One model A1100 Kawasaki Jet Ski Personal Watercraft was sold for cash. This model retails for $9,375.00 plus 8% sales tax ($9,375.00 x 8%

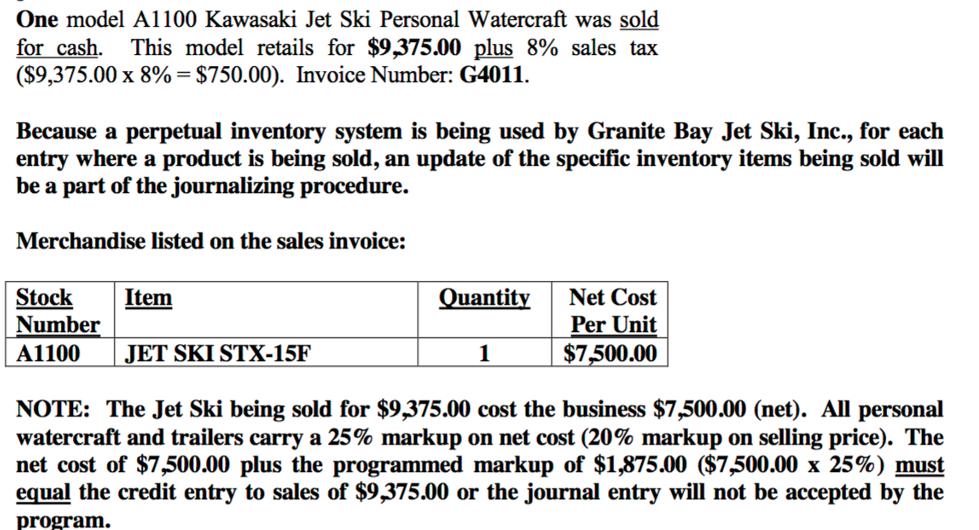

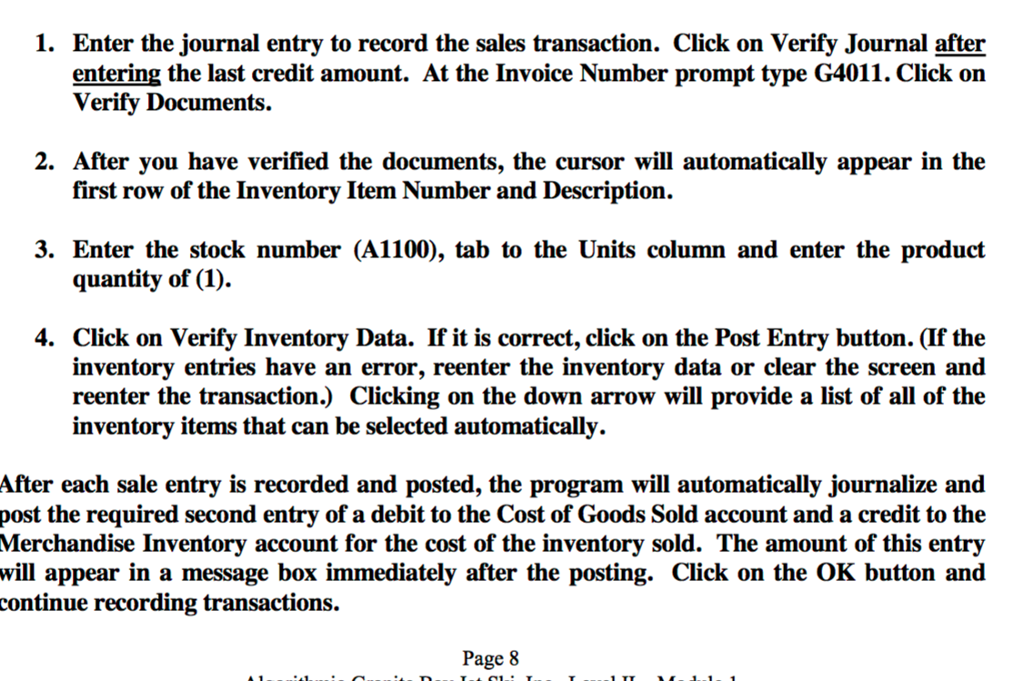

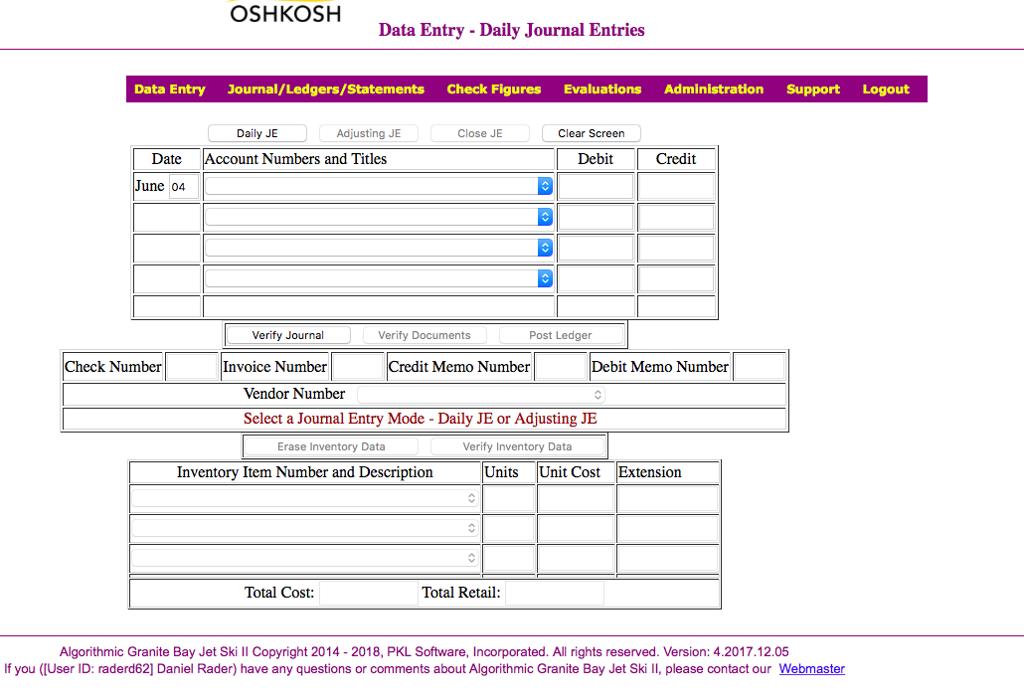

One model A1100 Kawasaki Jet Ski Personal Watercraft was sold for cash. This model retails for $9,375.00 plus 8% sales tax ($9,375.00 x 8% = $750.00). Invoice Number: G4011. Because a perpetual inventory system is being used by Granite Bay Jet Ski, Inc., for each entry where a product is being sold, an update of the specific inventory items being sold will be a part of the journalizing procedure. Merchandise listed on the sales invoice: Stock Number A1100 JET SKI STX-15F Item Quantity 1 Net Cost Per Unit $7,500.00 NOTE: The Jet Ski being sold for $9,375.00 cost the business $7,500.00 (net). All personal watercraft and trailers carry a 25% markup on net cost (20% markup on selling price). The net cost of $7,500.00 plus the programmed markup of $1,875.00 ($7,500.00 x 25%) must equal the credit entry to sales of $9,375.00 or the journal entry will not be accepted by the program. 1. Enter the journal entry to record the sales transaction. Click on Verify Journal after entering the last credit amount. At the Invoice Number prompt type G4011. Click on Verify Documents. 2. After you have verified the documents, the cursor will automatically appear in the first row of the Inventory Item Number and Description. 3. Enter the stock number (A1100), tab to the Units column and enter the product quantity of (1). 4. Click on Verify Inventory Data. If it is correct, click on the Post Entry button. (If the inventory entries have an error, reenter the inventory data or clear the screen and reenter the transaction.) Clicking on the down arrow will provide a list of all of the inventory items that can be selected automatically. After each sale entry is recorded and posted, the program will automatically journalize and post the required second entry of a debit to the Cost of Goods Sold account and a credit to the Merchandise Inventory account for the cost of the inventory sold. The amount of this entry will appear in a message box immediately after the posting. Click on the OK button and continue recording transactions. Page 8 1 TT Madis1. Data Entry Date June 04 Check Number OSHKOSH Journal/Ledgers/Statements Data Entry - Daily Journal Entries Daily JE Adjusting JE Account Numbers and Titles Verify Journal Invoice Number Total Cost: Check Figures Evaluations Close JE Verify Documents Credit Memo Number C O C C C C Total Retail: C Debit Memo Number Vendor Number C Select a Journal Entry Mode - Daily JE or Adjusting JE Erase Inventory Data Inventory Item Number and Description Verify Inventory Data Clear Screen Debit Post Ledger Administration Support Logout Credit Units Unit Cost Extension Algorithmic Granite Bay Jet Ski II Copyright 2014 - 2018, PKL Software, Incorporated. All rights reserved. Version: 