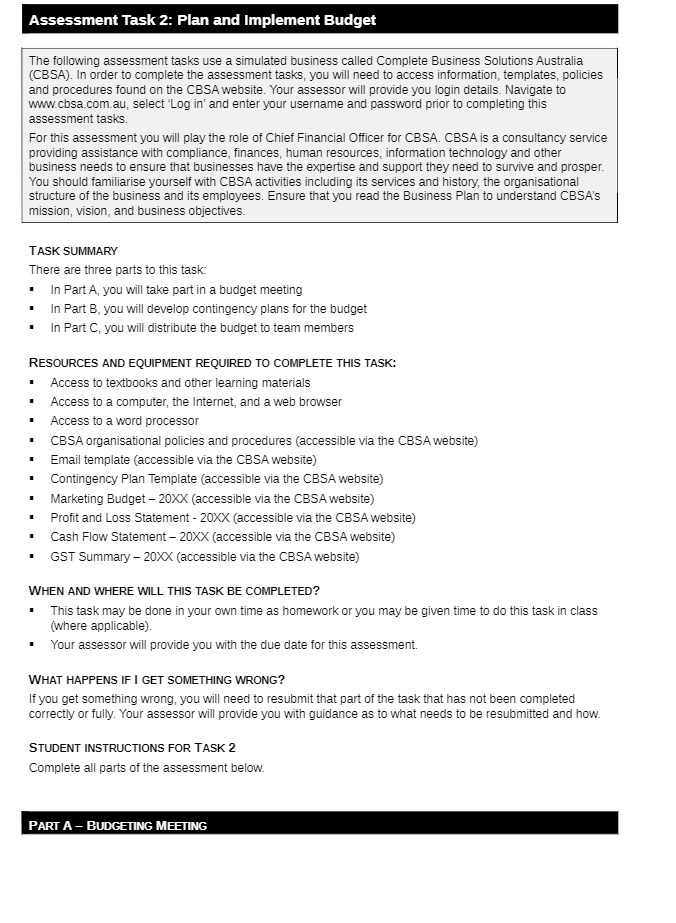

Assessment Task 2: Plan and Implement Budget The following assessment tasks use a simulated business called Complete Business Solutions Australia (CBSA). In order to complete the assessment tasks, you will need to access information, templates, policies and procedures found on the CBSA website. Your assessor will provide you login details. Navigate to www.cbsa.com.au, select 'Log in' and enter your username and password prior to completing this assessment tasks. For this assessment you will play the role of Chief Financial Officer for CBSA. CBSA is a consultancy service providing assistance with compliance, finances, human resources, information technology and other business needs to ensure that businesses have the expertise and support they need to survive and prosper. You should familiarise yourself with CBSA activities including its services and history, the organisational structure of the business and its employees. Ensure that you read the Business Plan to understand CBSA'S mission, vision, and business objectives. TASK SUMMARY There are three parts to this task: In Part A, you will take part in a budget meeting In Part B, you will develop contingency plans for the budget In Part C, you will distribute the budget to team members RESOURCES AND EQUIPMENT REQUIRED TO COMPLETE THIS TASK: Access to textbooks and other learning materials Access to a computer, the Internet, and a web browser Access to a word processor CBSA organisational policies and procedures (accessible via the CBSA website) Email template (accessible via the CBSA website) Contingency Plan Template (accessible via the CBSA website) Marketing Budget - 20XX (accessible via the CBSA website) Profit and Loss Statement - 20XX (accessible via the CBSA website) Cash Flow Statement - 20XX (accessible via the CBSA website) GST Summary - 20XX (accessible via the CBSA website) WHEN AND WHERE WILL THIS TASK BE COMPLETED? This task may be done in your own time as homework or you may be given time to do this task in class (where applicable). Your assessor will provide you with the due date for this assessment. WHAT HAPPENS IF I GET SOMETHING WRONG? If you get something wrong, you will need to resubmit that part of the task that has not been completed correctly or fully. Your assessor will provide you with guidance as to what needs to be resubmitted and how. STUDENT INSTRUCTIONS FOR TASK 2 Complete all parts of the assessment below. PART A - BUDGETING MEETING