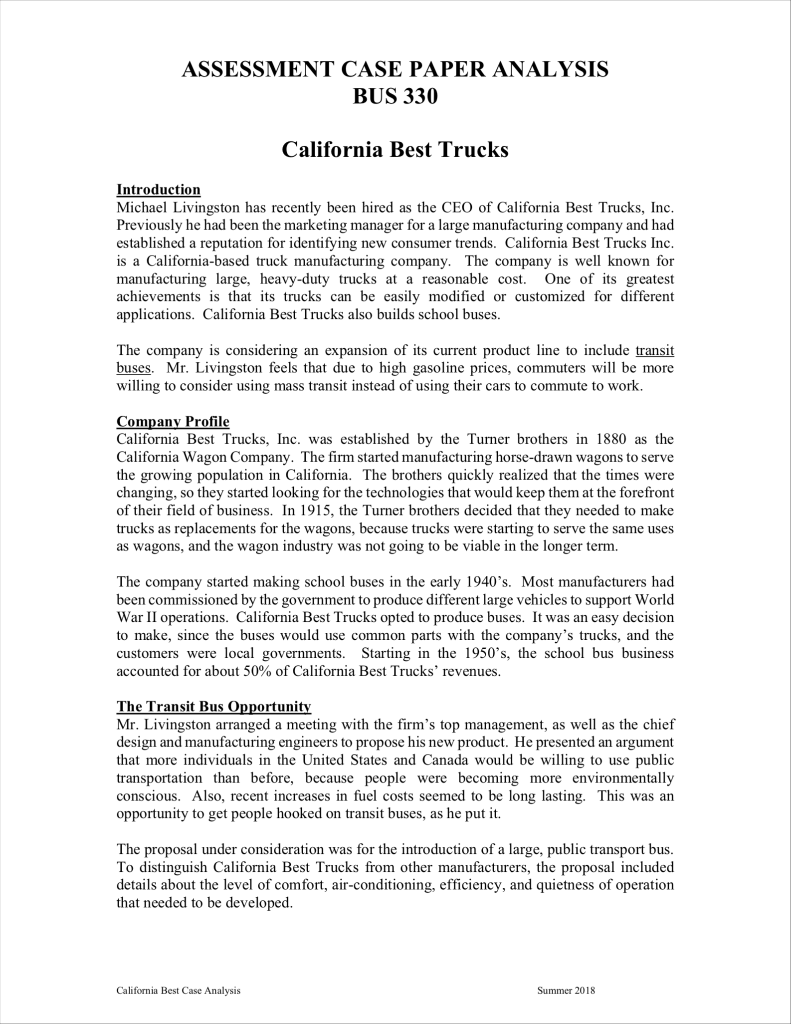

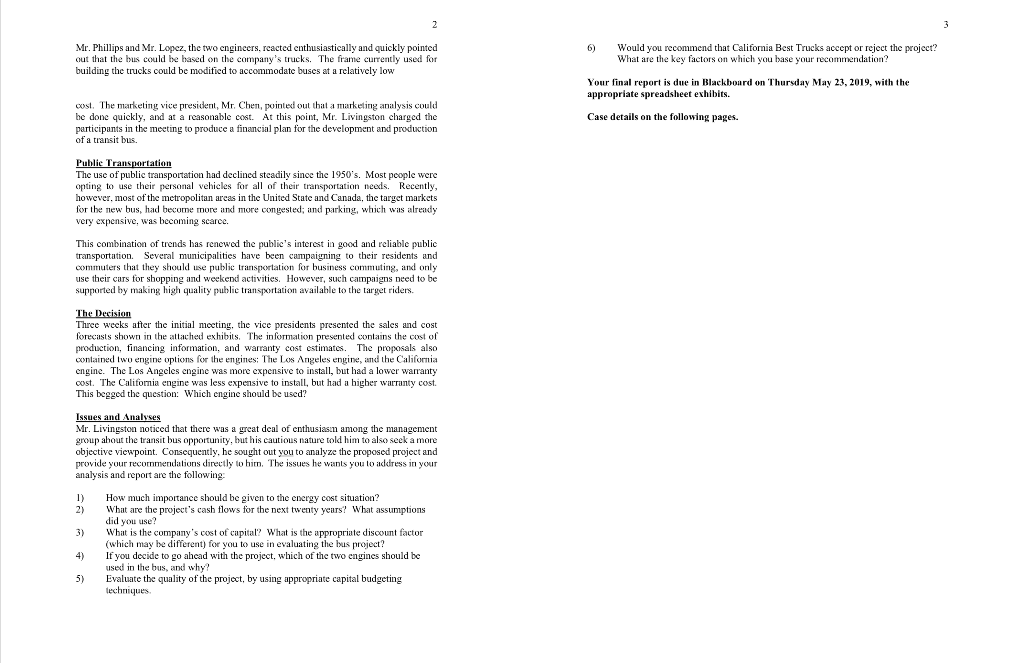

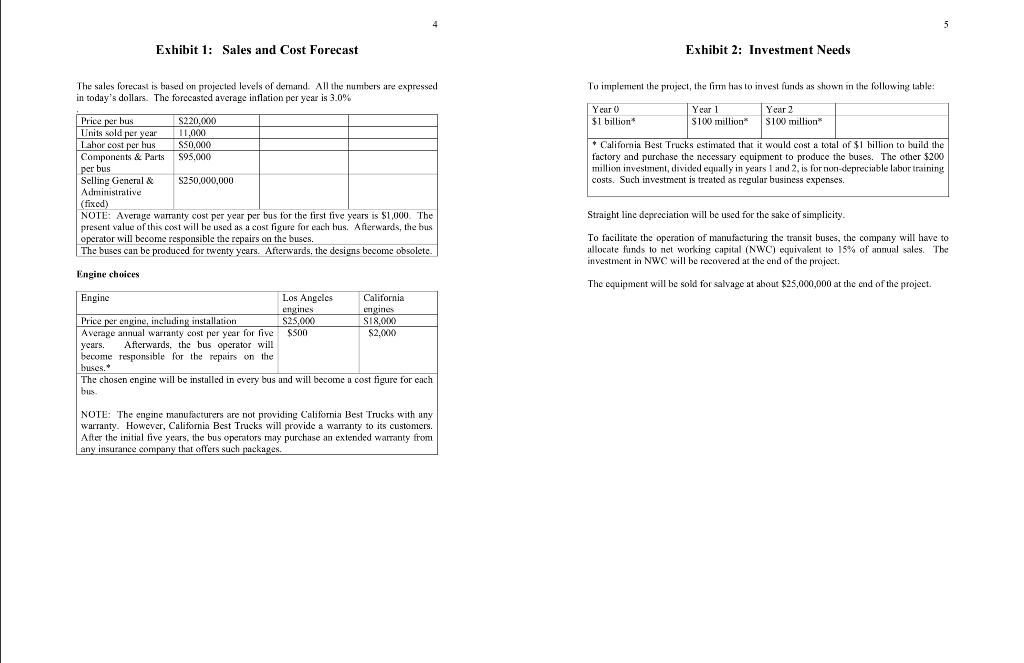

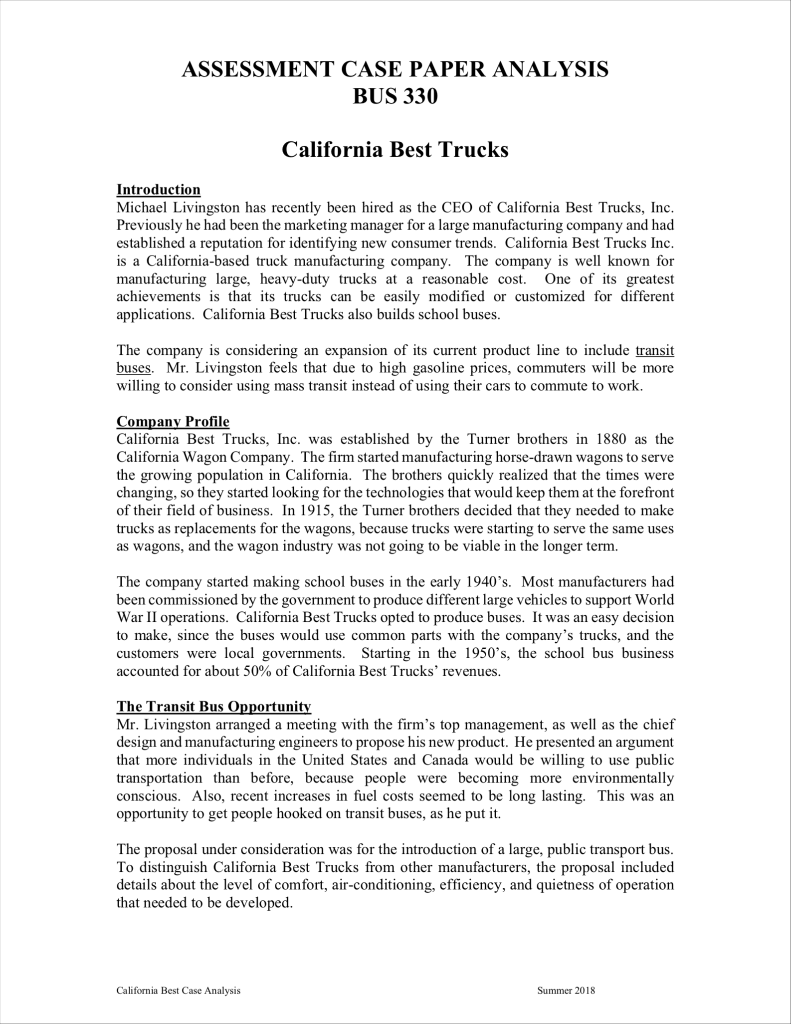

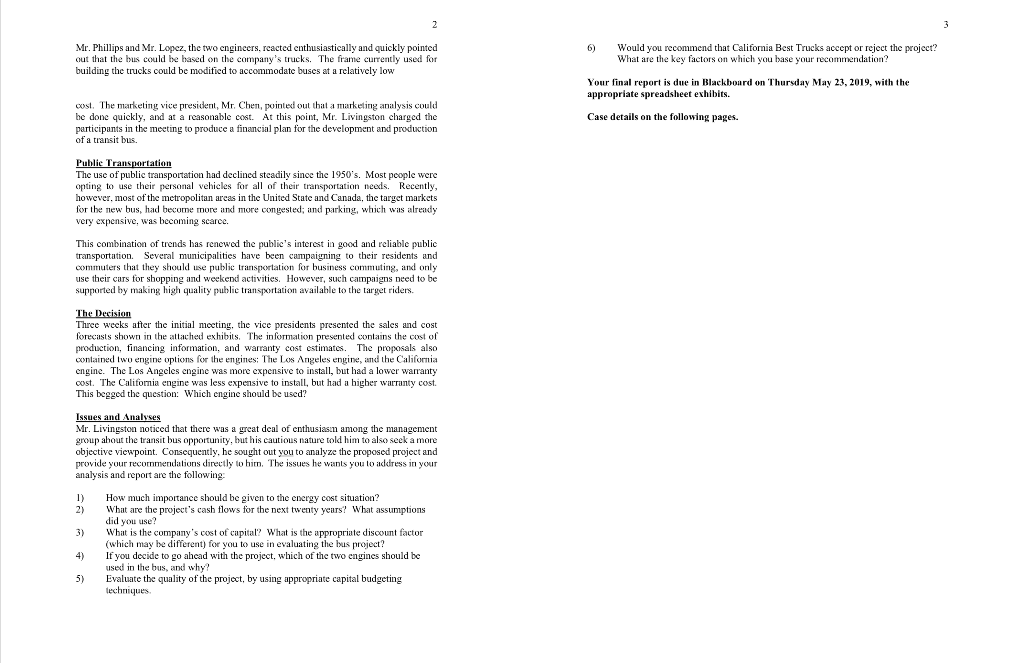

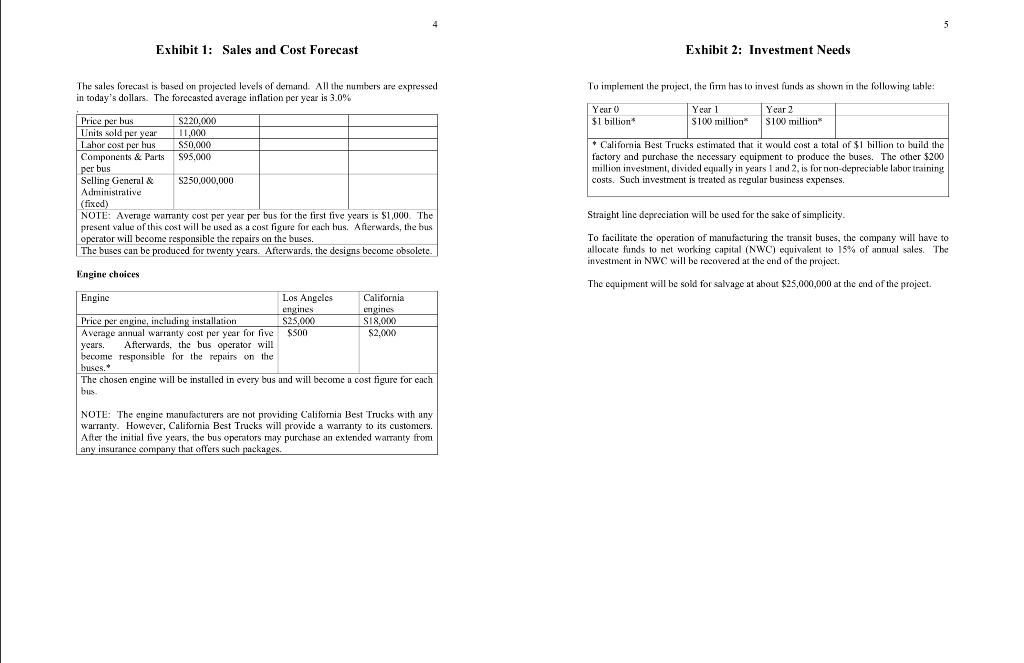

ASSESSMENT CASE PAPER ANALYSIS BUS 330 California Best Trucks Introduction Michael Livingston has recently been hired as the CEO of California Best Trucks, Inc Previously he had been the marketing manager for a large manufacturing company and had established a reputation for identifying new consumer trends. California Best Trucks Inc is a California-based truck manufacturing company. The company is well known for manufacturing large, heavy-duty trucks at a reasonable cost. One of its greatest achievements is that its trucks can be easily modified or customized for different applications. California Best Trucks also builds school buses The company is considering an expansion of its current product line to include transit buses. Mr. Livingston feels that due to high gasoline prices, commuters will be more willing to consider using mass transit instead of using their cars to commute to work ofile California Best Trucks, Inc. was established by the Turner brothers in 1880 as the California Wagon Company. The firm started manufacturing horse-drawn wagons to serve the growing population in California. The brothers quickly realized that the times were changing, so they started looking for the technologies that would keep them at the forefront of their field of business. In 1915, the Turner brothers decided that they needed to make trucks as replacements for the wagons, because trucks were starting to serve the same uses as wagons, and the wagon industry was not going to be viable in the longer term. The company started making school buses in the early 1940's. Most manufacturers had been commissioned by the government to produce different large vehicles to support World War II operations. California Best Trucks opted to produce buses. It was an easy decision to make, since the buses would use common parts with the company's trucks, and the customers were local governments. Starting in the 1950's, the school bus business accounted for about 50% of California Best Trucks, revenues he Transit Bus Opportunit Mr. Livingston arranged a meeting with the firm's top management, as well as the chief sign and manufacturing engineers to propose his new product. He presented an argument that more individuals in the United States and Canada would be willing to use public transportation than before, because people were becoming more environmentally conscious. Also, recent