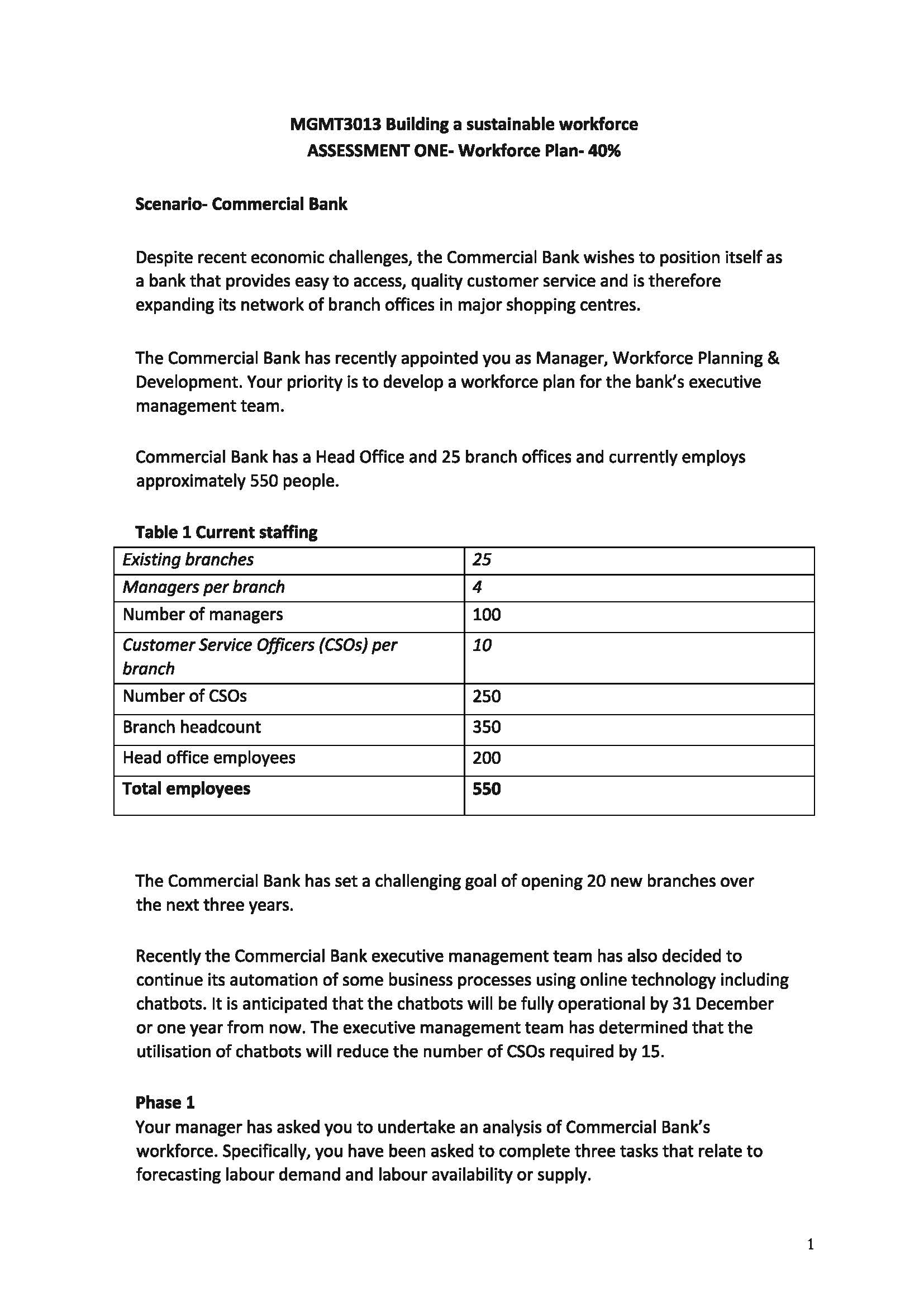

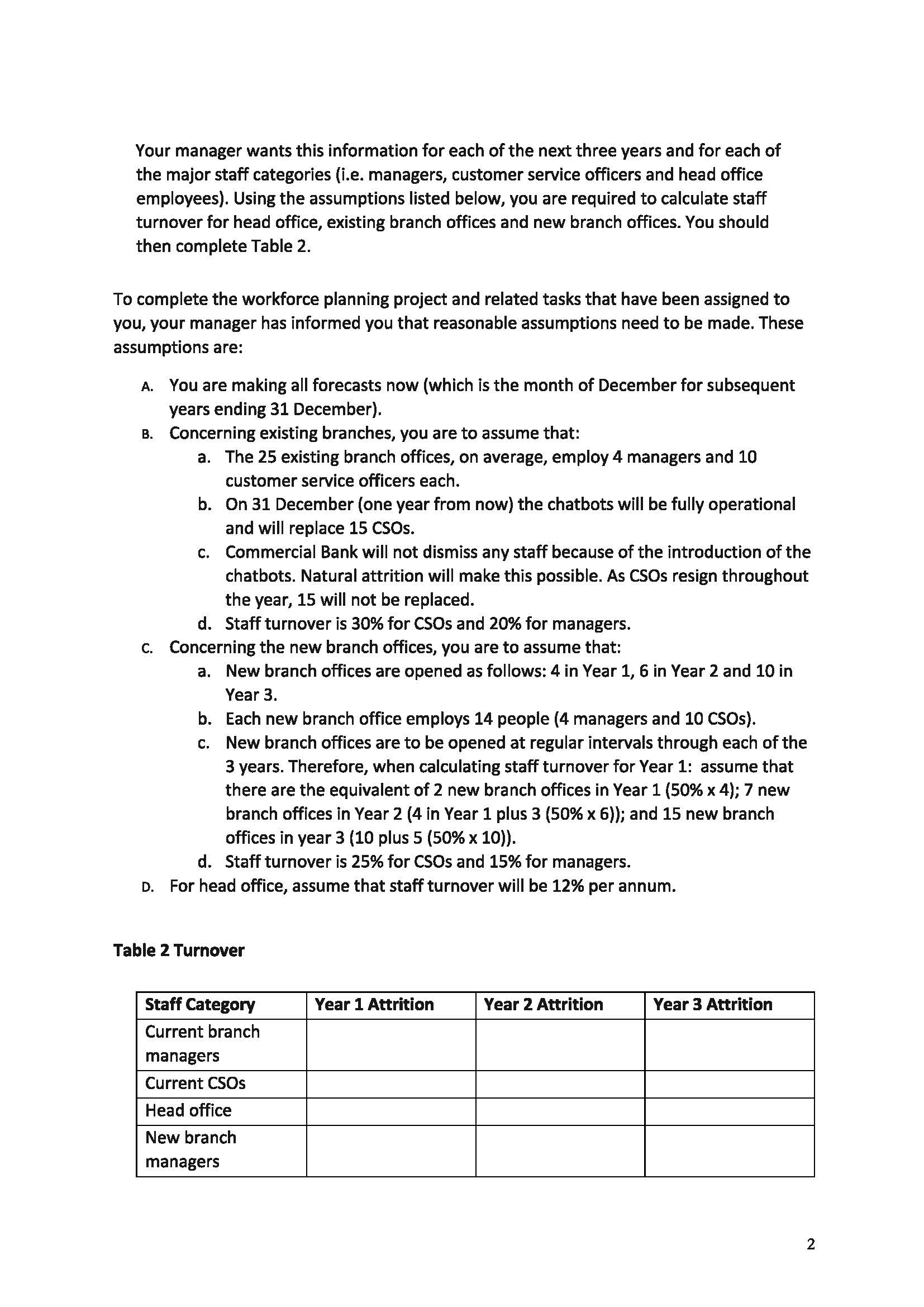

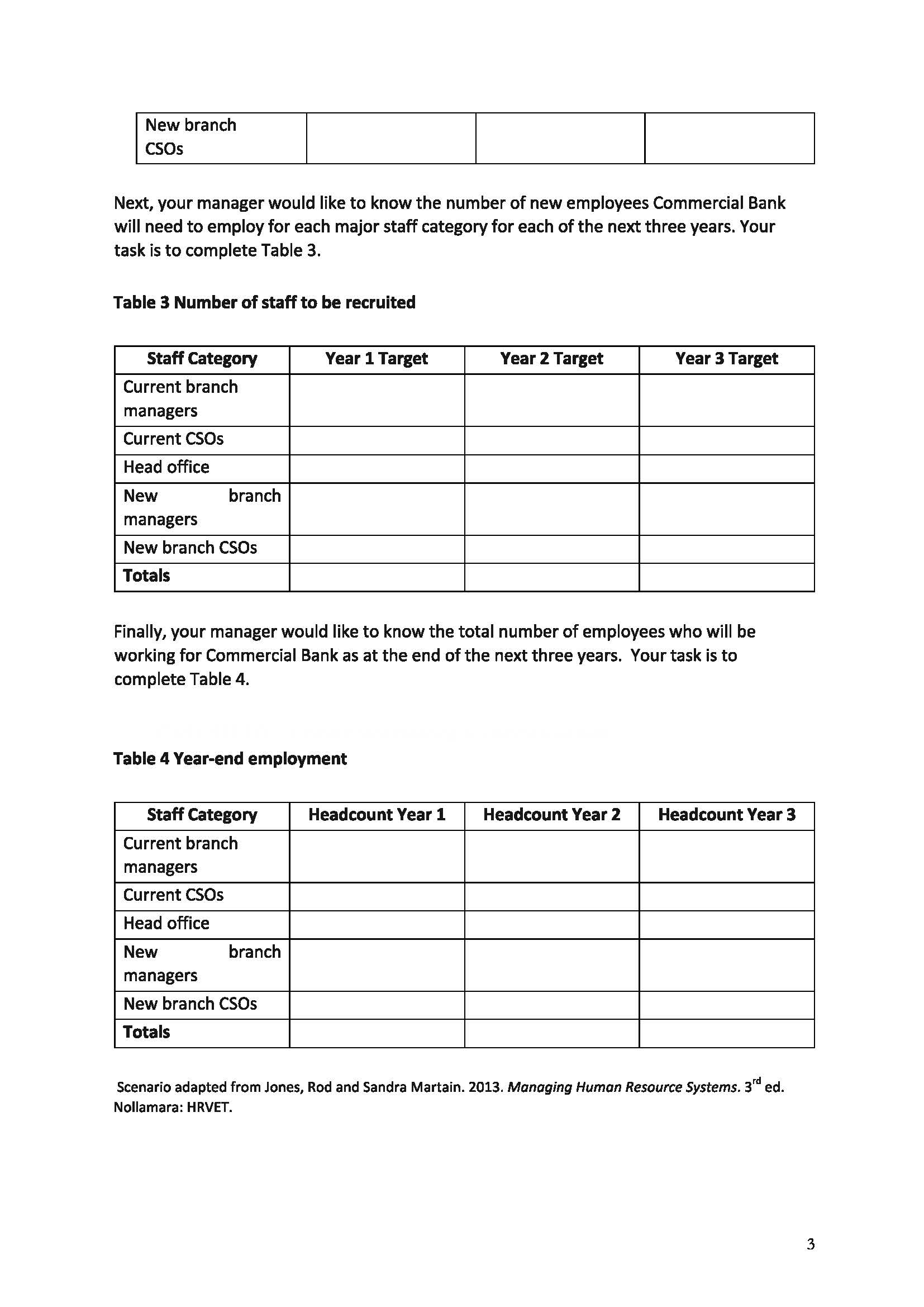

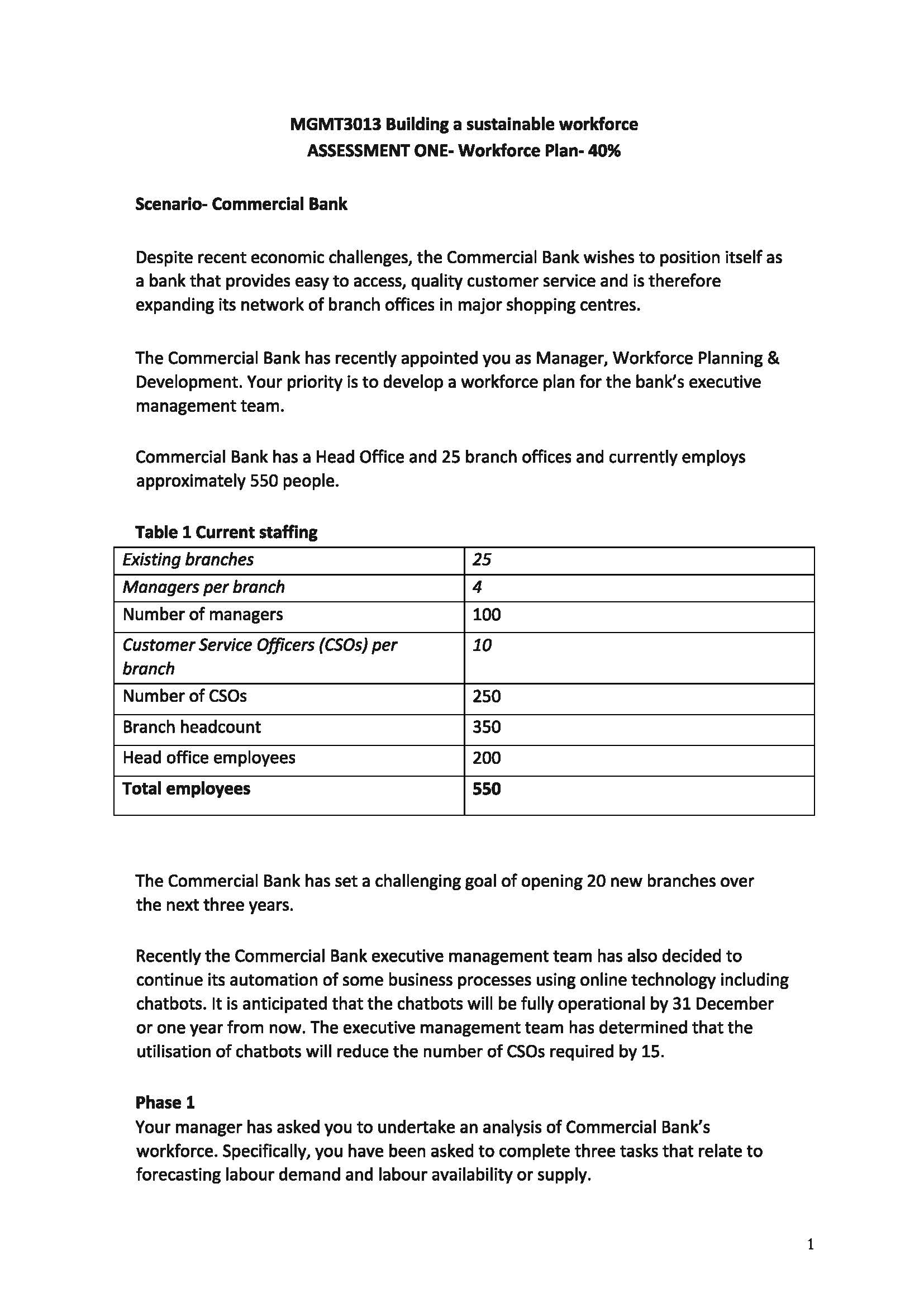

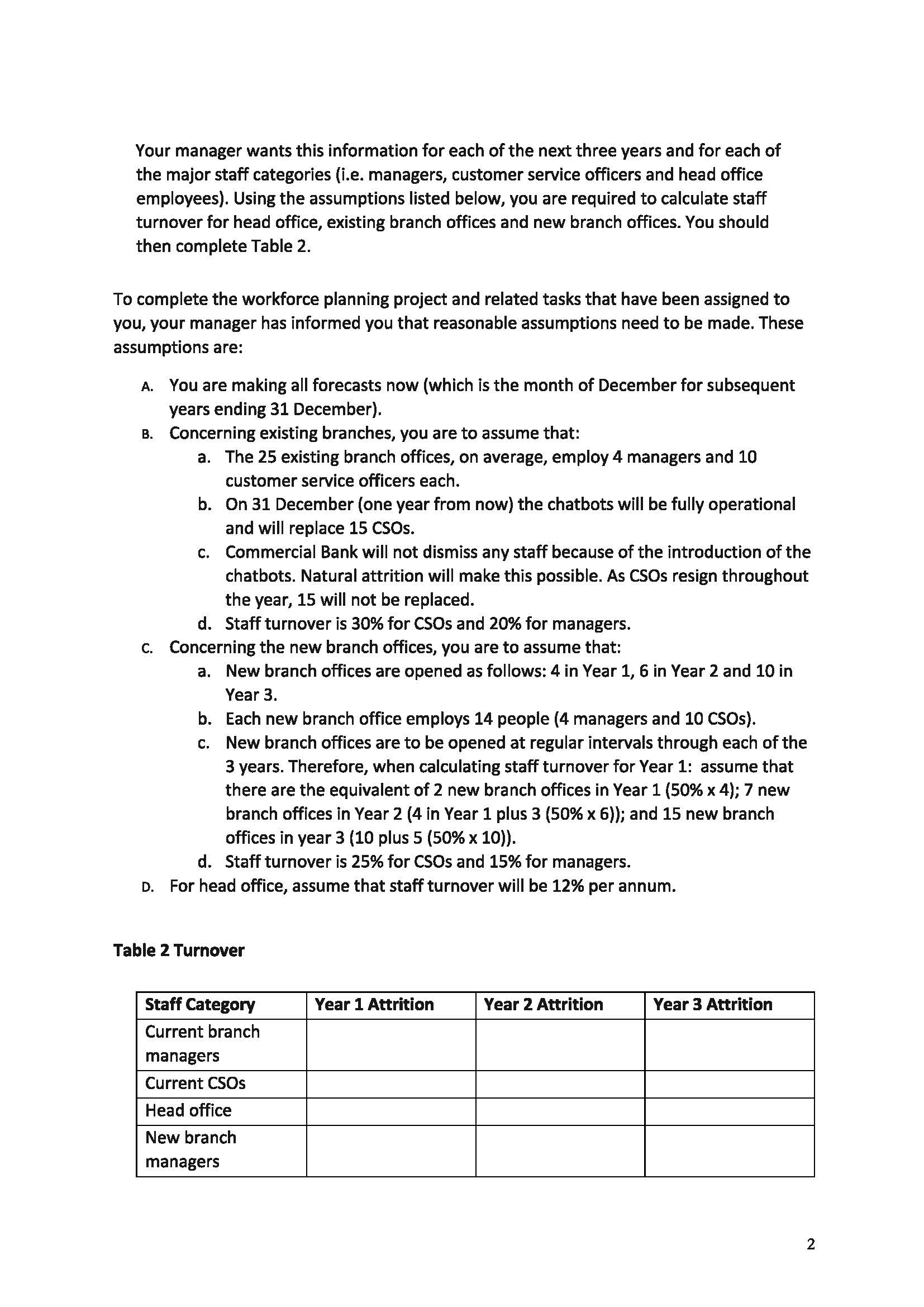

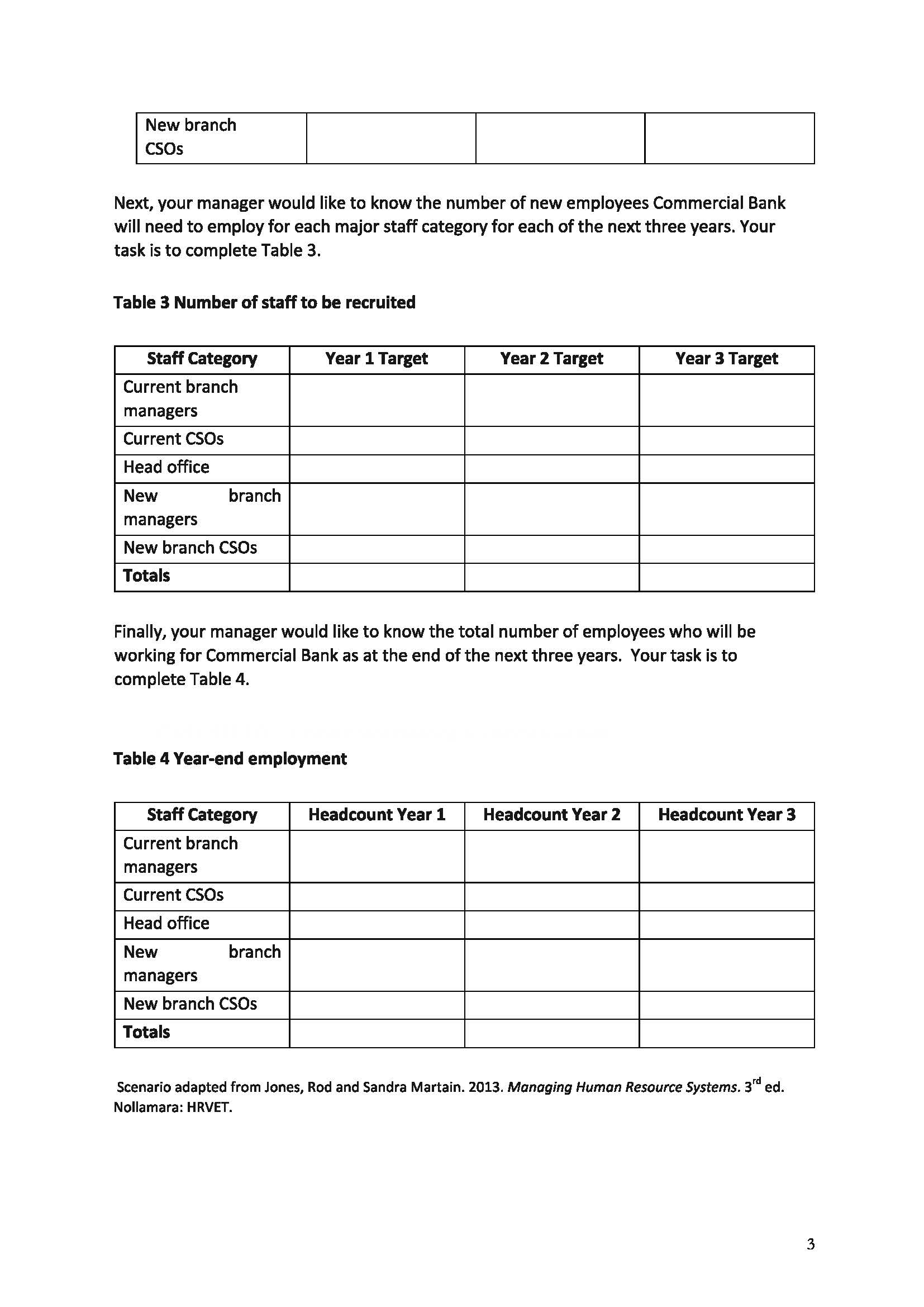

ASSESSMENT ONE- Workforce Plan- 40% Scenario- Commercial Bank Despite recent economic challenges, the Commercial Bank wishes to position itself as a bank that provides easy to access, quality customer service and is therefore expanding its network of branch offices in major shopping centres. The Commercial Bank has recently appointed you as Manager, Workforce Planning \& Development. Your priority is to develop