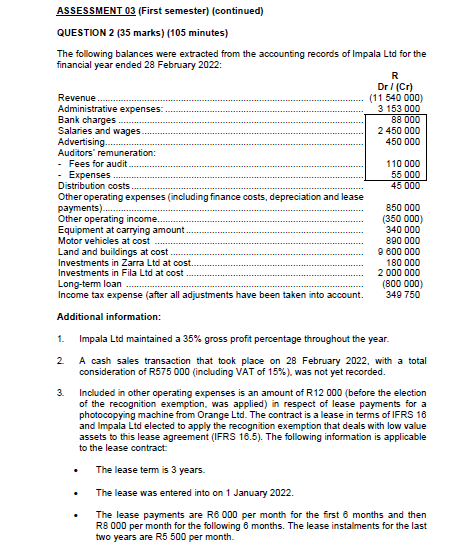

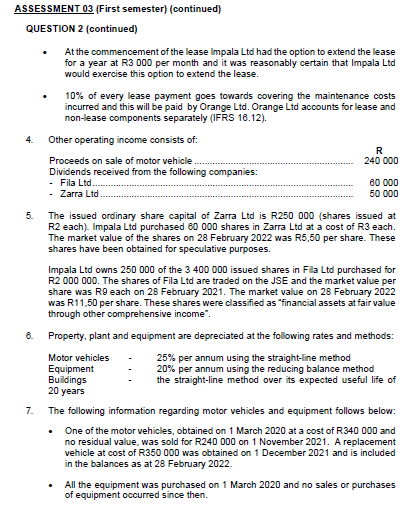

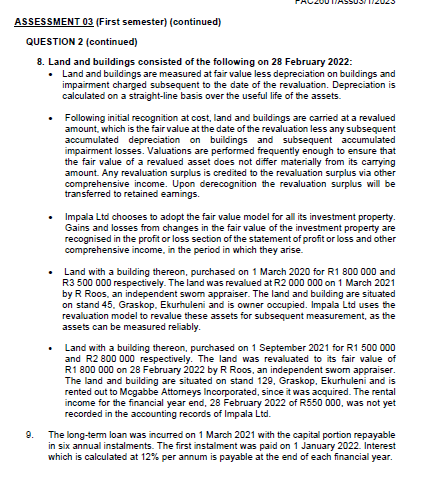

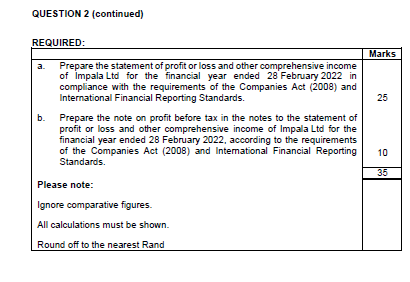

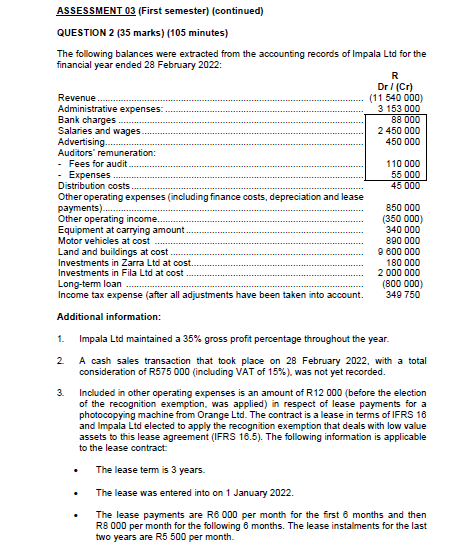

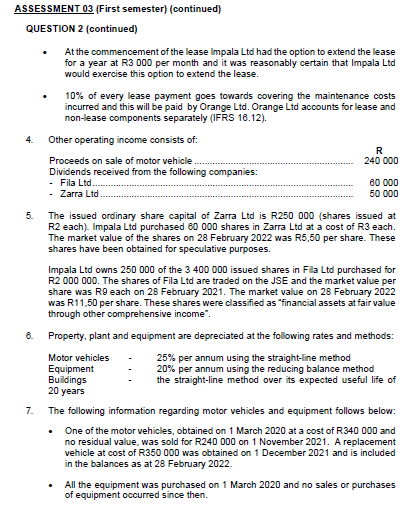

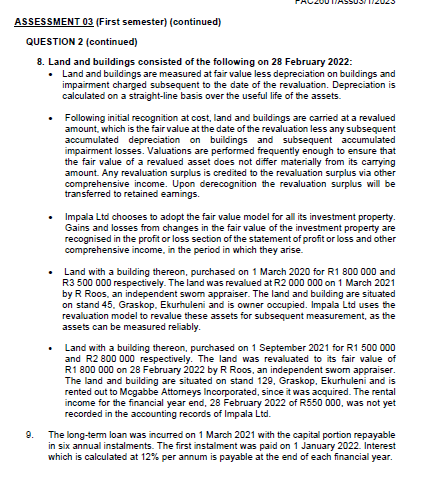

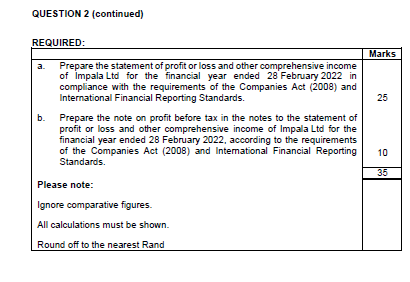

ASSESSMENT 03 (First semester) (continued) QUESTION 2 ( 35 marks) (105 minutes) The following balances were extracted from the accounting records of Impala Ltd for the financial year ended 28 February 2022 : R Additional information: 1. Impala Ltd maintained a 35% gross profit percentage throughout the year. 2. A cash sales transaction that took place on 28 February 2022, with a total consideration of R575 000 (including VAT of 15% ), was not yet recorded. 3. Included in other operating expenses is an amount of R12 000 (before the election of the recognition exemption, was applied) in respect of lease payments for a photocopying machine from Orange Ltd. The contract is a lease in terms of IFRS 16 and Impala Ltd elected to apply the recognition exemption that deals with low value assets to this lease agreement (IFRS 16.5). The following information is applicable to the lease contract - The lease term is 3 years. - The lease was entered into on 1 January 2022. - The lease payments are R 600 per month for the first 6 months and then R8 000 per month for the following 6 months. The lease instalments for the last two years are R5 500 per month. ASSESSMENT 03 (First semester) (continued) QUESTION 2 (continued) - At the commencement of the lease lmpala Ltd had the option to extend the lease for a year at R3 000 per month and it was reasonably certain that Impala Ltd would exercise this option to extend the lease. - 10% of every lease payment goes towards covering the maintenance costs incurred and this will be paid by Orange Ltd. Orange Ltd accounts for lease and non-lease components separately (IFRS 16.12). 5. The issued ordinary share capital of Zarra Ltd is R250 000 (shares issued at R2 each). Impala Ltd purchased 60000 shares in Zarra Ltd at a cost of R3 each. The market value of the shares on 28 February 2022 was R5,50 per share. These shares have been obtained for speculative purposes. Impala Ltd owns 250000 of the 3400000 issued shares in Flla Ltd purchased for R2 000 000. The shares of Fila Ltd are traded on the JSE and the market value per share was R9 each on 28 February 2021 . The market value on 28 February 2022 was R 11,50 per share. These shares were classified as "financial assets at fair value through other comprehensive income". 6. Property, plant and equipment are depreciated at the following rates and methods: Motor vehicles - 25% per annum using the straight-line method Equipment - 20% per annum using the reducing balance method Buildings - the straight-line method over its expected useful life of 20 years 7. The following information regarding motor vehicles and equipment follows below: - One of the motor vehicles, obtained on 1 March 2020 at a cost of R340 000 and no residual value, was sold for R240 000 on 1 November 2021. A replacement vehicle at cost of R350 000 was obtained on 1 December 2021 