Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asset Equipment Furniture Equipment Furniture Computer Vehicle Computer Commercial Building Furniture Date Purchased 2/1/2018 11/1/2019 12/1/2019 5/5/2020 3/31/2021 7/31/2022 11/7/2022 12/23/2022 2019 2020 2021

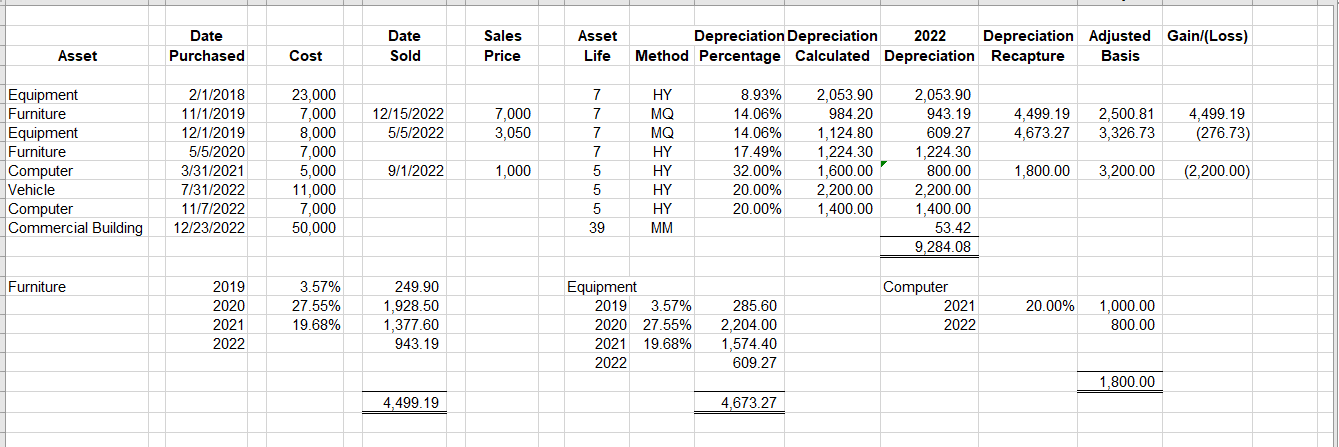

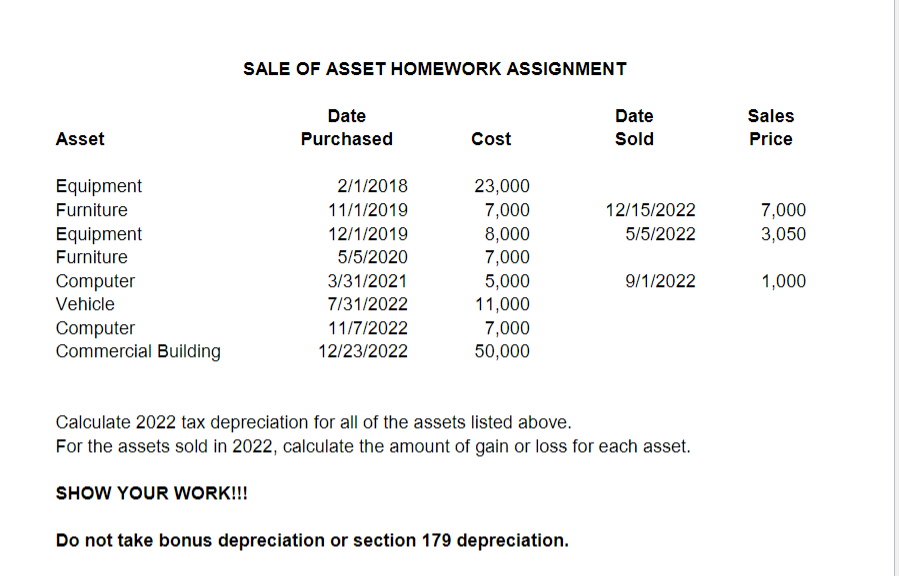

Asset Equipment Furniture Equipment Furniture Computer Vehicle Computer Commercial Building Furniture Date Purchased 2/1/2018 11/1/2019 12/1/2019 5/5/2020 3/31/2021 7/31/2022 11/7/2022 12/23/2022 2019 2020 2021 2022 Cost 23,000 7,000 8,000 7,000 5,000 11,000 7,000 50,000 3.57% 27.55% 19.68% Date Sold 12/15/2022 5/5/2022 9/1/2022 249.90 1,928.50 1,377.60 943.19 4,499.19 Sales Price 7,000 3,050 1,000 Asset Life 7 7 7 7 5 5 5 39 Depreciation Depreciation 2022 Depreciation Adjusted Gain/(Loss) Method Percentage Calculated Depreciation Recapture Basis Equipment 2019 HY MQ MQ HY HY HY HY MM 3.57% 2020 27.55% 2021 19.68% 2022 8.93% 14.06% 14.06% 17.49% 32.00% 20.00% 20.00% 285.60 2,204.00 1,574.40 609.27 4,673.27 2,053.90 984.20 1,124.80 1,224.30 1,600.00 2,200.00 1,400.00 2,053.90 943.19 609.27 1,224.30 800.00 2,200.00 1,400.00 53.42 9,284.08 Computer 2021 2022 4,499.19 2,500.81 4,499.19 4,673.27 3,326.73 (276.73) 1,800.00 3,200.00 (2,200.00) 20.00% 1,000.00 800.00 1,800.00 Asset Equipment Furniture Equipment Furniture Computer Vehicle Computer Commercial Building SALE OF ASSET HOMEWORK ASSIGNMENT Date Purchased 2/1/2018 11/1/2019 12/1/2019 5/5/2020 3/31/2021 7/31/2022 11/7/2022 12/23/2022 Cost 23,000 7,000 8,000 7,000 5,000 11,000 7,000 50,000 Date Sold Do not take bonus depreciation or section 179 depreciation. 12/15/2022 5/5/2022 9/1/2022 Calculate 2022 tax depreciation for all of the assets listed above. For the assets sold in 2022, calculate the amount of gain or loss for each asset. SHOW YOUR WORK!!! Sales Price 7,000 3,050 1,000

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the 2022 tax depreciation for all assets listed above we need to determine the deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started