a workforce plan for the bank's executive management team. Commercial Bank has a Head Office and 25 branch offices and currently employs approximately 550 people. The Commercial Bank has set a challenging goal of opening 20 new branches over the next three years. Recently the Commercial Bank executive management team has also decided to continue its automation of some business processes using online technology including chatbots. It is anticipated that the chatbots will be fully operational by 31 December or one year from now. The executive management team has determined that the utilisation of chatbots will reduce the number of CSOs required by 15 . Phase 1 Your manager has asked you to undertake an analysis of Commercial Bank's workforce. Specifically, you have been asked to complete three tasks that relate to forecasting labour demand and labour availability or supply. Your manager wants this information for each of the next three years and for each of the major staff categories (i.e. managers, customer service officers and head office employees). Using the assumptions listed below, you are required to calculate staff turnover for head office, existing branch offices and new branch offices. You should then complete Table 2. To complete the workforce planning project and related tasks that have been assigned to you, your manager has informed you that reasonable assumptions need to be made. These assumptions are: A. You are making all forecasts now (which is the month of December for subsequent years ending 31 December). B. Concerning existing branches, you are to assume that: a. The 25 existing branch offices, on average, employ 4 managers and 10 customer service officers each. b. On 31 December (one year from now) the chatbots will be fully operational and will replace 15 CSOs. c. Commercial Bank will not dismiss any staff because of the introduction of the chatbots. Natural attrition will make this possible. As CSOs resign throughout the year, 15 will not be replaced. d. Staff turnover is 30% for CSOs and 20% for managers. c. Concerning the new branch offices, you are to assume that: a. New branch offices are opened as follows: 4 in Year 1, 6 in Year 2 and 10 in Year 3. b. Each new branch office employs 14 people (4 managers and 10 CSOs). c. New branch offices are to be opened at regular intervals through each of the 3 years. Therefore, when calculating staff turnover for Year 1: assume that there are the equivalent of 2 new branch offices in Year 1(50%4);7 new branch offices in Year 2 (4 in Year 1 plus 3(50%6) ); and 15 new branch offices in year 3(10 plus 5(50%10)). d. Staff turnover is 25% for CSOs and 15% for managers. D. For head office, assume that staff turnover will be 12% per annum. Table 2 Turnover Next, your manager would like to know the number of new employees Commercial Bank will need to employ for each major staff category for each of the next three years. Your task is to complete Table 3 . Table 3 Number of staff to be recruited Finally, your manager would like to know the total number of employees who will be working for Commercial Bank as at the end of the next three years. Your task is to complete Table 4. Table 4 Year-end employment Scenario adapted from Jones, Rod and Sandra Martain. 2013. Managing Human Resource Systems. 3rd ed. Nollamara: HRVET