and is included in the balances as at 28 February 2022 . - All the equipment was purchased on 1 March 2020 and no sales or purchases of equipment occurred since then. SSESSMENT 03 (First semester) (continued) QUESTION 2 (continued) 8. Land and buildings consisted of the following on 28 February 2022: - Land and buildings are measured at fair value less depreciation on buildings and impairment charged subsequent to the date of the revaluation. Depreciation is calculated on a straight-line basis over the useful life of the assets. - Following initial recognition at cost, land and buildings are carried at a revalued amount, which is the fair value at the date of the revaluation less any subsequent accumulated depreciation on buildings and subsequent accumulated impairment losses. Valuations are performed frequently enough to ensure that the fair value of a revalued asset does not differ materially from its carrying amount. Any revaluation surplus is credited to the revaluation surplus via other comprehensive income. Upon derecognition the revaluation surplus will be transferred to retained earnings. - Impala Ltd chooses to adopt the fair value model for all its investment property. Gains and losses from changes in the fair value of the investment property are recognised in the profit or loss section of the statement of profit or loss and other comprehensive income, in the period in which they arise. - Land with a building thereon, purchased on 1 March 2020 for R1 800000 and R3 500000 respectively. The land was revalued at R2 000000 on 1 March 2021 by R Roos, an independent swom appraiser. The land and building are situated on stand 45 , Graskop. Ekurhuleni and is owner occupied. Impala Ltd uses the revaluation model to revalue these assets for subsequent measurement, as the assets can be measured reliably. - Land with a building thereon, purchased on 1 September 2021 for R1 500000 and R2 800000 respectively. The land was revaluated to its fair value of R 1800000 on 28 February 2022 by R Roos, an independent swom appraiser. The land and building are situated on stand 129, Graskop. Ekurhuleni and is rented out to Mcgabbe Attomeys Incorporated, since it was acquired. The rental income for the financial year end, 28 February 2022 of R550 000, was not yet recorded in the accounting records of Impala Ltd. 9. The long-term loan was incurred on 1 March 2021 with the capital portion repayable in six annual instalments. The first instalment was paid on 1 January 2022. Interest which is calculated at 12% per annum is payable at the end of each financial year. QUESTION 2 (continued) REQUIRED: \begin{tabular}{|l|c|} \hline & Marks \\ \hline a. Prepare the statement of profit or loss and other comprehensive income \\ of Impala Ltd for the financial year ended 28 February 2022 in \\ compliance with the requirements of the Companies Act (2008) and \\ International Financial Reporting Standards. & \\ b. Prepare the note on profit before tax in the notes to the statement of \\ profit or loss and other comprehensive income of Impala Ltd for the \\ financial year ended 28 February 2022, according to the requirements \\ of the Companies Act (2008) and Intemational