increases in fuel costs seemed to be long lasting. This was an opportunity to get people hooked on transit buses, as he put it. he proposal under consideration was for the introduction of a large, public transport bus To distinguish California Best Trucks from other manufacturers, the proposal included details about the level of comfort, air-conditioning, efficiency, and quietness of operation that needed to be developed California Best Case Analysis Summer 2018 Mr. Phillips and Mr. Lopez, the two engineers, reacted enthusiastically and quickly pointed out that the bus could be based on the company's trucks. The frame currently used for building the trucks could be modified to accommodate buses at a relatively low 6) Would you recommend that California Best Trucks accept or reject the project? What are the key factors on which you base your recommendation? Your final report is due in Blackboard on Thursday May 23, 2019, with the appropriate spreadsheet exhibits. cost. The marketng vice president, Mr. Chen, pointed out that a marketing analysis could be donc quickly, and at a reasonable cost. At this point, Mr Livingston charged the participants in the meeting to produce a financial plan for the development and production of a transit bus. Case details on the following pages ublic The use of public transportation had declined steadily since the 1950's. Most people were opting to use their persnal vehicles for all of their transportation needs. Recently however, most of the metropolitan areas in the United State and Canada, the target markets for the new bus, had become more and more congested; and parking, which was already very expensive, was becoming scarcc. This combination of trends has renewod the public's interest in good and rcliable public transportation. Several municipalities have been campaigning to their residents and commuters that they should use public transportation for business commuting, and only use their cars for shopping and weekend activities. Howeve, such campaigns need to be supported by making high quality public transportation availahle to the target riders. Three weeks after the initial meeting, the vice presidents presented the sales and cost forecasts shown in the attached exhibits. The information presented contains the cost of production, financing information, and warranty cost estimates. The proposals also conlained Iwo engine options for the engines: The Los Angeles engine,ad th Califormia engine. The Los Angeles engine was more expensive to install, but had a lower warranty oost. The Calioia engine was less expensive to install, but had a higher