4.2017.12.05 If you ([User ID: raderd62] Daniel Rader) have any questions or comments about Algorithmic Granite Bay Jet Ski II, please contact our Webmaster One model A1100 Kawasaki Jet Ski Personal Watercraft was sold for cash. This model retails for $9,375.00 plus 8% sales tax ($9,375.00 x 8% = $750.00). Invoice Number: G4011. Because a perpetual inventory system is being used by Granite Bay Jet Ski, Inc., for each entry where a product is being sold, an update of the specific inventory items being sold will be a part of the journalizing procedure. Merchandise listed on the sales invoice: Stock Number A1100 JET SKI STX-15F Item Quantity 1 Net Cost Per Unit $7,500.00 NOTE: The Jet Ski being sold for $9,375.00 cost the business $7,500.00 (net). All personal watercraft and trailers carry a 25% markup on net cost (20% markup on selling price). The net cost of $7,500.00 plus the programmed markup of $1,875.00 ($7,500.00 x 25%) must equal the credit entry to sales of $9,375.00 or the journal entry will not be accepted by the program. 1. Enter the journal entry to record the sales transaction. Click on Verify Journal after entering the last credit amount. At the Invoice Number prompt type G4011. Click on Verify Documents. 2. After you have verified the documents, the cursor will automatically appear in the first row of the Inventory Item Number and Description. 3. Enter the stock number (A1100), tab to the Units column and enter the product quantity of (1). 4. Click on Verify Inventory Data. If it is correct, click on the Post Entry button. (If the inventory entries have an error, reenter the inventory data or clear the screen and reenter the transaction.) Clicking on the down arrow will provide a list of all of the inventory items that can be selected automatically. After each sale entry is recorded and posted, the program will automatically journalize and post the required second entry of a debit to the Cost of Goods Sold account and a credit to the Merchandise Inventory account for the cost of the inventory sold. The amount of this entry will appear in a message box immediately after the posting. Click on the OK button and continue recording transactions. Page 8 1 TT Madis1. Data Entry Date June 04 Check Number OSHKOSH Journal/Ledgers/Statements Data Entry - Daily Journal Entries Daily JE Adjusting JE Account Numbers and Titles Verify Journal Invoice Number Total Cost: Check Figures Evaluations Close JE Verify Documents Credit Memo Number C O C C C C Total Retail: C Debit Memo Number Vendor Number C Select a Journal Entry Mode - Daily JE or Adjusting JE Erase Inventory Data Inventory Item Number and Description Verify Inventory Data Clear Screen Debit Post Ledger Administration Support Logout Credit Units Unit Cost Extension Algorithmic Granite Bay Jet Ski II Copyright 2014 - 2018, PKL Software, Incorporated. All rights reserved. Version: 4.2017.12.05 If you ([User ID: raderd62] Daniel Rader) have any questions or comments about Algorithmic