Financial Reporting \\ & 25 \\ Standards. \\ Please note: \\ lgnore comparative figures. \\ All calculations must be shown. \\ Round off to the nearest Rand \end{tabular} ASSESSMENT 03 (First semester) (continued) QUESTION 2 ( 35 marks) (105 minutes) The following balances were extracted from the accounting records of Impala Ltd for the financial year ended 28 February 2022 : R Additional information: 1. Impala Ltd maintained a 35% gross profit percentage throughout the year. 2. A cash sales transaction that took place on 28 February 2022, with a total consideration of R575 000 (including VAT of 15% ), was not yet recorded. 3. Included in other operating expenses is an amount of R12 000 (before the election of the recognition exemption, was applied) in respect of lease payments for a photocopying machine from Orange Ltd. The contract is a lease in terms of IFRS 16 and Impala Ltd elected to apply the recognition exemption that deals with low value assets to this lease agreement (IFRS 16.5). The following information is applicable to the lease contract - The lease term is 3 years. - The lease was entered into on 1 January 2022. - The lease payments are R 600 per month for the first 6 months and then R8 000 per month for the following 6 months. The lease instalments for the last two years are R5 500 per month. ASSESSMENT 03 (First semester) (continued) QUESTION 2 (continued) - At the commencement of the lease lmpala Ltd had the option to extend the lease for a year at R3 000 per month and it was reasonably certain that Impala Ltd would exercise this option to extend the lease. - 10% of every lease payment goes towards covering the maintenance costs incurred and this will be paid by Orange Ltd. Orange Ltd accounts for lease and non-lease components separately (IFRS 16.12). 5. The issued ordinary share capital of Zarra Ltd is R250 000 (shares issued at R2 each). Impala Ltd purchased 60000 shares in Zarra Ltd at a cost of R3 each. The market value of the shares on 28 February 2022 was R5,50 per share. These shares have been obtained for speculative purposes. Impala Ltd owns 250000 of the 3400000 issued shares in Flla Ltd purchased for R2 000 000. The shares of Fila Ltd are traded on the JSE and the market value per share was R9 each on 28 February 2021 . The market value on 28 February 2022 was R 11,50 per share. These shares were classified as "financial assets at fair value through other comprehensive income". 6. Property, plant and equipment are depreciated at the following rates and methods: Motor vehicles - 25% per annum using the straight-line method Equipment - 20% per annum using the reducing balance method Buildings - the straight-line method over its expected useful life of 20 years 7. The following information regarding motor vehicles and equipment follows below: - One of the motor vehicles, obtained on 1 March 2020 at a cost of R340 000 and no residual value, was sold for R240 000 on 1 November 2021. A replacement vehicle at cost of R350 000 was obtained on 1 December 2021 and is included in the balances as at 28 February 2022 . - All the equipment was purchased on 1 March 2020 and no sales or purchases of equipment occurred since