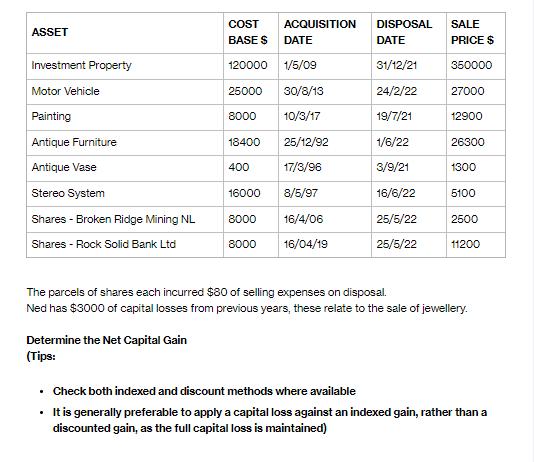

ASSET Investment Property Motor Vehicle Painting Antique Furniture Antique Vase Stereo System Shares - Broken Ridge Mining NL Shares - Rock Solid Bank Ltd

ASSET Investment Property Motor Vehicle Painting Antique Furniture Antique Vase Stereo System Shares - Broken Ridge Mining NL Shares - Rock Solid Bank Ltd Determine the Net Capital Gain (Tips: COST ACQUISITION BASE $ DATE 120000 1/5/09 25000 30/8/13 8000 10/3/17 18400 25/12/92 400 17/3/96 8/5/97 16/4/06 16/04/19 16000 . 8000 8000 DISPOSAL DATE 31/12/21 24/2/22 19/7/21 1/6/22 3/9/21 16/6/22 25/5/22 25/5/22 SALE PRICE $ 350000 27000 12900 26300 1300 5100 2500 The parcels of shares each incurred $80 of selling expenses on disposal. Ned has $3000 of capital losses from previous years, these relate to the sale of jewellery. 11200 Check both indexed and discount methods where available It is generally preferable to apply a capital loss against an indexed gain, rather than a discounted gain, as the full capital loss is maintained) Total Collectables Total Personal and Other Use Total Other Method and Indexed Net Gain before Discount - Discount = Net Capital Gain $ Answer for part 1 $ Answer for part 2 $ Answer for part 3 $ Answer for part 4 $ Answer for part 5 $ Answer for part 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the net capital gain Investment Property Acquisition cost 120000 Disposal pric...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started