Answered step by step

Verified Expert Solution

Question

1 Approved Answer

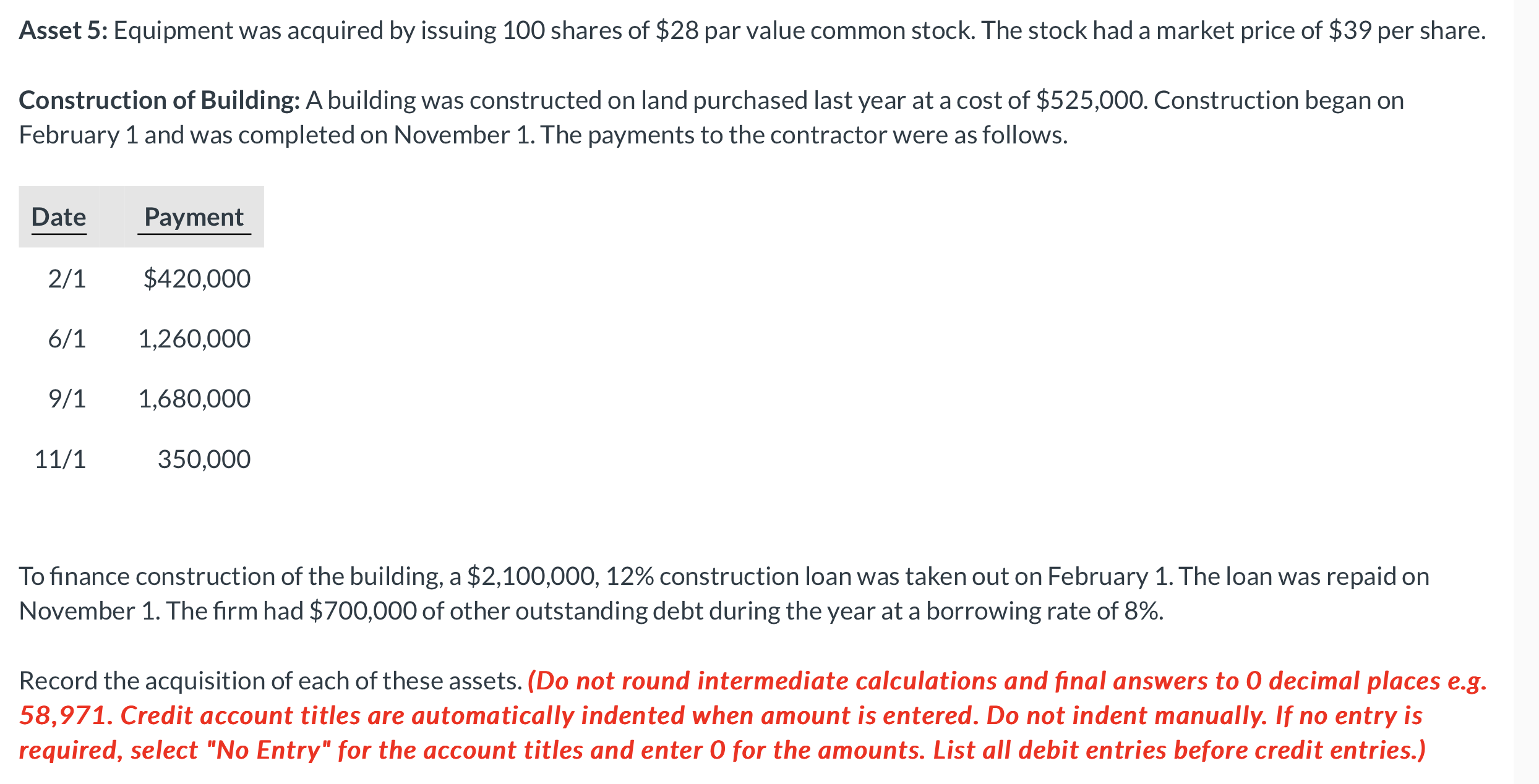

Asset 5 : Equipment was acquired by issuing 1 0 0 shares of $ 2 8 par value common stock. The stock had a market

Asset : Equipment was acquired by issuing shares of $ par value common stock. The stock had a market price of $ per share. Interest Expense

Construction of Building: A building was constructed on land purchased last year at a cost of $ Construction began on

February and was completed on November The payments to the contractor were as follows.

To finance construction of the building, a $ construction loan was taken out on February The loan was repaid on

November The firm had $ of other outstanding debt during the year at a borrowing rate of

Record the acquisition of each of these assets. Do not round intermediate calculations and final answers to decimal places eg

Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started