Question

Blades, Inc., has been exporting to Thailand since its decision to supplement its declining U.S. sales by exporting there. Furthermore, Blades has recently begun exporting

Blades, Inc., has been exporting to Thailand since its decision to supplement its declining U.S. sales by exporting there. Furthermore, Blades has recently begun exporting to a retailer in the United Kingdom. The suppliers of the components needed by Blades for roller blade production (such as rubber and plastic) are located in the United States and Thailand. Blades decided to use Thai suppliers for rubber and plastic components needed to manufacture roller blades because of cost and quality considerations. All of Blades’ exports and imports are denominated in the respective foreign currency; for example, Blades pays for the Thai imports in baht.

The decision to export to Thailand was supported by the fact that Thailand had been one of the world’s fastest growing economies in recent years. Furthermore, Blades found an importer in Thailand that was willing to commit itself to the annual purchase of 180,000 pairs of Blades’ Speedos, which are among the highest quality roller blades in the world. The commitment began last year and will last another 2 years, at which time it may be renewed by the two parties. Due to this commitment, Blades is selling its roller blades for 4,594 baht per pair (approximately $100 at current exchange rates) instead of the usual $120 per pair. Although this price represents a substantial discount from the regular price for a pair of Speedo blades, it still constitutes a considerable markup above cost. Because importers in other Asian countries were not willing to make this type of commitment, this was a decisive factor in the choice of Thailand for exporting purposes. Although Ben Holt, Blades’ chief financial officer (CFO), believes the sports product market in Asia has very high future growth potential, Blades has recently begun exporting to Jogs, Ltd., a British retailer. Jogs has committed itself to purchase 200,000 pairs of Speedos annually for a fixed price of £80 per pair.

For the coming year, Blades expects to import rubber and plastic components from Thailand sufficient to manufacture 80,000 pairs of Speedos at a cost of approximately 3,000 baht per pair of Speedos.

You, as Blades’ financial analyst, have told Holt that recent events in Asia have fundamentally affected the economic condition of Asian countries, including Thailand. For example, you have pointed out that the high level of consumer spending on leisure products such as roller blades has declined considerably. Thus, the Thai retailer may not renew its commitment with Blades in 2 years. Furthermore, you are worried that the current economic conditions in Thailand may lead to a substantial depreciation of the Thai baht, which would affect Blades negatively.

Despite recent developments, however, Holt remains optimistic; he is convinced that Southeast Asia will exhibit high potential for growth when the impact of recent events in Asia subsides. Consequently, Holt has no doubt that the Thai customer will renew its commitment for another 3 years when the current agreement terminates. In your opinion, Holt is not considering all of the factors that might directly or indirectly affect Blades. Moreover, you are worried that he is ignoring Blades’ future in Thailand even if the Thai importer renews its commitment for another 3 years. In fact, you believe that a renewal of the existing agreement with the Thai customer may affect Blades negatively due to the high level of inflation in Thailand.

Since Holt is interested in your opinion and wants to assess Blades’ economic exposure in Thailand, he has asked you to conduct an analysis of the impact of the value of the baht on next year’s earnings to assess Blades’ economic exposure. You have gathered the following information:

¦ Blades has forecasted sales in the United States of 520,000 pairs of Speedos at regular prices; exports to Thailand of 180,000 pairs of Speedos for 4,594 baht a pair; and exports to the United Kingdom of 200,000 pairs of Speedos for £80 per pair.

¦ Cost of goods sold for 80,000 pairs of Speedos are incurred in Thailand; the remainder is incurred in the United States, where the cost of goods sold per pair of Speedos runs approximately $70.

¦ Fixed costs are $2 million, and variable operating expenses other than costs of goods sold represent approximately 11 percent of U.S. sales. All fixed and variable operating expenses other than cost of goods sold are incurred in the United States.

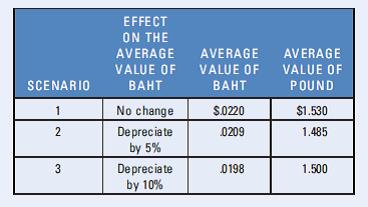

¦ Recent events in Asia have increased the uncertainty regarding certain Asian currencies considerably, making it extremely difficult to forecast the value of the baht at which the Thai revenues will be converted. The current spot rate of the baht is $.022, and the current spot rate of the pound is $1.50. You have created three scenarios and derived an expected value on average for the upcoming year based on each scenario (see the following table):

Blades currently has no debt in its capital structure. However, it may borrow funds in Thailand if it establishes a subsidiary in the country.

Now repeat your analysis in question 3 but assume that the British pound and the Thai baht are perfectly correlated. For example, if the baht depreciates by 5 percent, the pound will also depreciate by 5 percent. Under this assumption, is Blades subject to a greater degree of economic exposure? Why or why not?

EFFECT ON THE AVERAGE AVERAGE VALUE OF VALUE OF VALUE OF AVERAGE SCENARIO POUND 1 No change S.0220 $1.530 Depreciate by 5% 0209 1.485 Depreciate 0198 1.500 by 10% 3.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

4202124BIC SA 4083 SR 2885 Estimated cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started