Question

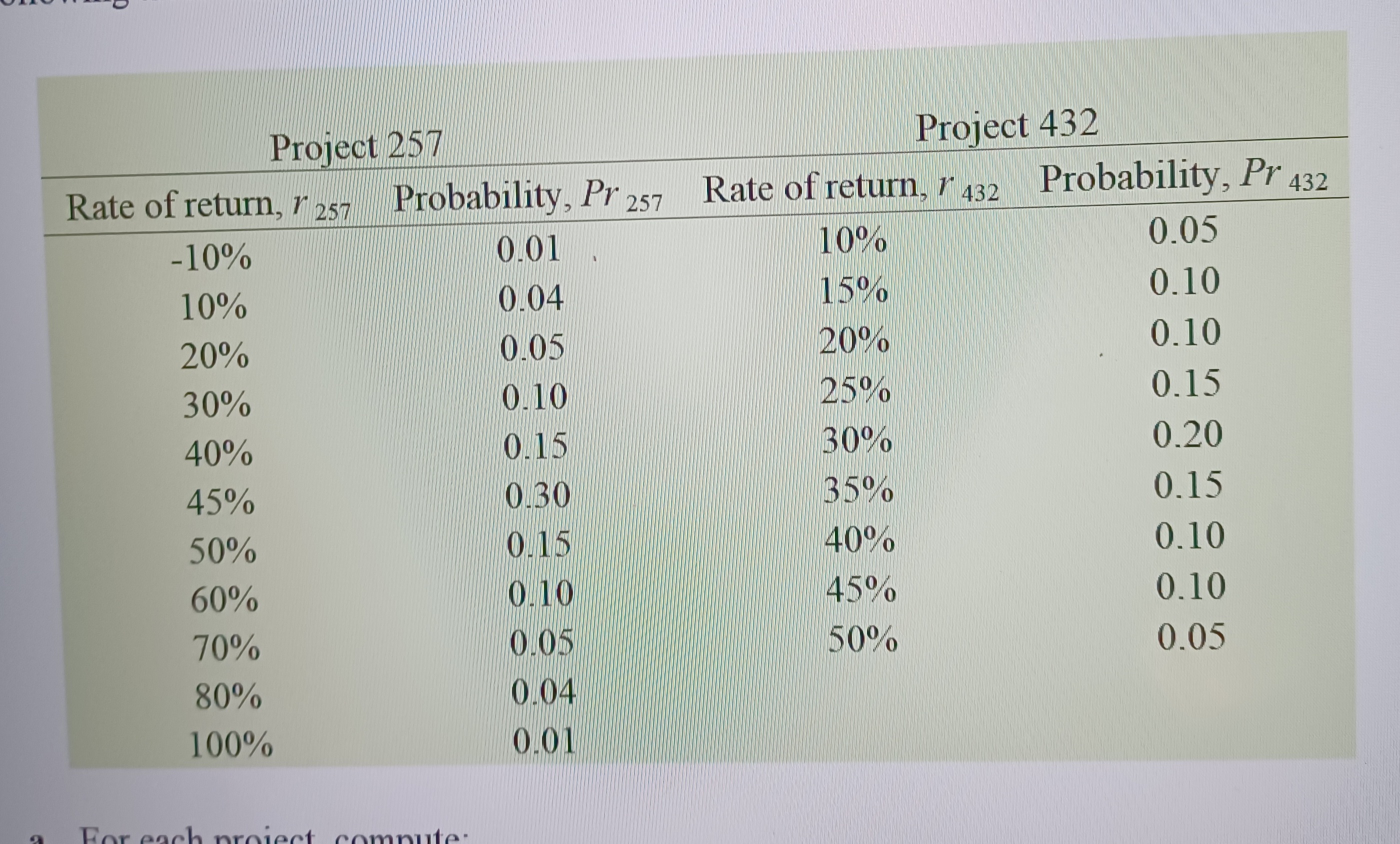

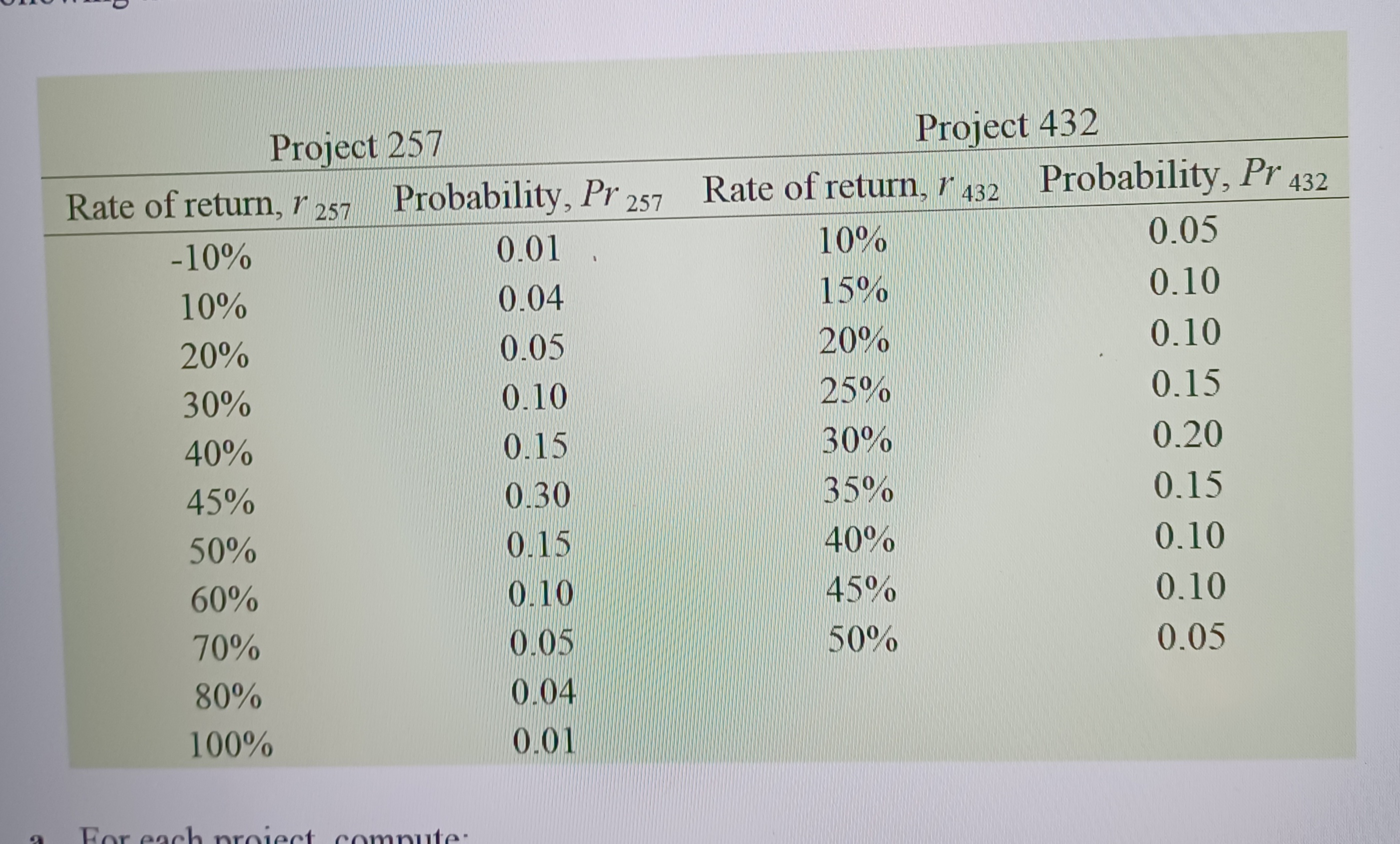

Assessing return and risk Swift Manufacturing must choose between two asset purchases. The annual rate of return and the related probabilities given in the following

