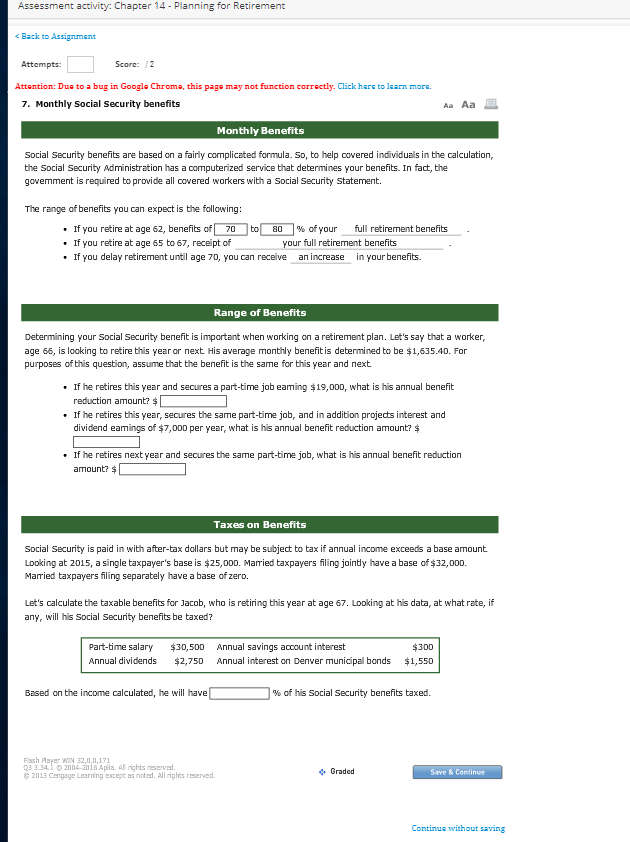

Assessment activity: Chapter 14 Planning for Retirement Back to Assignment Attempts Attention: Dua toa bug in Google Chrome, this page may not function correctly. Click hereto learn more. Scorc: 2 7. Monthly Social Security benefits Aa Aa Monthly Benefits Social Security benefits are based on a fairly complicated formula. So, to help covered individuals in the calculation, the Social Security Administration has a computerized service that determines your benefits. In fact, the govemment is required to provide all covered workers with a Social Security Statement. The range of benefits you can expect is the following . If you retire at age 62, benefits of[70]bo[80]%of your If you retire at age 65 to 67, receipt of If you delay retirement until age 70, you can receive an increase full retirement benefits our full retirement benefits in your benefits. Range of Benefits Determining your Social Security benefit is important when working on a retirement plan. Let's say that a worker age 66, is looking to retire this year or next. His average monbhly benefitis determined to be $1,635.4D. For purposes of this question, assume that the benefit is the same for this year and next If he retires this year and secures a part-time job eaming $19,00D, what is his annual benefit reduction amount? $ If he retires this year, secures the same part-time job, and in addition projects interest and dividend eamings of $7,000 per year, what is his annual benefit reduction amount?$ If he retires nextyear and secures the same part-time job, what is his annual benefit reduction Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount Looking at 2015, a single taxpayer's base is $25,0DD. Married taxpayers filing joindy have a base of $32,0D0. Married taxpayers filing separately have a base of zero. Let's calculatethe taxable benefits for Jacob, who is retiring this year at age 67. Looking at his data, at what rate, if any, will his Social Security benefits be taxed? Part-time salary Annual dividends $30,5DD $2,75D Annual savings account interest Annual interest on Denver municipal bonds 3DD $1,550 Based on the income calculated, he will have % of his Social Security benefits taxed. Fash 3 3.341 2004-2016 Apia. All rights reserve 2013 Cangage Learning excepta noted. All rights reserved Graded Continus without saving Assessment activity: Chapter 14 Planning for Retirement Back to Assignment Attempts Attention: Dua toa bug in Google Chrome, this page may not function correctly. Click hereto learn more. Scorc: 2 7. Monthly Social Security benefits Aa Aa Monthly Benefits Social Security benefits are based on a fairly complicated formula. So, to help covered individuals in the calculation, the Social Security Administration has a computerized service that determines your benefits. In fact, the govemment is required to provide all covered workers with a Social Security Statement. The range of benefits you can expect is the following . If you retire at age 62, benefits of[70]bo[80]%of your If you retire at age 65 to 67, receipt of If you delay retirement until age 70, you can receive an increase full retirement benefits our full retirement benefits in your benefits. Range of Benefits Determining your Social Security benefit is important when working on a retirement plan. Let's say that a worker age 66, is looking to retire this year or next. His average monbhly benefitis determined to be $1,635.4D. For purposes of this question, assume that the benefit is the same for this year and next If he retires this year and secures a part-time job eaming $19,00D, what is his annual benefit reduction amount? $ If he retires this year, secures the same part-time job, and in addition projects interest and dividend eamings of $7,000 per year, what is his annual benefit reduction amount?$ If he retires nextyear and secures the same part-time job, what is his annual benefit reduction Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount Looking at 2015, a single taxpayer's base is $25,0DD. Married taxpayers filing joindy have a base of $32,0D0. Married taxpayers filing separately have a base of zero. Let's calculatethe taxable benefits for Jacob, who is retiring this year at age 67. Looking at his data, at what rate, if any, will his Social Security benefits be taxed? Part-time salary Annual dividends $30,5DD $2,75D Annual savings account interest Annual interest on Denver municipal bonds 3DD $1,550 Based on the income calculated, he will have % of his Social Security benefits taxed. Fash 3 3.341 2004-2016 Apia. All rights reserve 2013 Cangage Learning excepta noted. All rights reserved Graded Continus without saving