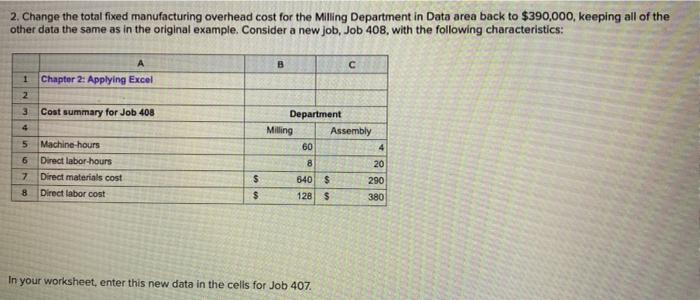

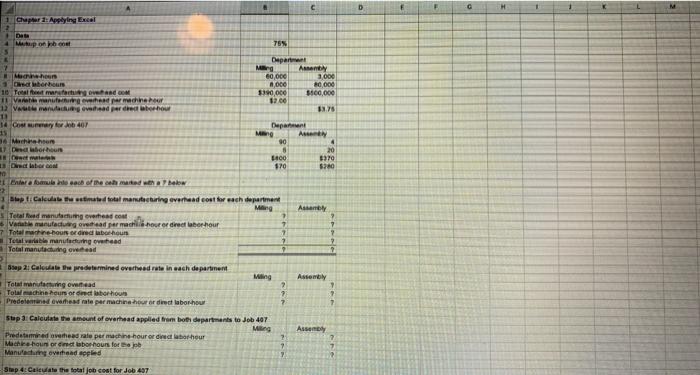

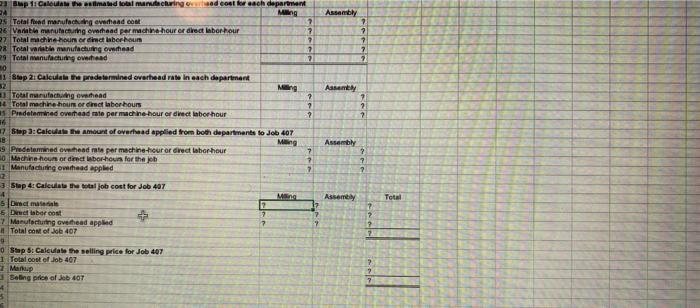

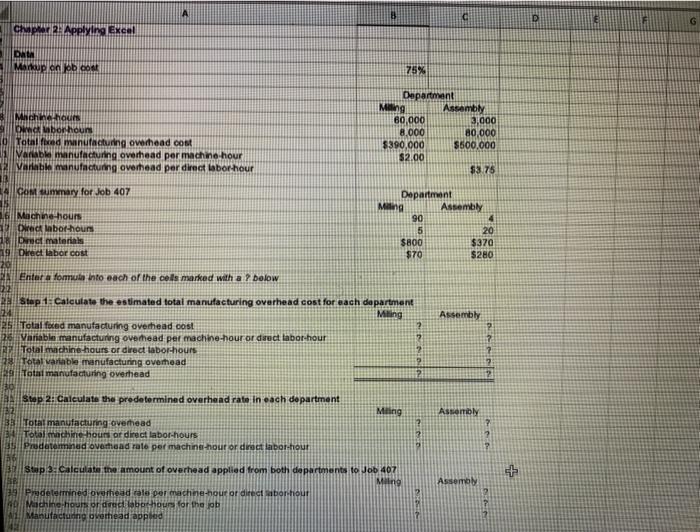

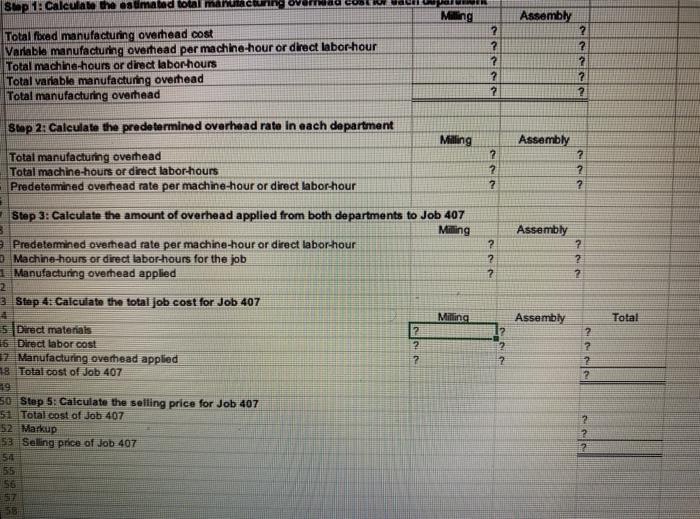

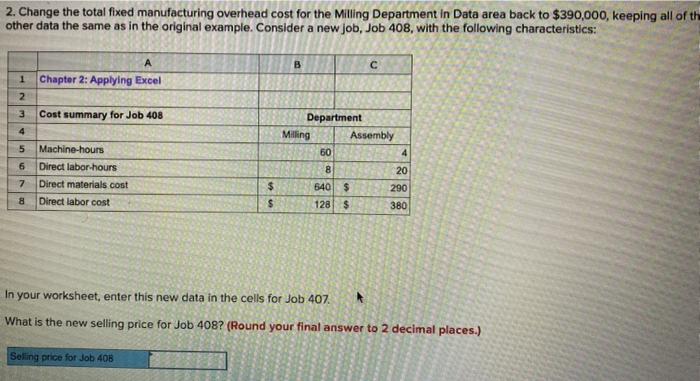

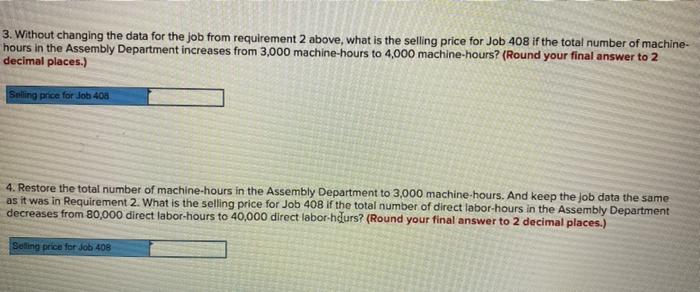

Assembly 7 7 7 7 7 3p 1. Calea hematocringer ad coet kreach department 24 Ming 25 Totalfond manufacturing and con 26 Variant mutacturing vahead per machine hour or direct labor hour ? 27 Total machine houn ordimct laber houm 9 28. Total variabile manufacturing whead 2 9 Totainnufacturing and 2 10 1 Step 2. Calculate the predetermined overhead rate in each department Total manufacturing thead ? Total machine hour or direct labor hours ? 11 Pindetermined overhead male per machine hour or direct labor hour ? 36 17 Step 3: Calculate the amount of overhead applied from both departments to Job 407 8 Meng 9 Predetermined overhead rate per machine-tour or direct labor hour 0 Machine hours or direct labor hours for the job 1 Manufacturing overhead applied AMY 2 7 ? Assembly ? 7 ? Asseme Total 3 Stap 4: Calculate the job cost for Job 407 4 5 cm 6 Denet laber con + 7. Manufacturing overhead applied # Total con of Job 407 7 0 Smp 5: Calculate the selling price for Job 407 1 Total cost of job 407 7 Mark Seling price of Job 407 7 7 A e G Chapter 2 Applying Excel DAN - Moup on to do 75% ne hours Oink bor houn 10 Total med manufacturing overhead con Variable manufacturing overhead por machine hour Variable manufacturing overhead per direct labor hour Department Maling Assembly 60.000 3,000 8,000 80,000 $390.000 $500,000 $2.00 $3.75 ACOM summary for Job 407 Machine hours Oreck Mabor hours 1 materials 19 Oireet Labor cost Department Ming Assembly 90 5 20 $800 $370 $70 $280 Enter a fomut into each of the cols marked with a ? bolow Stap 1: Calculate the estimated total manufacturing overhead cost for each dapartment Miling Assembly 25. Total foxed manufacturing overhead cost 26 Variable manufacturing overhead per machine-hour or duct labor-hour Total machine hours or direct labor hours Total variable manufacturing overhead 29 | Total manufacturing overhead 2 Step 2: Calculate the predetermined overhead rate in each department Mling ASTON Total manufacturing overhead Total machine hour or direct labor-hours minud overhead rato per machine hour or direct labor-hour + ON Stap 2: Calculate the amount of overhead applied from both departments to Job 407 Ming Predetermined overhead al por machine-hour or dired sabor hour Mall Machine hours or de labour for the Manufacturing overhead appled Step 1: Calculate the estimated to Milling Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour or direct labor hour Total machine-hours or direct labor hours Total variable manufacturing overhead Total manufacturing overhead 2 ? ? ? ? Assembly 2 ? 