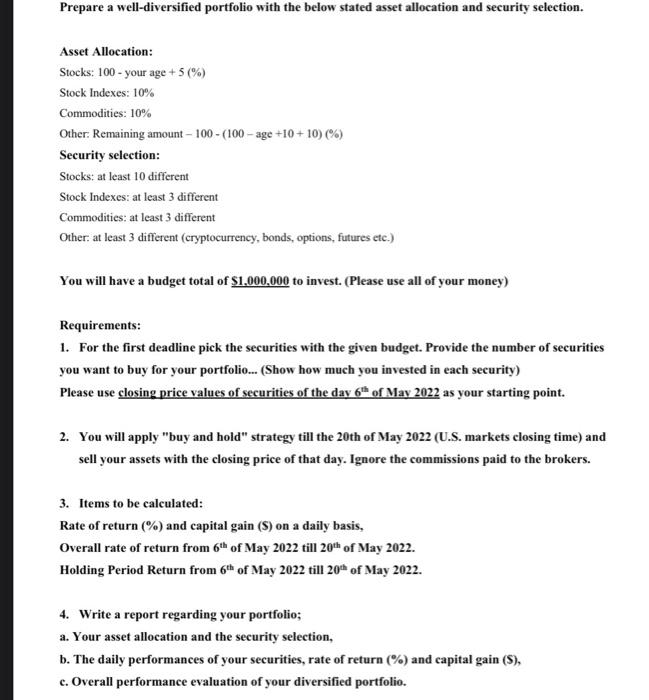

Asset Allocation: Stocks: 100 - your age +5(%) Stock Indexes: 10% Commodities: 10% Other: Remaining amount 100(100 age +10+10)(%) Security selection: Stocks: at least 10 different Stock Indexes: at least 3 different Commodities: at least 3 different Other. at least 3 different (cryptocurrency, bonds, options, futures etc.) You will have a budget total of $1,000,000 to invest. (Please use all of your money) Requirements: 1. For the first deadline pick the securities with the given budget. Provide the number of securities you want to buy for your portfolio... (Show how much you invested in each security) Please use closing price values of securities of the day 6th of May 2022 as your starting point. 2. You will apply "buy and hold" strategy till the 20 th of May 2022 (U.S. markets closing time) and sell your assets with the closing price of that day. Ignore the commissions paid to the brokers. 3. Items to be calculated: Rate of return (\%) and capital gain (S) on a daily basis, Overall rate of return from 6th of May 2022 till 20th of May 2022. Holding Period Return from 6th of May 2022 till 20th of May 2022. 4. Write a report regarding your portfolio; a. Your asset allocation and the security selection, b. The daily performances of your securities, rate of return (\%) and capital gain (\$), c. Overall performance evaluation of your diversified portfolio. Asset Allocation: Stocks: 100 - your age +5(%) Stock Indexes: 10% Commodities: 10% Other: Remaining amount 100(100 age +10+10)(%) Security selection: Stocks: at least 10 different Stock Indexes: at least 3 different Commodities: at least 3 different Other. at least 3 different (cryptocurrency, bonds, options, futures etc.) You will have a budget total of $1,000,000 to invest. (Please use all of your money) Requirements: 1. For the first deadline pick the securities with the given budget. Provide the number of securities you want to buy for your portfolio... (Show how much you invested in each security) Please use closing price values of securities of the day 6th of May 2022 as your starting point. 2. You will apply "buy and hold" strategy till the 20 th of May 2022 (U.S. markets closing time) and sell your assets with the closing price of that day. Ignore the commissions paid to the brokers. 3. Items to be calculated: Rate of return (\%) and capital gain (S) on a daily basis, Overall rate of return from 6th of May 2022 till 20th of May 2022. Holding Period Return from 6th of May 2022 till 20th of May 2022. 4. Write a report regarding your portfolio; a. Your asset allocation and the security selection, b. The daily performances of your securities, rate of return (\%) and capital gain (\$), c. Overall performance evaluation of your diversified portfolio