Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hugo is now 50 and plans to retire by the age 60. He is single, owns an apartment with current market value around HKD

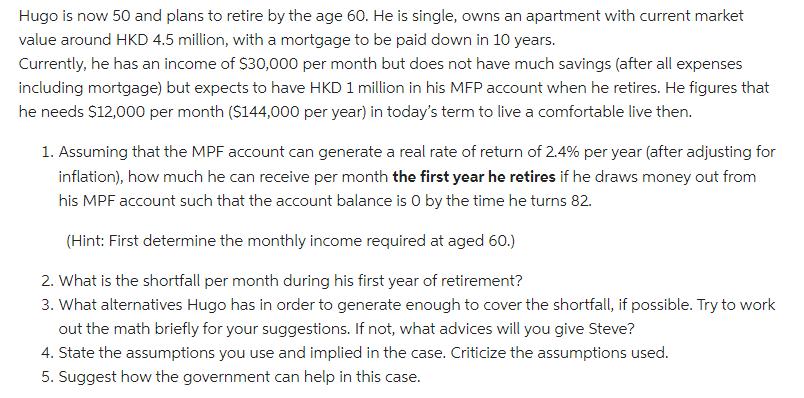

Hugo is now 50 and plans to retire by the age 60. He is single, owns an apartment with current market value around HKD 4.5 million, with a mortgage to be paid down in 10 years. Currently, he has an income of $30,000 per month but does not have much savings (after all expenses including mortgage) but expects to have HKD 1 million in his MFP account when he retires. He figures that he needs $12,000 per month (S144,000 per year) in today's term to live a comfortable live then. 1. Assuming that the MPF account can generate a real rate of return of 2.4% per year (after adjusting for inflation), how much he can receive per month the first year he retires if he draws money out from his MPF account such that the account balance is 0 by the time he turns 82. (Hint: First determine the monthly income required aged 60.) 2. What is the shortfall per month during his first year of retirement? 3. What alternatives Hugo has in order to generate enough to cover the shortfall, if possible. Try to work out the math briefly for your suggestions. If not, what advices will you give Steve? 4. State the assumptions you use and implied in the case. Criticize the assumptions used. 5. Suggest how the government can help in this case.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer The question is based on the concept present value and future value of money with annuity pay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started