2 ? 2 Assembly 2 2 7 ? 2 ? Miling ? 2 7 Assembly ? 2 7 Stap 2: Calculate the predetermined overhead rate in each department Milling Total manufacturing overhead Total machine-hours or direct labor hours Predetemined overhead rate per machine-hour or direct labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407 3 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job 1 Manufacturing overhead applied 2 3 Step 4: Calculate the total job cost for Job 407 Milling 5 Direct materiais 2 Direct labor cost 2 7 Manufacturing overhead applied 18 Total cost of Job 407 19 50 Step 5: Calculate the selling price for Job 407 51 Total cost of Job 407 52 Markup 53 Selling price of Job 407 51 Assembly Total 2 ? 2 ? 2 2 55 -55 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408, with the following characteristics: 1 A Chapter 2: Applying Excel WN Cost summary for Job 408 4 5 Machine-hours Direct labor-hours Direct materials cost Direct labor cost Department Milling Assembly 50 4 8 20 640$ 290 128 $ 380 6 7 $ $ 8 In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408? (Round your final answer to 2 decimal places.) Selling price for Job 408 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine- hours in the Assembly Department increases from 3,000 machine-hours to 4,000 machine-hours? (Round your final answer to 2 decimal places.) Selling price for Job 400 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hdurs? (Round your final answer to 2 decimal places.) Selling price for Job 408 Assembly 7 7 7 7 7 3p 1. Calea hematocringer ad coet kreach department 24 Ming 25 Totalfond manufacturing and con 26 Variant mutacturing vahead per machine hour or direct labor hour ? 27 Total machine houn ordimct laber houm 9 28. Total variabile manufacturing whead 2 9 Totainnufacturing and 2 10 1 Step 2. Calculate the predetermined overhead rate in each department Total manufacturing thead ? Total machine hour or direct labor hours ? 11 Pindetermined overhead male per machine hour or direct labor hour ? 36 17 Step 3: Calculate the amount of overhead applied from both departments to Job 407 8 Meng 9 Predetermined overhead rate per machine-tour or direct labor hour 0 Machine hours or direct labor hours for the job 1 Manufacturing overhead applied AMY 2 7 ? Assembly ? 7 ? Asseme Total 3 Stap 4: Calculate the job cost for Job 407 4 5 cm 6 Denet laber con + 7. Manufacturing overhead applied # Total con of Job 407 7 0 Smp 5: Calculate the selling price for Job 407 1 Total cost of job 407 7 Mark Seling price of Job 407 7 7 A e G Chapter 2 Applying Excel DAN - Moup on to do 75% ne hours Oink bor houn 10 Total med manufacturing overhead con Variable manufacturing overhead por machine hour Variable manufacturing overhead per direct labor hour