warranty cost. This begged the question: Which engine should be used? Issues and Anal Mr. Livingston noticed that there was a great deal of enthusiasm among the management group ahout the transit bus opportunity, but his cautious nature told him to also seck a more objective viewpoint. Consequently, he sought out you to analyze the proposed project and provide your recommendations directly to hin. The issues he wants you to address in your analysis and report are the following: I)How much importance should be given to the energy cost situation? 2 What are the project's cash tlows for the next twenty years? What assumptions 3What is the company's cost of capital? What is the appropriate discount factor 4) Ifyou decide to go ahcad with the project, which of the two engines should be 5) Evaluate the quality of the project, by using appropriate capital budgeting did you use? (which may be different) for you to use in evaluating the bus project? used in the bus, and why? techniques. Exhibit 1: Sales and Cost Forecast Exhibit 2: Investment Needs The sales forecast is based on projecled levels of dead. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0% To implement the pruject, the firm has lo invest furnds as shown in the following lable: Year O $1 billion* Price per bus Units soled Lahor cost per hus Components& Parts S95,000 per bus Selling General &S250,000,000 S220,000 5100 million S100 million S50,000 Califomia Best Trucks estimated that it would cost a total of $1 billion to build the factory and purchase the necessary equipment to produce the buses. The other $200 million investment, divided eually in years 1 ad2, is for non-depreciable labor training costs. Such investment is treated as regular business expenses. fixed) NOTE: Average waranty cost per year per bus for the first five years is S1,000. The present value of this cost will he used as a cost figure for each hus. Afterwards, the bus operator will become responsible the repairs oun The buses can be produced for twenty years. Afterwards, the designs become obsolete Straight line depreciationwill be used for the sake of simplicity To facilitate the operation of manufacturing the transit buses, the company will have to allocate funds to net working capital (NWC) equivalent to 15% of annual sales. The investment in NWC wil be recovered at the end of the project Engine choices The equipment will be sold for salvage at ahout $25,000,000 at the end of the project. Engine Los Angcles S25.000 S500 California Price per engine, including installation Average annual warranty cost per year for five years. Afterwards. the bus operator