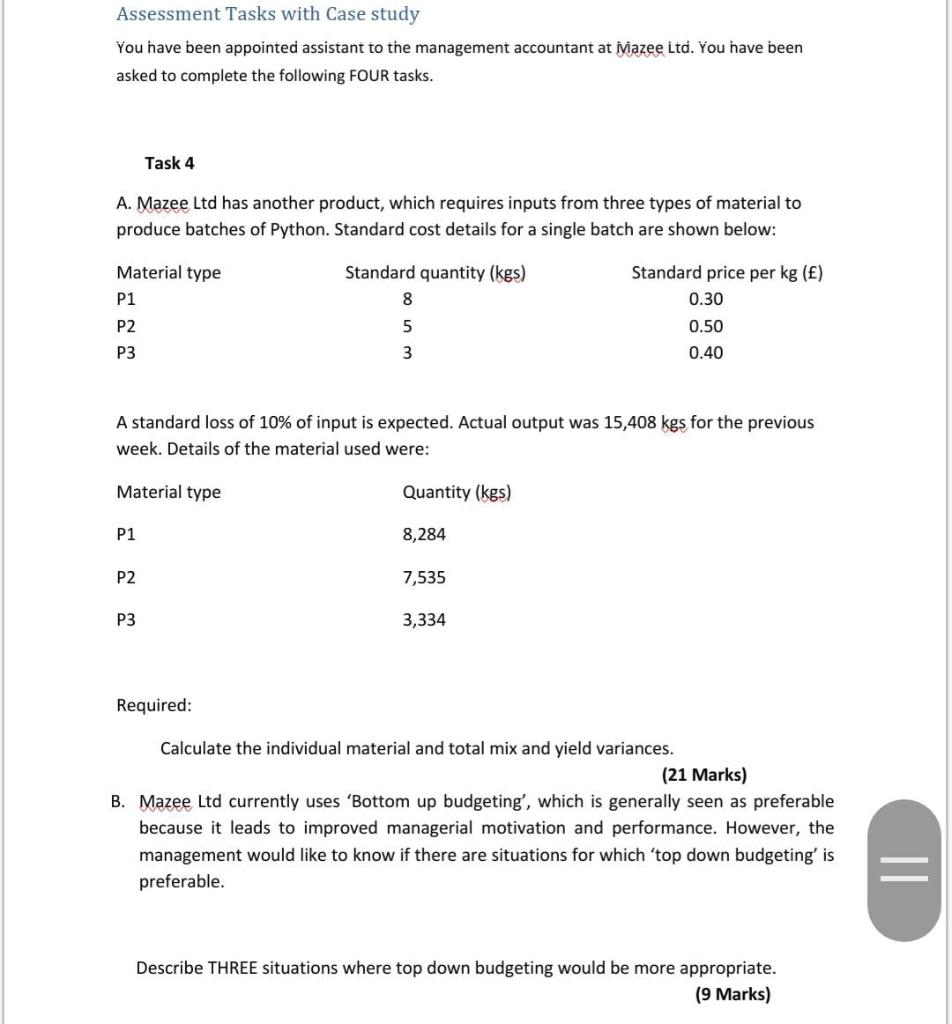

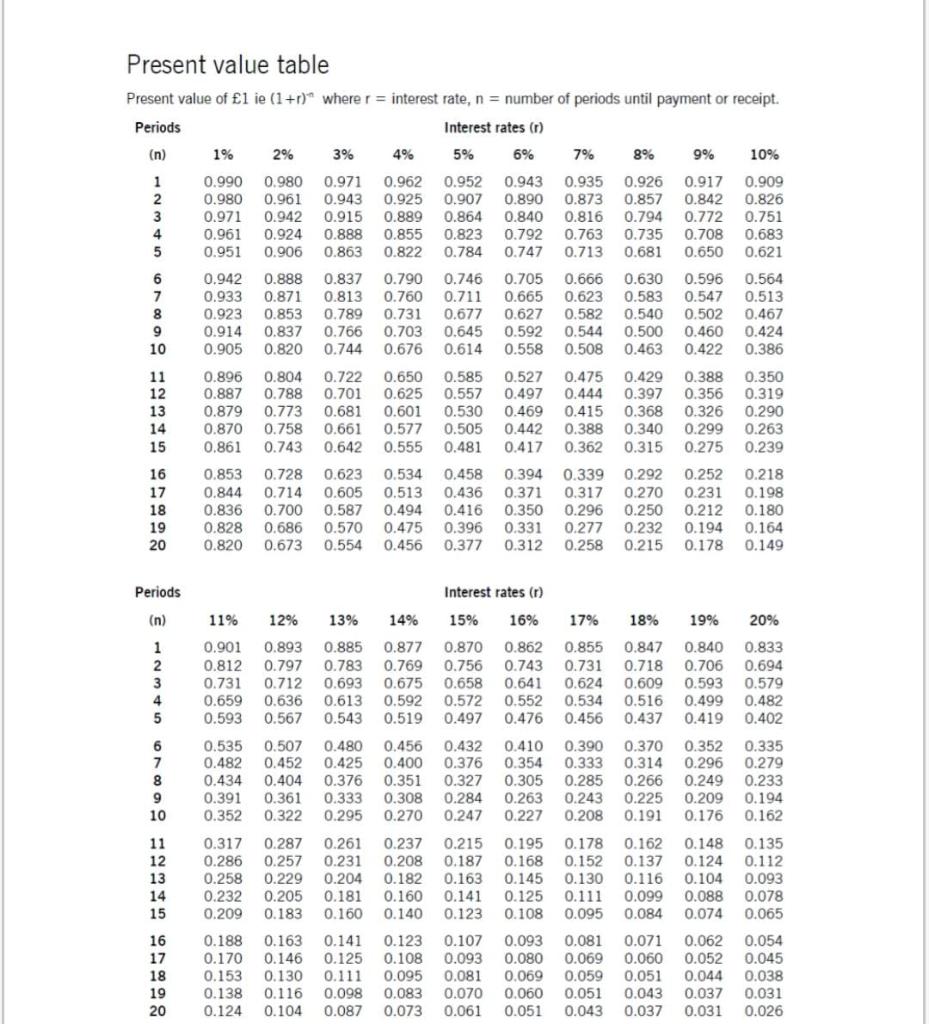

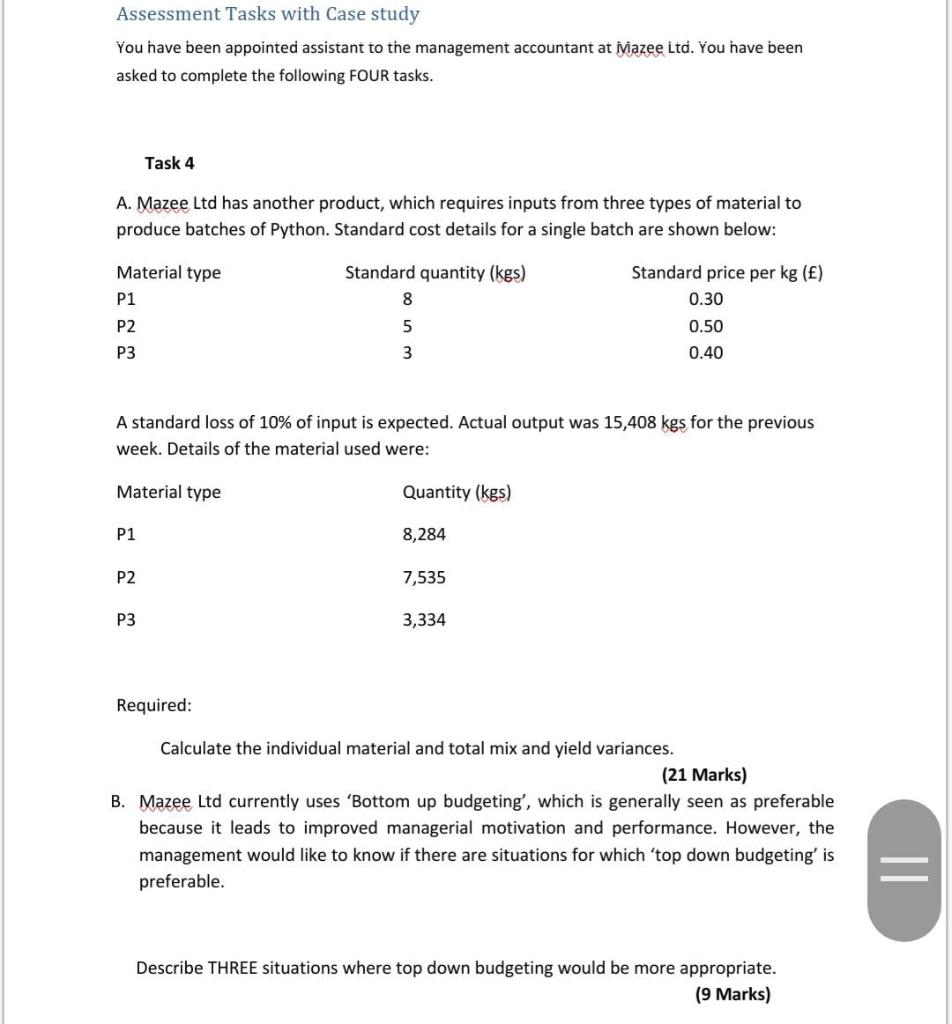

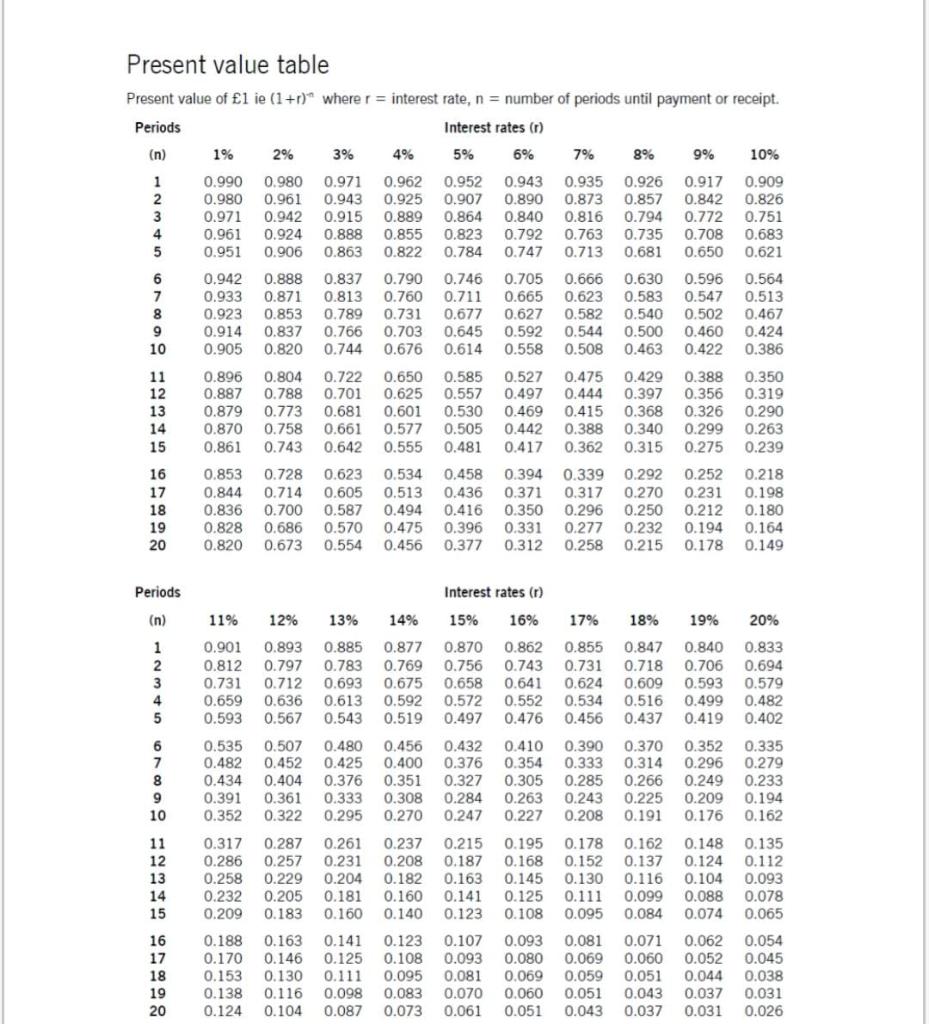

Assessment Tasks with Case study You have been appointed assistant to the management accountant at iviazee Ltd. You have been asked to complete the following FOUR tasks. Task 4 A. Mazee Ltd has another product, which requires inputs from three types of material to produce batches of Python. Standard cost details for a single batch are shown below: Material type Standard quantity (kgs) 8 P1 Standard price per kg () 0.30 0.50 0.40 P2 5 P3 3 A standard loss of 10% of input is expected. Actual output was 15,408 kgs