Granite Bay Jet Ski II, please contact our Webmaster One model A1100 Kawasaki Jet Ski Personal Watercraft was sold for cash. This model retails for $9,375.00 plus 8% sales tax ($9,375.00 x 8% = $750.00). Invoice Number: G4011. Because a perpetual inventory system is being used by Granite Bay Jet Ski, Inc., for each entry where a product is being sold, an update of the specific inventory items being sold will be a part of the journalizing procedure. Merchandise listed on the sales invoice: Stock Number A1100 JET SKI STX-15F Item Quantity 1 Net Cost Per Unit $7,500.00 NOTE: The Jet Ski being sold for $9,375.00 cost the business $7,500.00 (net). All personal watercraft and trailers carry a 25% markup on net cost (20% markup on selling price). The net cost of $7,500.00 plus the programmed markup of $1,875.00 ($7,500.00 x 25%) must equal the credit entry to sales of $9,375.00 or the journal entry will not be accepted by the program. 1. Enter the journal entry to record the sales transaction. Click on Verify Journal after entering the last credit amount. At the Invoice Number prompt type G4011. Click on Verify Documents. 2. After you have verified the documents, the cursor will automatically appear in the first row of the Inventory Item Number and Description. 3. Enter the stock number (A1100), tab to the Units column and enter the product quantity of (1). 4. Click on Verify Inventory Data. If it is correct, click on the Post Entry button. (If the inventory entries have an error, reenter the inventory data or clear the screen and reenter the transaction.) Clicking on the down arrow will provide a list of all of the inventory items that can be selected automatically. After each sale entry is recorded and posted, the program will automatically journalize and post the required second entry of a debit to the Cost of Goods Sold account and a credit to the Merchandise Inventory account for the cost of the inventory sold. The amount of this entry will appear in a message box immediately after the posting. Click on the OK button and continue recording transactions. Page 8 1 TT Madis1. Data Entry Date June 04 Check Number OSHKOSH Journal/Ledgers/Statements Data Entry - Daily Journal Entries Daily JE Adjusting JE Account Numbers and Titles Verify Journal Invoice Number Total Cost: Check Figures Evaluations Close JE Verify Documents Credit Memo Number C O C C C C Total Retail: C Debit Memo Number Vendor Number C Select a Journal Entry Mode - Daily JE or Adjusting JE Erase Inventory Data Inventory Item Number and Description Verify Inventory Data Clear Screen Debit Post Ledger Administration Support Logout Credit Units Unit Cost Extension Algorithmic Granite Bay Jet Ski II Copyright 2014 - 2018, PKL Software, Incorporated. All rights reserved. Version: 4.2017.12.05 If you ([User ID: raderd62] Daniel Rader) have any questions or comments about Algorithmic Granite Bay Jet Ski II, please contact our Webmaster One model A1100 Kawasaki Jet Ski Personal Watercraft