will become responsible for the repairs on the buses. The chosen engine will be installed in e bus S18.000 $2,000 very bus and will become a cost tigure for each NOTE: The engine manufacturers are not providing California Best Trucks with any warranty. However, California Best Trucks will provide a waranty to its customers. After the initial five years, the bus operators may purchase an extended warmanty from any insurance that offers such Exhibit 3: Financing Assumptions The following assumptions are used to determine the cost of capital. Historically, the company has maintained a debt ratio is 50%. This ratio was used, because lowering the debt implies giving up the debt tax shield, and increasing it makes debt service a burden on the firm's cash flow. In addition, increasing the debt level may cause a reduced rating of the company's bonds. The marginal tax rate is 30%. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0%. Cost of debt The company's bond rating is roughly at the high end of the A range. Surveying the debt market yielded the following information about the cost of debt for different rating levels: Bond rating Interest cost range | 5.5% ~ 6.5% The company's current bonds have a yield to maturity of about 6.5%. Cost of equity: The current 10-year Treasury notes have a yield to maturity of 3.00% and the forecast for 6.25% ~ 7.5% 7.5% ~ 9% the S&P 500 market premium is 9.50%. The company's overall is 1.25 ASSESSMENT CASE PAPER ANALYSIS BUS 330 California Best Trucks Introduction Michael Livingston has recently been hired as the CEO of California Best Trucks, Inc Previously he had been the marketing manager for a large manufacturing company and had established a reputation for identifying new consumer trends. California Best Trucks Inc is a California-based truck manufacturing company. The company is well known for manufacturing large, heavy-duty trucks at a reasonable cost. One of its greatest achievements is that its trucks can be easily modified or customized for different applications. California Best Trucks also builds school buses The company is considering an expansion of its current product line to include transit buses. Mr. Livingston feels that due to high gasoline prices, commuters will be more willing to consider using mass transit instead of using their cars to commute to work ofile California Best Trucks, Inc. was established by the Turner brothers in 1880 as the California Wagon Company. The firm started manufacturing horse-drawn wagons to serve the growing population in California. The brothers quickly realized that the times were changing, so they started