for the previous week. Details of the material used were: Material type Quantity (kgs) P1 8,284 P2 7,535 P3 3,334 Required: Calculate the individual material and total mix and yield variances. (21 Marks) B. Mazee Ltd currently uses 'Bottom up budgeting', which is generally seen as preferable because it leads to improved managerial motivation and performance. However, the management would like to know if there are situations for which 'top down budgeting' is preferable. = Describe THREE situations where top down budgeting would be more appropriate. (9 Marks) Present value table Present value of 1 ie (1+r)^ where r = interest rate, n = number of periods until payment or receipt. Periods Interest rates (1) (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 Periods Interest rates (1) (n) 11% 12% 14% 15% 16% 1 2 3 4 5 0.901 0.812 0.731 0.659 0.593 0.893 0.797 0.712 0.636 0.567 13% 0.885 0.783 0.693 0.613 0.543 0.877 0.769 0.675 0.592 0.519 0.870 0.756 0.658 0.572 0.497 0.862 0.743 0.641 0.552 0.476 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.452 0.404 0.361 0.322 0.480 0.425 0.376 0.333 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 17% 18% 19% 20% 0.855 0.847 0.840 0.833 0.731 0.718 0.706 0.694 0.624 0.609 0.593 0.579 0.534 0.516 0.499 0.482 0.456 0.437 0.419 0.402 0.390 0.370 0.352 0.335 0.333 0.314 0.296 0.279 0.285 0.266 0.249 0.233 0.243 0.225 0.209 0.194 0.208 0.191 0.176 0.162 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.112 0.130 0.116 0.104 0.093 0.111 0.099 0.088 0.078 0.095 0.084 0.074 0.065 0.081 0.071 0.062 0.054 0.069 0.060 0.052 0.045 0.059 0.051 0.044 0.038 0.051 0.043 0.037 0.031 0.043 0.037 0.031 0.026 11 12 13 14 15 0.317 0.286 0.258 0.232 0.209 0.287 0.261 0.257 0.231 0.229 0.204 0.205 0.181 0.183 0.160 0.237 0.215 0.195 0.208 0.187 0.168 0.182 0.163 0.145 0.160 0.141 0.125 0.140 0.123 0.108 0.123 0.107 0.093 0.108 0.093 0.080 0.095 0.081 0.069 0.083 0.070 0.060 0.073 0.061 0.051 16 17 18 19 20 0.188 0.170 0.153 0.138 0.124 0.163 0.146 0.130 0.116 0.104 0.141 0.125 0.111 0.098 0.087