Department Maling Assembly 60.000 3,000 8,000 80,000 $390.000 $500,000 $2.00 $3.75 ACOM summary for Job 407 Machine hours Oreck Mabor hours 1 materials 19 Oireet Labor cost Department Ming Assembly 90 5 20 $800 $370 $70 $280 Enter a fomut into each of the cols marked with a ? bolow Stap 1: Calculate the estimated total manufacturing overhead cost for each dapartment Miling Assembly 25. Total foxed manufacturing overhead cost 26 Variable manufacturing overhead per machine-hour or duct labor-hour Total machine hours or direct labor hours Total variable manufacturing overhead 29 | Total manufacturing overhead 2 Step 2: Calculate the predetermined overhead rate in each department Mling ASTON Total manufacturing overhead Total machine hour or direct labor-hours minud overhead rato per machine hour or direct labor-hour + ON Stap 2: Calculate the amount of overhead applied from both departments to Job 407 Ming Predetermined overhead al por machine-hour or dired sabor hour Mall Machine hours or de labour for the Manufacturing overhead appled Step 1: Calculate the estimated to Milling Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour or direct labor hour Total machine-hours or direct labor hours Total variable manufacturing overhead Total manufacturing overhead 2 ? ? ? ? Assembly 2 ? 2 ? 2 Assembly 2 2 7 ? 2 ? Miling ? 2 7 Assembly ? 2 7 Stap 2: Calculate the predetermined overhead rate in each department Milling Total manufacturing overhead Total machine-hours or direct labor hours Predetemined overhead rate per machine-hour or direct labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407 3 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job 1 Manufacturing overhead applied 2 3 Step 4: Calculate the total job cost for Job 407 Milling 5 Direct materiais 2 Direct labor cost 2 7 Manufacturing overhead applied 18 Total cost of Job 407 19 50 Step 5: Calculate the selling price for Job 407 51 Total cost of Job 407 52 Markup 53 Selling price of Job 407 51 Assembly Total 2 ? 2 ? 2 2 55 -55 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408, with the following characteristics: 1 A Chapter 2: Applying Excel WN Cost summary for Job 408 4 5 Machine-hours Direct labor-hours Direct materials cost Direct labor cost Department Milling Assembly 50 4 8 20 640$ 290 128 $ 380 6 7 $ $ 8 In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408? (Round your final answer to 2 decimal places.) Selling price for Job 408 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine- hours in the Assembly Department increases from 3,000 machine-hours to 4,000 machine-hours? (Round your final answer to 2 decimal places.) Selling price for Job 400 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hdurs? (Round your final answer to 2 decimal places.) Selling price for Job 408