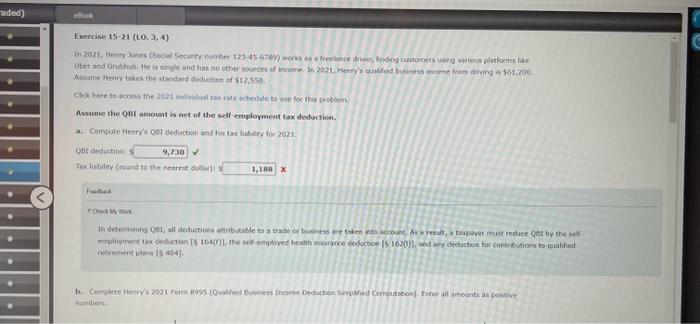

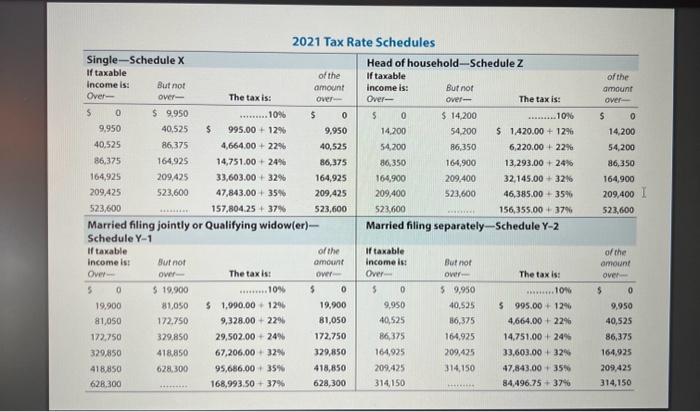

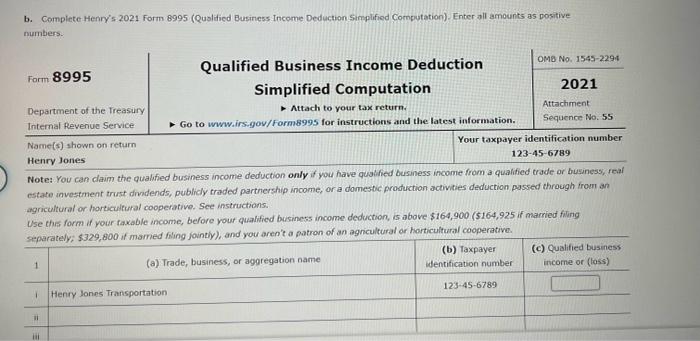

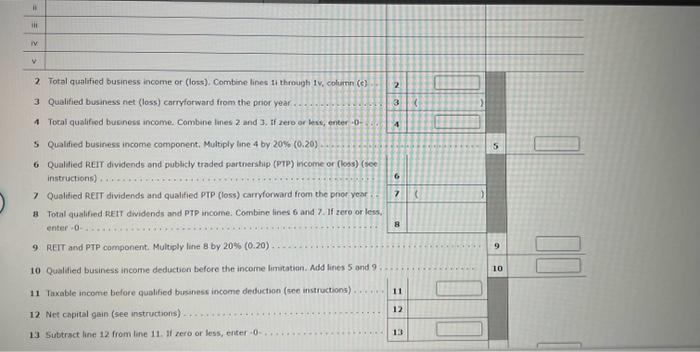

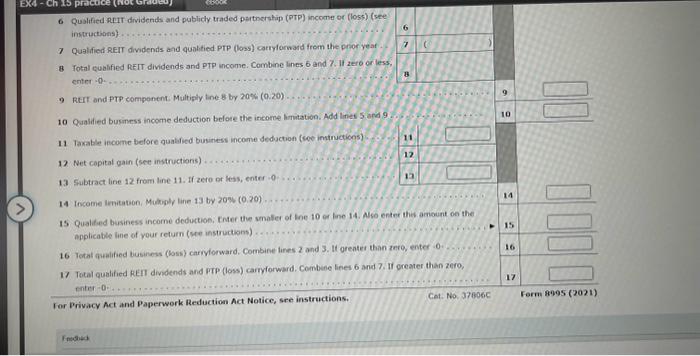

Assame Heriry tabes the standard dedudtion of 512.550 Assume the 96t aenount is aet of the self-employment tax deduction. Qht deductioni x fienas FCrik My Wou if towinent ulors |o abu). numbienk. 2021 Tax Rate Schedules b. Complete-Henry's 2021 Form 8995 (Quolidied Business Income Deduction Stmplified Computation). Enter all amounts as Dositive numbers. 2 Total qualified business income or (lons), Combine lines tu through iv, column (c) 3 Qualified business net (loss) carryforward from the prior year . s 4. Total qualified business income. Combine lanes 2 and 3 , if rero or lers, enter 0 - 5 Qualified business income component. Multiply lane 4 by 20%(0.20) 6. Qualilied REIT dividends ond publicly traded parthership (PTP) income or (loss) (see instructions) 7 Qualitied ReIT dividends and qualified PTP (loss) carryforward from the pnor year B Total qualified RetI dividends and PTP income. Combine lines 6 and 7 . If zero orless, enter -0 9 RET and PTP component. Multiply line 8 by 20%(0.20) 10 Qualdied business income deduction before the incorne lumitation. Add lines 5 and 9 11 Taxable income before qualified biranesc income deductson (see instructions) . ... . is 12. Net capital gain (see instructoons) 13 Subtrsct line 12 from line 11. If zero or less, enter 013 6 Qualfied ReIt dividends and publicly traded patherstip (PTP) income or (loss) (see instructions) 7 Qualified ReIT dividends and qualitied PTP (loss) carrylorwand from the prior yeat. 8 Iotal eublified REII dividends and PTP income. Combine lines 6 and 7 . If zero cr less, enter -0. 9 REIt and PTP Compenent. Multiply ine 8 by 200 (0.20). .. 10 Qualidied business income deduction before the income limitation. Add lines 5 ard 9 11. Taxable income before quatified bininess income deduction (see intructions) 12. Net capital gain (see instructions) 14 Income Imitation, Mukiply line 13 by 30rov(0.20) 15. Qualifed business income deduction, thter the smalier of line 10 or line 14. Aso enter this amount on the. applicable line of vour return (Me instructions) 16 Total au alified tusiness (loss) carcyforward. Combine lines 2 and 3. It grenter than zere, enter -0 17 Total qualified REII dividends and PTP (loss) carrforward. Combine lines 6 and 7 . If greater than zero, For Privacy Act and Paperwork Reduction Act Notice, see instructions. f neduct Assame Heriry tabes the standard dedudtion of 512.550 Assume the 96t aenount is aet of the self-employment tax deduction. Qht deductioni x fienas FCrik My Wou if towinent ulors |o abu). numbienk. 