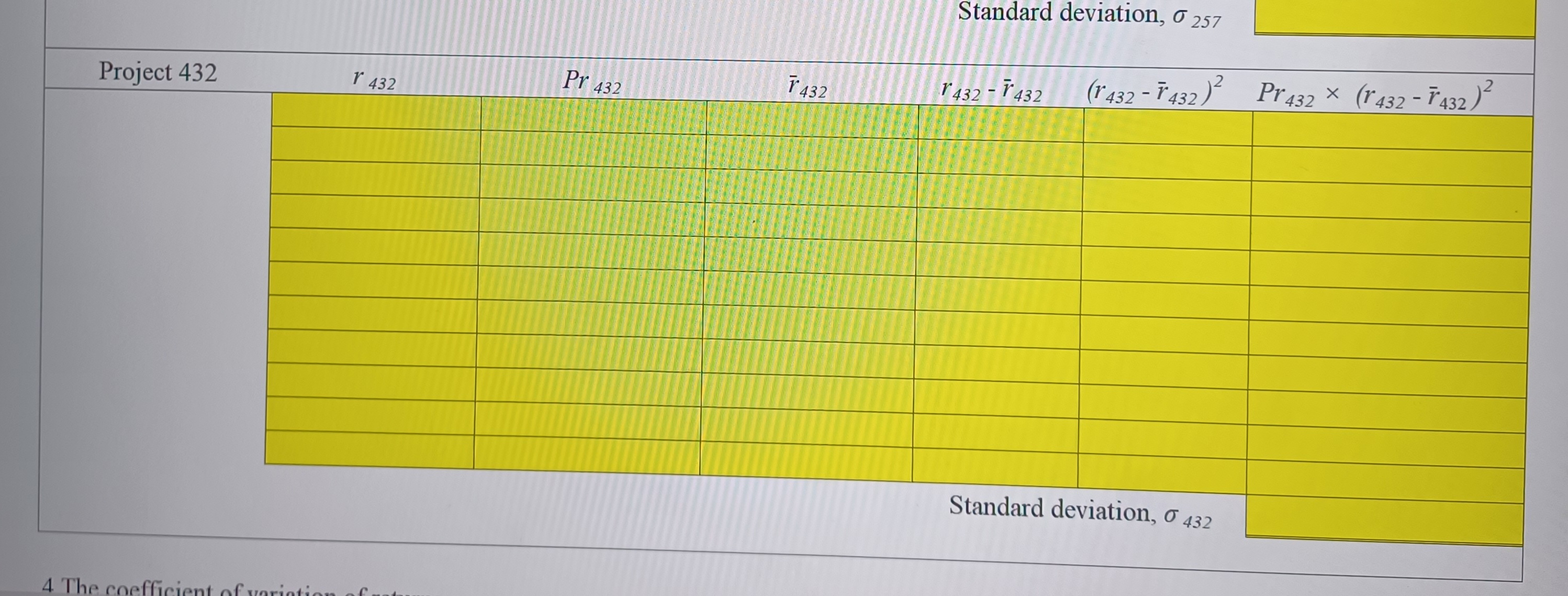

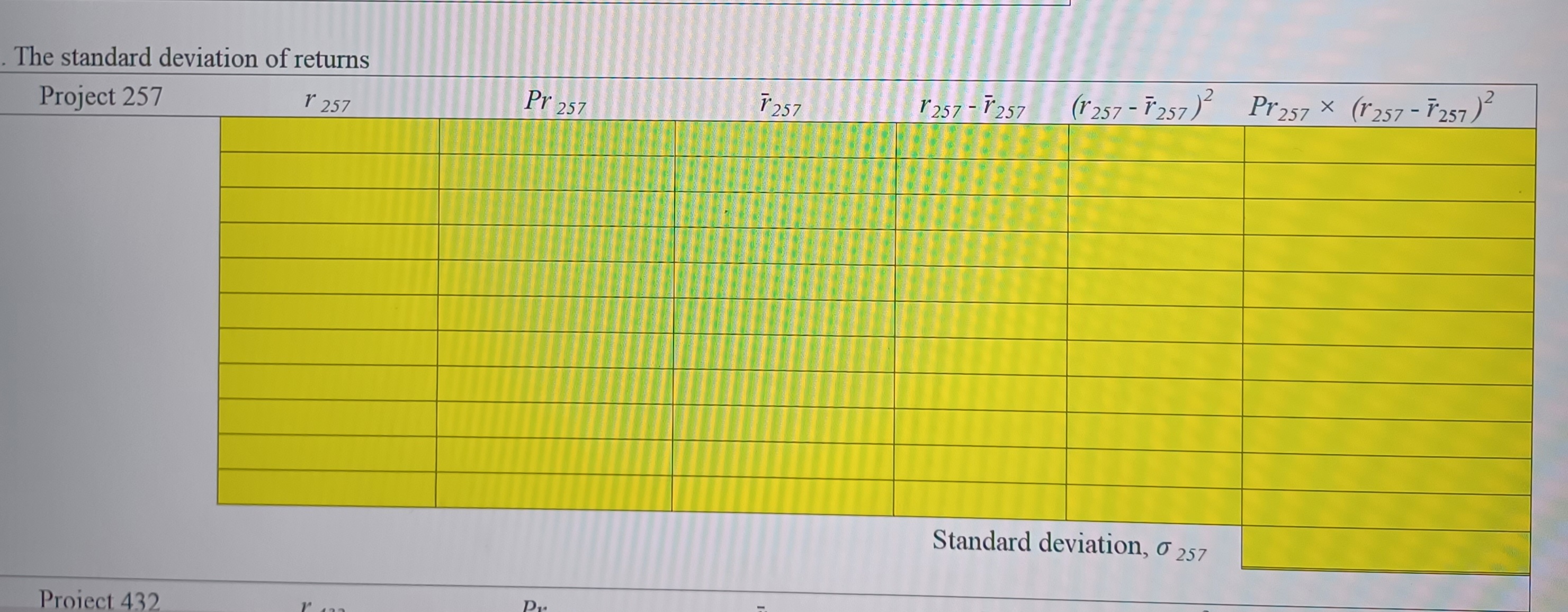

Assessing return and risk Swift Manufacturing must choose between two asset purchases. The annual rate of return and the related probabilities given in the following table summarize the firms analysis to this point. a. For each project, compute: 1. The range of possible rates of return. 2. The average return 3. The standard deviation of returns 4 The coefficient of variation of returns. c. Which project would you consider less risky? Why?

Assessing return and risk Swift Manufacturing must choose between two asset purchases. The annual rate of return and the related probabilities given in the following table summarize the firms analysis to this point. a. For each project, compute: 1. The range of possible rates of return. 2. The average return 3. The standard deviation of returns 4 The coefficient of variation of returns. c. Which project would you consider less risky? Why?

Not all of the photos were able to upload, but it also wants answers for Range of possible rate for the return for Project 257 and 432.

It wants The average return of project 257 with r257, Pr257, and r257 x Pr 257 and it has 11 rows on each one

and also the same for the average return with 432, but it wants r432, Pr 432, and r 432 x Pr 432 with also 11 rows on each of those.

And the last thing that is missing on the photos is the Coefficient of variation of return for Project 257 and Project 432 and it just wants one answer for each of those for the coefficient

4 The coefficient of a For each nroiect comnute- . The sta Proje Standard deviation, 257 a For each nroiect comnute- 4 The coefficient of a For each nroiect comnute- . The sta Proje Standard deviation, 257 a For each nroiect comnuteStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started