looking for the technologies that would keep them at the forefront of their field of business. In 1915, the Turner brothers decided that they needed to make trucks as replacements for the wagons, because trucks were starting to serve the same uses as wagons, and the wagon industry was not going to be viable in the longer term. The company started making school buses in the early 1940's. Most manufacturers had been commissioned by the government to produce different large vehicles to support World War II operations. California Best Trucks opted to produce buses. It was an easy decision to make, since the buses would use common parts with the company's trucks, and the customers were local governments. Starting in the 1950's, the school bus business accounted for about 50% of California Best Trucks, revenues he Transit Bus Opportunit Mr. Livingston arranged a meeting with the firm's top management, as well as the chief sign and manufacturing engineers to propose his new product. He presented an argument that more individuals in the United States and Canada would be willing to use public transportation than before, because people were becoming more environmentally conscious. Also, recent increases in fuel costs seemed to be long lasting. This was an opportunity to get people hooked on transit buses, as he put it. he proposal under consideration was for the introduction of a large, public transport bus To distinguish California Best Trucks from other manufacturers, the proposal included details about the level of comfort, air-conditioning, efficiency, and quietness of operation that needed to be developed California Best Case Analysis Summer 2018 Mr. Phillips and Mr. Lopez, the two engineers, reacted enthusiastically and quickly pointed out that the bus could be based on the company's trucks. The frame currently used for building the trucks could be modified to accommodate buses at a relatively low 6) Would you recommend that California Best Trucks accept or reject the project? What are the key factors on which you base your recommendation? Your final report is due in Blackboard on Thursday May 23, 2019, with the appropriate spreadsheet exhibits. cost. The marketng vice president, Mr. Chen, pointed out that a marketing analysis could be donc quickly, and at a reasonable cost. At this point, Mr Livingston charged the participants in the meeting to produce a financial plan for the development and production of a transit bus. Case details on the following pages ublic The use of public transportation had declined steadily since the 1950's. Most people were opting to use their persnal vehicles for