Answered step by step

Verified Expert Solution

Question

1 Approved Answer

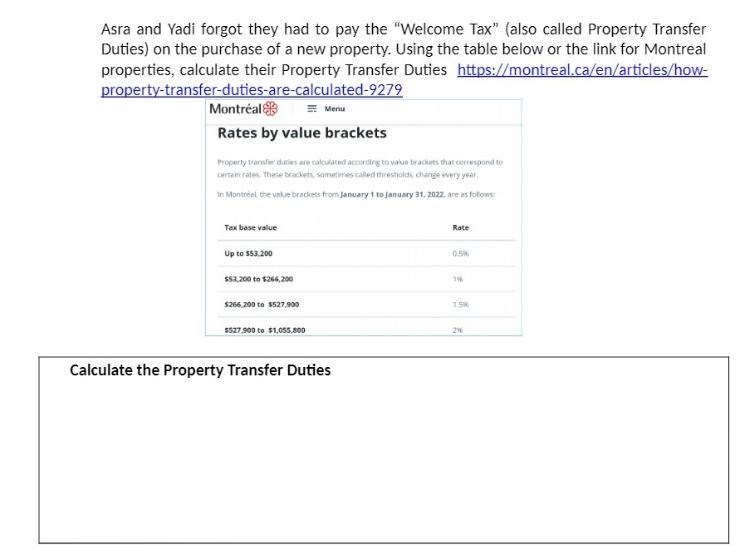

Asra and Yadi forgot they had to pay the Welcome Tax (also called Property Transfer Duties) on the purchase of a new property. Using

Asra and Yadi forgot they had to pay the "Welcome Tax" (also called Property Transfer Duties) on the purchase of a new property. Using the table below or the link for Montreal properties, calculate their Property Transfer Duties https://montreal.ca/en/articles/how- property-transfer-duties-are-calculated-9279 Montral Rates by value brackets Property transfer duties are calculated according to value brackets that correspond to certain rates. These brackets, sometimes called thresholds change every year. in Montreal, the value brackets from January 1 to January 31, 2022, are as follows: Tax base value Up to $53,200 $52,200 to $266,200 $266,200 to $527,900 Menu $527,900 to $1,055,800 Calculate the Property Transfer Duties Rate 0.5% 15W 216

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Property Transfer Duties also known as the Welcome Ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started