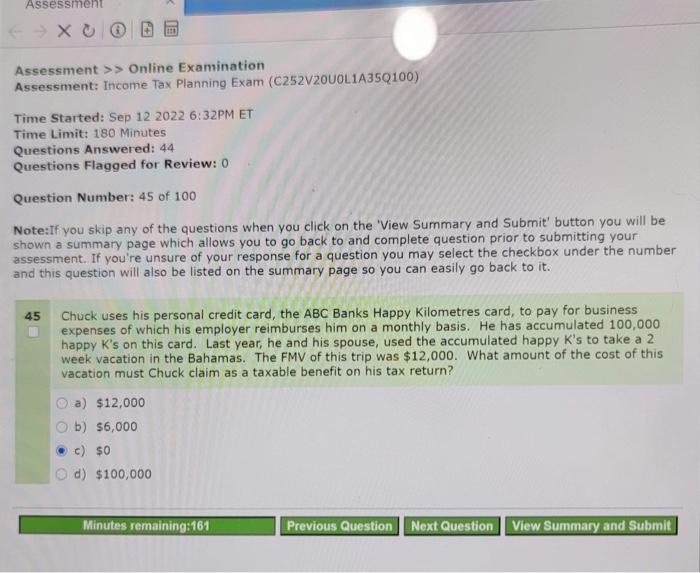

Assessment >> Online Examination Assessment: Income Tax Planning Exam (C252V20U0L1A35Q100) Time Started: Sep 122022 6:32PM ET Time Limit: 180 Minutes Questions Answered: 44 Questions Flagged for Review: 0 Question Number: 45 of 100 Note:If you skip any of the questions when you click on the 'View Summary and Submit' button you will be shown a summary page which allows you to go back to and complete question prior to submitting your assessment. If you're unsure of your response for a question you may select the checkbox under the number and this question will also be listed on the summary page so you can easily go back to it. 45 Chuck uses his personal credit card, the ABC Banks Happy Kilometres card, to pay for business expenses of which his employer reimburses him on a monthly basis. He has accumulated 100,000 happy K's on this card. Last year, he and his spouse, used the accumulated happy K's to take a 2 week vacation in the Bahamas. The FMV of this trip was $12,000. What amount of the cost of this vacation must Chuck claim as a taxable benefit on his tax return? a) $12,000 b) $6,000 c) $0 d) $100,000 Assessment >> Online Examination Assessment: Income Tax Planning Exam (C252V20U0L1A35Q100) Time Started: Sep 122022 6:32PM ET Time Limit: 180 Minutes Questions Answered: 44 Questions Flagged for Review: 0 Question Number: 45 of 100 Note:If you skip any of the questions when you click on the 'View Summary and Submit' button you will be shown a summary page which allows you to go back to and complete question prior to submitting your assessment. If you're unsure of your response for a question you may select the checkbox under the number and this question will also be listed on the summary page so you can easily go back to it. 45 Chuck uses his personal credit card, the ABC Banks Happy Kilometres card, to pay for business expenses of which his employer reimburses him on a monthly basis. He has accumulated 100,000 happy K's on this card. Last year, he and his spouse, used the accumulated happy K's to take a 2 week vacation in the Bahamas. The FMV of this trip was $12,000. What amount of the cost of this vacation must Chuck claim as a taxable benefit on his tax return? a) $12,000 b) $6,000 c) $0 d) $100,000