all of their transportation needs. Recently however, most of the metropolitan areas in the United State and Canada, the target markets for the new bus, had become more and more congested; and parking, which was already very expensive, was becoming scarcc. This combination of trends has renewod the public's interest in good and rcliable public transportation. Several municipalities have been campaigning to their residents and commuters that they should use public transportation for business commuting, and only use their cars for shopping and weekend activities. Howeve, such campaigns need to be supported by making high quality public transportation availahle to the target riders. Three weeks after the initial meeting, the vice presidents presented the sales and cost forecasts shown in the attached exhibits. The information presented contains the cost of production, financing information, and warranty cost estimates. The proposals also conlained Iwo engine options for the engines: The Los Angeles engine,ad th Califormia engine. The Los Angeles engine was more expensive to install, but had a lower warranty oost. The Calioia engine was less expensive to install, but had a higher warranty cost. This begged the question: Which engine should be used? Issues and Anal Mr. Livingston noticed that there was a great deal of enthusiasm among the management group ahout the transit bus opportunity, but his cautious nature told him to also seck a more objective viewpoint. Consequently, he sought out you to analyze the proposed project and provide your recommendations directly to hin. The issues he wants you to address in your analysis and report are the following: I)How much importance should be given to the energy cost situation? 2 What are the project's cash tlows for the next twenty years? What assumptions 3What is the company's cost of capital? What is the appropriate discount factor 4) Ifyou decide to go ahcad with the project, which of the two engines should be 5) Evaluate the quality of the project, by using appropriate capital budgeting did you use? (which may be different) for you to use in evaluating the bus project? used in the bus, and why? techniques. Exhibit 1: Sales and Cost Forecast Exhibit 2: Investment Needs The sales forecast is based on projecled levels of dead. