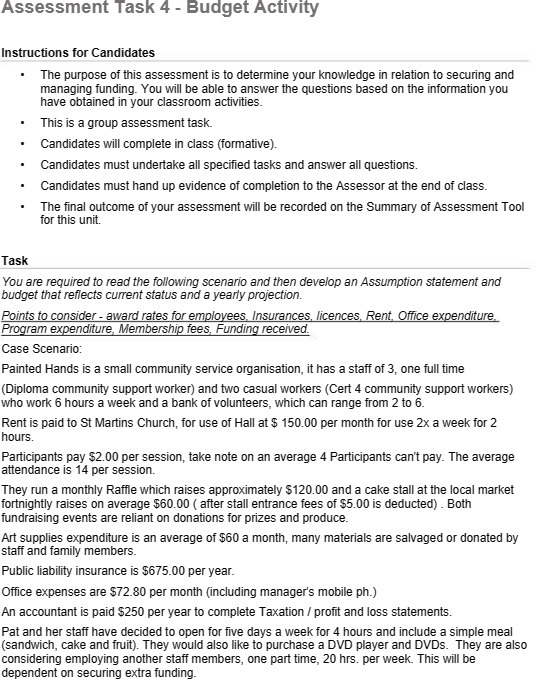

Assessment Task 4 - Budget Activity Instructions for Candidates The purpose of this assessment is to determine your knowledge in relation to securing and managing funding. You will be able to answer the questions based on the information you have obtained in your classroom activities. This is a group assessment task. Candidates will complete in class (formative). Candidates must undertake all specified tasks and answer all questions. Candidates must hand up evidence of completion to the Assessor at the end of class. The final outcome of your assessment will be recorded on the Summary of Assessment Tool for this unit. Task You are required to read the following scenario and then develop an Assumption statement and budget that reflects current status and a yearly projection. Points to consider - award rates for employees, Insurances, licences, Rent, Office expenditure. Program expenditure, Membership fees, Funding received. Case Scenario: Painted Hands is a small community service organisation, it has a staff of 3, one full time (Diploma community support worker) and two casual workers (Cert 4 community support workers) who work 6 hours a week and a bank of volunteers, which can range from 2 to 6. Rent is paid to St Martins Church, for use of Hall at $ 150.00 per month for use 2x a week for 2 hours. Participants pay $2.00 per session, take note on an average 4 Participants can't pay. The average attendance is 14 per session. They run a monthly Raffle which raises approximately $120.00 and a cake stall at the local market fortnightly raises on average $60.00 ( after stall entrance fees of $5.00 is deducted) . Both fundraising events are reliant on donations for prizes and produce. Art supplies expenditure is an average of $60 a month, many materials are salvaged or donated by staff and family members. Public liability insurance is $675.00 per year. Office expenses are $72.80 per month (including manager's mobile ph.) An accountant is paid $250 per year to complete Taxation / profit and loss statements. Pat and her staff have decided to open for five days a week for 4 hours and include a simple meal (sandwich, cake and fruit). They would also like to purchase a DVD player and DVDs. They are also considering employing another staff members, one part time, 20 hrs. per week. This will be dependent on securing extra funding