that follows: Percentage of Capacity Machine-hours 801 52,800 1008 66,000 Utilities Supplies Indirect labour Maintenance Supervision Total manufacturing overhead cost $ 34,400 5,280 10,560 40,120 26,000 $ 41,000 6,600 13,200 45,400 26,000 $ 116,360 $ 132,200 The company assigns manufacturing overhead costs to production on the basis of standard machine-hours. The cost formulas used to prepare the budgeted figures above are relevant over a range of 80% to 100% of capacity in a month. The managers who will be working under these budgets have control over both fixed and variable manufacturing overhead costs. Required: 1. Use the high-low method to separate fixed and variable costs. (Round variable cost answers to 2 decimal places.) Overhead Item Variable Component Fixed Component Utilities Supplies Indirect labour Maintenance Supervision Totals $ 0.00 $ 0 2. Come up with a single cost formula for all overhead costs based on your analysis in requirement 1 above. (Hint Your cost formula should be of the form: y = a + bx) (Round variable cost answer to 2 decimal places.) 3. During May, the company operated at 88% of machine-hour capacity. Actual manufacturing overhead costs incurred during the month were as follows: Utilities Supplies Indirect labour Maintenance Supervision $ 35,940 7,730 12,450 37,930 26,000 Total actual manufacturing overhead cost $120,050 Fixed costs had no budget variances. Prepare an overhead performance report for May. Include both fixed and variable costs in your report (in separate sections). Structure your report so that it shows only a spending variance for variable overhead. The company originally budgeted to work 52,800 machine-hours during the month; standard hours allowed for the month's production totalled 53.800 machine-hours. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Round "Cost Formula per MH" answers to 2 decimal places.) Fixed costs had no budget variances. Prepare an overhead performance report for May. Include both fixed and variable costs in your report (in separate sections). Structure your report so that it shows only a spending variance for variable overhead. The company originally budgeted to work 52,800 machine hours during the month standard hours allowed for the month's production totalled 53,800 machine-hours. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (ie, zero variance). Round "Cost Formula per MH" answers to 2 decimal places.) Overhead Costs Variable overhead costs Cost Formula per MH Actual Cost 58,080 MH Flexible Budget 55,080 MH Spending Variance 0.00 Total variable overhead costs Fixed overhead costs: Total fixed overhead cost 0 $ Total overhead cost 0 0 $