Answered step by step

Verified Expert Solution

Question

1 Approved Answer

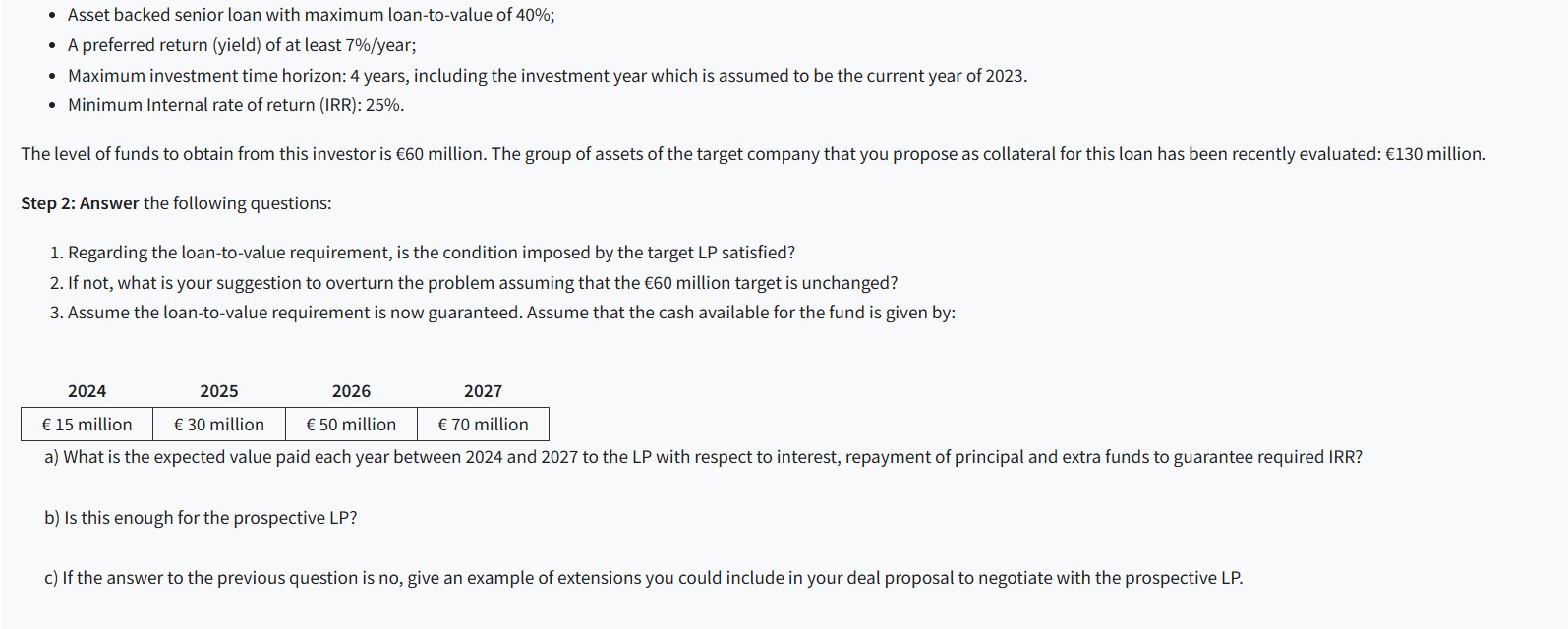

Asset backed senior loan with maximum loan - to - value of 4 0 % ; A preferred return ( yield ) of at least

Asset backed senior loan with maximum loantovalue of ;

A preferred return yield of at least year;

Maximum investment time horizon: years, including the investment year which is assumed to be the current year of

Minimum Internal rate of return IRR:

The level of funds to obtain from this investor is million. The group of assets of the target company that you propose as collateral for this loan has been recently evaluated: million.

Step : Answer the following questions:

Regarding the loantovalue requirement, is the condition imposed by the target LP satisfied?

If not, what is your suggestion to overturn the problem assuming that the million target is unchanged?

Assume the loantovalue requirement is now guaranteed. Assume that the cash available for the fund is given by:

a What is the expected value paid each year between and to the LP with respect to interest, repayment of principal and extra funds to guarantee required IRR?

b Is this enough for the prospective LP

c If the answer to the previous question is no give an example of extensions you could include in your deal proposal to negotiate with the prospective LP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started