was sold for cash. This model retails for $9,375.00 plus 8% sales tax ($9,375.00 x 8% = $750.00). Invoice Number: G4011. Because a perpetual inventory system is being used by Granite Bay Jet Ski, Inc., for each entry where a product is being sold, an update of the specific inventory items being sold will be a part of the journalizing procedure. Merchandise listed on the sales invoice: Stock Number A1100 JET SKI STX-15F Item Quantity 1 Net Cost Per Unit $7,500.00 NOTE: The Jet Ski being sold for $9,375.00 cost the business $7,500.00 (net). All personal watercraft and trailers carry a 25% markup on net cost (20% markup on selling price). The net cost of $7,500.00 plus the programmed markup of $1,875.00 ($7,500.00 x 25%) must equal the credit entry to sales of $9,375.00 or the journal entry will not be accepted by the program. 1. Enter the journal entry to record the sales transaction. Click on Verify Journal after entering the last credit amount. At the Invoice Number prompt type G4011. Click on Verify Documents. 2. After you have verified the documents, the cursor will automatically appear in the first row of the Inventory Item Number and Description. 3. Enter the stock number (A1100), tab to the Units column and enter the product quantity of (1). 4. Click on Verify Inventory Data. If it is correct, click on the Post Entry button. (If the inventory entries have an error, reenter the inventory data or clear the screen and reenter the transaction.) Clicking on the down arrow will provide a list of all of the inventory items that can be selected automatically. After each sale entry is recorded and posted, the program will automatically journalize and post the required second entry of a debit to the Cost of Goods Sold account and a credit to the Merchandise Inventory account for the cost of the inventory sold. The amount of this entry will appear in a message box immediately after the posting. Click on the OK button and continue recording transactions. Page 8 1 TT Madis1. Data Entry Date June 04 Check Number OSHKOSH Journal/Ledgers/Statements Data Entry - Daily Journal Entries Daily JE Adjusting JE Account Numbers and Titles Verify Journal Invoice Number Total Cost: Check Figures Evaluations Close JE Verify Documents Credit Memo Number C O C C C C Total Retail: C Debit Memo Number Vendor Number C Select a Journal Entry Mode - Daily JE or Adjusting JE Erase Inventory Data Inventory Item Number and Description Verify Inventory Data Clear Screen Debit Post Ledger Administration Support Logout Credit Units Unit Cost Extension Algorithmic Granite Bay Jet Ski II Copyright 2014 - 2018, PKL Software, Incorporated. All rights reserved. Version: 4.2017.12.05 If you ([User ID: raderd62] Daniel Rader) have any questions or comments about Algorithmic Granite Bay Jet Ski II, please contact our Webmaster

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The Jet Ski sold for 937500 and it cost the b...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started