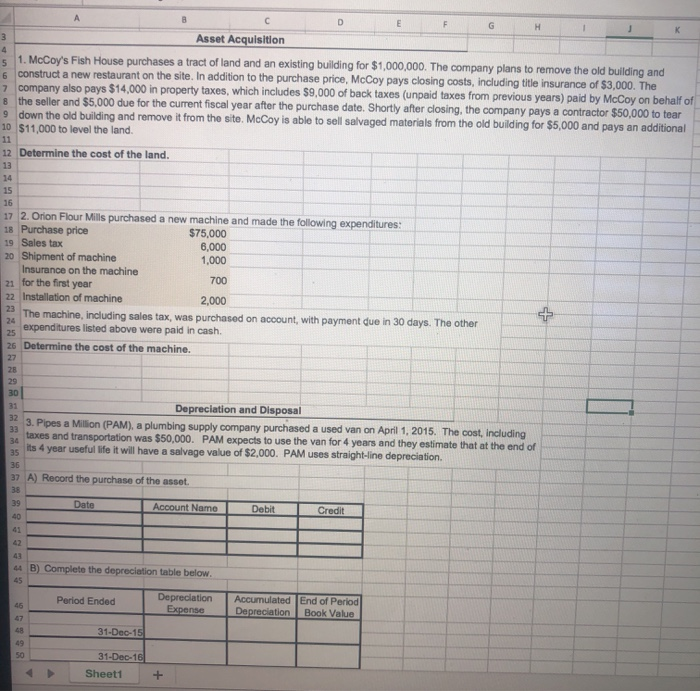

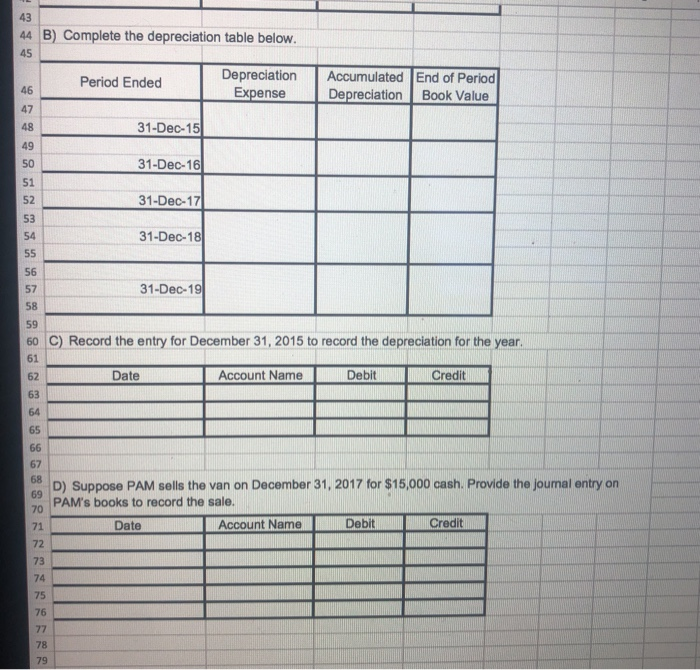

Asset Acquisition 1. McCoy's Fish House purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of $3,000. The company also pays $14,000 in property taxes, which includes $9,000 of back taxes (unpaid taxes from previ f back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $5,000 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $50,000 to tear down the old building and remove it from the site McCoy is able to sell salvaged materials from the old building for $5,000 and pays an additional 0 $11,000 to level the land. 12 Determine the cost of the land. 17 2. Orion Flour Mills purchased a new machine and made the following expenditures: 18 Purchase price $75,000 19 Sales tax 6,000 20 Shipment of machine 1.000 Insurance on the machine 700 21 for the first year 22 Installation of machine 2,000 The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. 26 Determine the cost of the machine. Depreciation and Disposal 3. Pipes a Million (PAM), a plumbing supply company purchased a used van on April 1, 2015. The cost. Including taxes and transportation was $50,000. PAM expects to use the van for 4 years and they estimate that at the end of its 4 year useful life it will have a salvage value of $2,000. PAM uses straight-line depreciation. 37 A) Record the purchase of the asset. Date Account Name Debit Credit B) Complete the depreciation table below. Period Ended Depreciation Expense Accumulated Depreciation End of Period Book Value 31-Dec-15 31-Dec-16 Sheet1 + 44 B) Complete the depreciation table below. Period Ended Depreciation Expense Accumulated End of Period Depreciation Book Value 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18 31-Dec-19 60 C) Record the entry for December 31, 2015 to record the depreciation for the year. Date Account Name Debit Credit D) Suppose PAM sells the van on December 31, 2017 for $15,000 cash. Provide the journal entry on PAM's books to record the sale. Date LE MAI Account Name Debit Credit