Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assess the past financial performance using the statement of cash flow and ratio analysis. Net sales Cost of goods sold Gross profit Operating expenses Wages

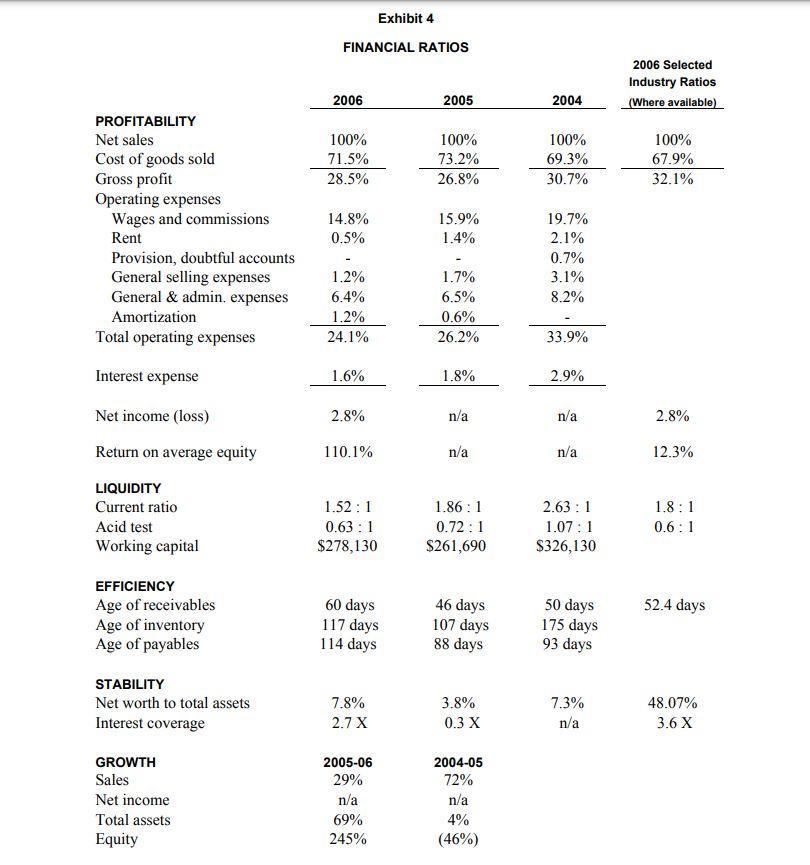

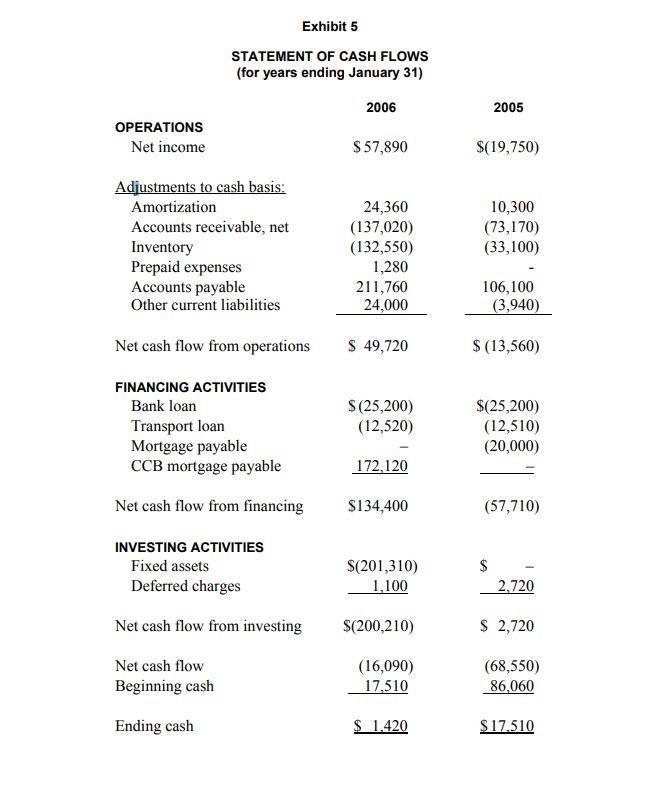

Assess the past financial performance using the statement of cash flow and ratio analysis.