2021 Tax Rate Schedules b. Complete-Henry's 2021 Form 8995 (Quolidied Business Income Deduction Stmplified Computation). Enter all amounts as Dositive numbers. 2 Total qualified business income or (lons), Combine lines tu through iv, column (c) 3 Qualified business net (loss) carryforward from the prior year . s 4. Total qualified business income. Combine lanes 2 and 3 , if rero or lers, enter 0 - 5 Qualified business income component. Multiply lane 4 by 20%(0.20) 6. Qualilied REIT dividends ond publicly traded parthership (PTP) income or (loss) (see instructions) 7 Qualitied ReIT dividends and qualified PTP (loss) carryforward from the pnor year B Total qualified RetI dividends and PTP income. Combine lines 6 and 7 . If zero orless, enter -0 9 RET and PTP component. Multiply line 8 by 20%(0.20) 10 Qualdied business income deduction before the incorne lumitation. Add lines 5 and 9 11 Taxable income before qualified biranesc income deductson (see instructions) . ... . is 12. Net capital gain (see instructoons) 13 Subtrsct line 12 from line 11. If zero or less, enter 013 6 Qualfied ReIt dividends and publicly traded patherstip (PTP) income or (loss) (see instructions) 7 Qualified ReIT dividends and qualitied PTP (loss) carrylorwand from the prior yeat. 8 Iotal eublified REII dividends and PTP income. Combine lines 6 and 7 . If zero cr less, enter -0. 9 REIt and PTP Compenent. Multiply ine 8 by 200 (0.20). .. 10 Qualidied business income deduction before the income limitation. Add lines 5 ard 9 11. Taxable income before quatified bininess income deduction (see intructions) 12. Net capital gain (see instructions) 14 Income Imitation, Mukiply line 13 by 30rov(0.20) 15. Qualifed business income deduction, thter the smalier of line 10 or line 14. Aso enter this amount on the. applicable line of vour return (Me instructions) 16 Total au alified tusiness (loss) carcyforward. Combine lines 2 and 3. It grenter than zere, enter -0 17 Total qualified REII dividends and PTP (loss) carrforward. Combine lines 6 and 7 . If greater than zero, For Privacy Act and Paperwork Reduction Act Notice, see instructions. f neduct