then. SSESSMENT 03 (First semester) (continued) QUESTION 2 (continued) 8. Land and buildings consisted of the following on 28 February 2022: - Land and buildings are measured at fair value less depreciation on buildings and impairment charged subsequent to the date of the revaluation. Depreciation is calculated on a straight-line basis over the useful life of the assets. - Following initial recognition at cost, land and buildings are carried at a revalued amount, which is the fair value at the date of the revaluation less any subsequent accumulated depreciation on buildings and subsequent accumulated impairment losses. Valuations are performed frequently enough to ensure that the fair value of a revalued asset does not differ materially from its carrying amount. Any revaluation surplus is credited to the revaluation surplus via other comprehensive income. Upon derecognition the revaluation surplus will be transferred to retained earnings. - Impala Ltd chooses to adopt the fair value model for all its investment property. Gains and losses from changes in the fair value of the investment property are recognised in the profit or loss section of the statement of profit or loss and other comprehensive income, in the period in which they arise. - Land with a building thereon, purchased on 1 March 2020 for R1 800000 and R3 500000 respectively. The land was revalued at R2 000000 on 1 March 2021 by R Roos, an independent swom appraiser. The land and building are situated on stand 45 , Graskop. Ekurhuleni and is owner occupied. Impala Ltd uses the revaluation model to revalue these assets for subsequent measurement, as the assets can be measured reliably. - Land with a building thereon, purchased on 1 September 2021 for R1 500000 and R2 800000 respectively. The land was revaluated to its fair value of R 1800000 on 28 February 2022 by R Roos, an independent swom appraiser. The land and building are situated on stand 129, Graskop. Ekurhuleni and is rented out to Mcgabbe Attomeys Incorporated, since it was acquired. The rental income for the financial year end, 28 February 2022 of R550 000, was not yet recorded in the accounting records of Impala Ltd. 9. The long-term loan was incurred on 1 March 2021 with the capital portion repayable in six annual instalments. The first instalment was paid on 1 January 2022. Interest which is calculated at 12% per annum is payable at the end of each financial year. QUESTION 2 (continued) REQUIRED: \begin{tabular}{|l|c|} \hline & Marks \\ \hline a. Prepare the statement of profit or loss and other comprehensive income \\ of Impala Ltd for the financial year ended 28 February 2022 in \\ compliance with the requirements of the Companies Act (2008) and \\ International Financial Reporting Standards. & \\ b. Prepare the note on profit before tax in the notes to the statement of \\ profit or loss and other comprehensive income of Impala Ltd for the \\ financial year ended 28 February 2022, according to the requirements \\ of the Companies Act (2008) and Intemational Financial Reporting \\ & 25 \\ Standards. \\ Please note: \\ lgnore comparative figures. \\ All calculations must be shown. \\ Round off to the nearest Rand \end{tabular}