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0% To implement the pruject, the firm has lo invest furnds as shown in the following lable: Year O $1 billion* Price per bus Units soled Lahor cost per hus Components& Parts S95,000 per bus Selling General &S250,000,000 S220,000 5100 million S100 million S50,000 Califomia Best Trucks estimated that it would cost a total of $1 billion to build the factory and purchase the necessary equipment to produce the buses. The other $200 million investment, divided eually in years 1 ad2, is for non-depreciable labor training costs. Such investment is treated as regular business expenses. fixed) NOTE: Average waranty cost per year per bus for the first five years is S1,000. The present value of this cost will he used as a cost figure for each hus. Afterwards, the bus operator will become responsible the repairs oun The buses can be produced for twenty years. Afterwards, the designs become obsolete Straight line depreciationwill be used for the sake of simplicity To facilitate the operation of manufacturing the transit buses, the company will have to allocate funds to net working capital (NWC) equivalent to 15% of annual sales. The investment in NWC wil be recovered at the end of the project Engine choices The equipment will be sold for salvage at ahout $25,000,000 at the end of the project. Engine Los Angcles S25.000 S500 California Price per engine, including installation Average annual warranty cost per year for five years. Afterwards. the bus operator will become responsible for the repairs on the buses. The chosen engine will be installed in e bus S18.000 $2,000 very bus and will become a cost tigure for each NOTE: The engine manufacturers are not providing California Best Trucks with any warranty. However, California Best Trucks will provide a waranty to its customers. After the initial five years, the bus operators may purchase an extended warmanty from any insurance that offers such Exhibit 3: Financing Assumptions The following assumptions are used to determine the cost of capital. Historically, the company has maintained a debt ratio is 50%. This ratio was used, because lowering the debt implies giving up the debt tax shield, and increasing it makes debt service a burden on the firm's cash flow. In addition, increasing the debt level may cause a reduced rating of the company's bonds. The marginal tax rate is 30%. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0%. Cost of debt The company's bond rating is roughly at the high end of the A range. Surveying the debt market yielded the following information about the cost of debt for different rating levels: Bond rating Interest cost range | 5.5% ~ 6.5% The company's current bonds have a yield to maturity of about 6.5%. Cost of equity: The current 10-year Treasury notes have a yield to maturity of 3.00% and the forecast for 6.25% ~ 7.5% 7.5% ~ 9% the S&P 500 market premium is 9.50%. The company's overall is 1.25