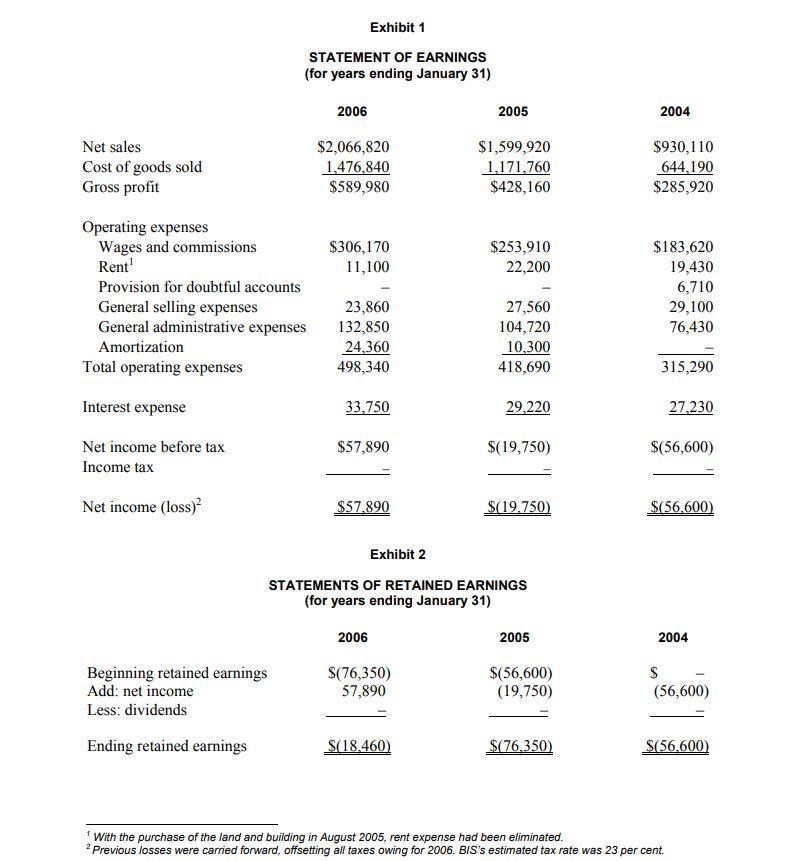

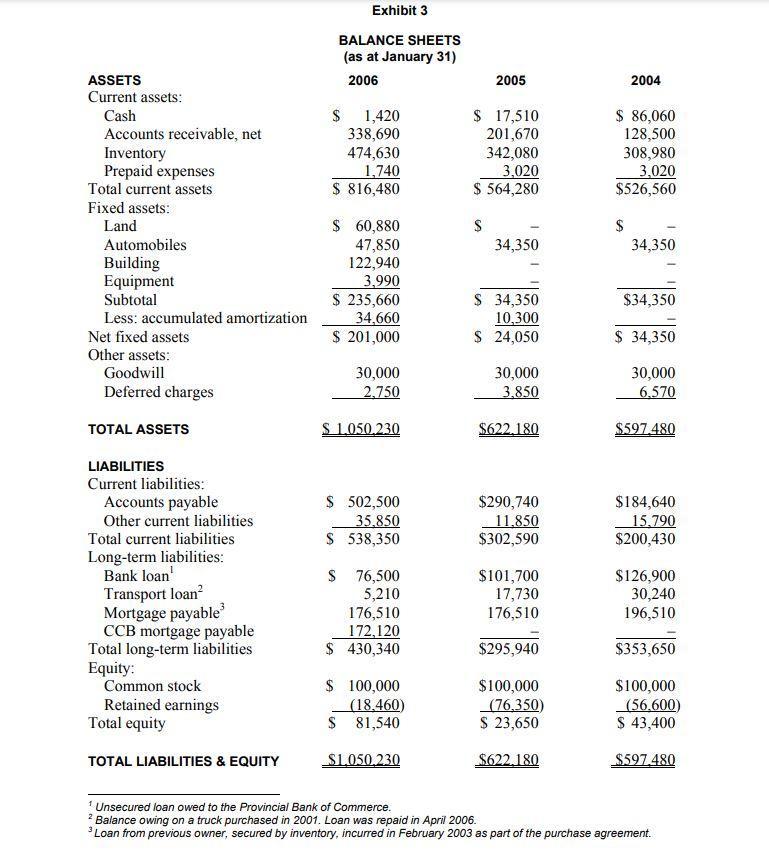

Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision for doubtful accounts General selling expenses General administrative expenses Amortization Total operating expenses Interest expense Net income before tax Income tax Net income (loss) Exhibit 1 STATEMENT OF EARNINGS (for years ending January 31) Beginning retained earnings Add: net income Less: dividends Ending retained earnings 2006 $2,066,820 1,476,840 $589,980 $306,170 11,100 23,860 132,850 24,360 498,340 33,750 $57,890 $57.890 2005 $(18,460) $1,599,920 1,171,760 $428,160 $253,910 22,200 27,560 104,720 10,300 418,690 29,220 $(19,750) $(19,750) Exhibit 2 STATEMENTS OF RETAINED EARNINGS (for years ending January 31) 2006 $(76,350) 57,890 2005 $(56,600) (19,750) $(76.350) 2004 $930,110 644,190 $285,920 $183,620 19,430 6,710 29,100 76,430 315,290 27,230 $(56,600) $(56.600) 2004 $ (56,600) $(56.600) With the purchase of the land and building in August 2005, rent expense had been eliminated. 2 Previous losses were carried forward, offsetting all taxes owing for 2006. BIS's estimated tax rate was 23 per cent. Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision for doubtful accounts General selling expenses General administrative expenses Amortization Total operating expenses Interest expense Net income before tax Income tax Net income (loss) Exhibit 1 STATEMENT OF EARNINGS (for years ending January 31) Beginning retained earnings Add: net income Less: dividends Ending retained earnings 2006 $2,066,820 1,476,840 $589,980 $306,170 11,100 23,860 132,850 24,360 498,340 33,750 $57,890 $57.890 2005 $(18,460) $1,599,920 1,171,760 $428,160 $253,910 22,200 27,560 104,720 10,300 418,690 29,220 $(19,750) $(19,750) Exhibit 2 STATEMENTS OF RETAINED EARNINGS (for years ending January 31) 2006 $(76,350) 57,890 2005 $(56,600) (19,750) $(76.350) 2004 $930,110 644,190 $285,920 $183,620 19,430 6,710 29,100 76,430 315,290 27,230 $(56,600) $(56.600) 2004 $ (56,600) $(56.600) With the purchase of the land and building in August 2005, rent expense had been eliminated. 2 Previous losses were carried forward, offsetting all taxes owing for 2006. BIS's estimated tax rate was 23 per cent.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the financial information provided in the exhibits we can perform a financial analysis and calculate various financial ratios for the company Here are some key calculations and analysis that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started