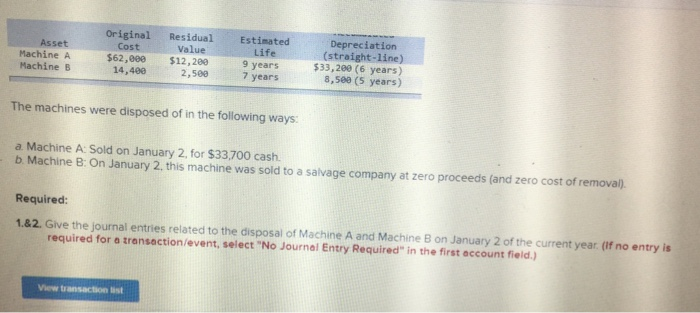

Question: Asset Machine A Machine B Original Residual Value $62,0e0 $12,280 Estimated Life 9 years Depreciation (stroight-line) $33,200 (6 years) 8,5e0 (5 years) Cost 14,400 2,5007

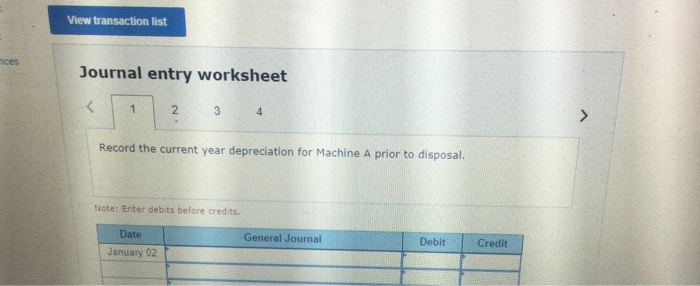

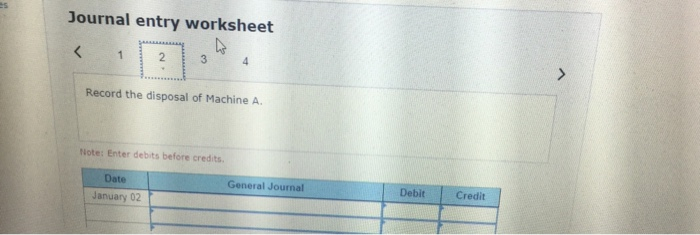

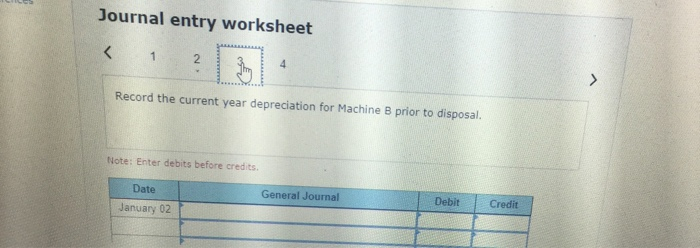

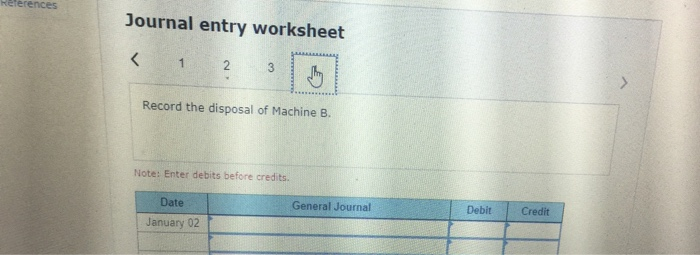

Asset Machine A Machine B Original Residual Value $62,0e0 $12,280 Estimated Life 9 years Depreciation (stroight-line) $33,200 (6 years) 8,5e0 (5 years) Cost 14,400 2,5007 years The machines were disposed of in the following ways: a Machine A: Sold on January 2, for $33,700 cash. b. Machine B: On January 2, this machine was sold to a salvage company at zero proceeds (and zero cost of removal) Required: 1.&2. Give the journal entries related to the disposal of Machine A and Machine B on January 2 of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View transaction list ces Journal entry worksheet Record the current year depreciation for Machine A prior to disposal Note: Enter debits before credits Date January 02 General Journal Debit Credit Journal entry worksheet Record the disposal of Machine A Note: Enter debits before credits. Date January 02 General Journal Debit Credit Journal entry worksheet 2 Record the current year depreciation for Machine B prior to disposal. Note: Enter debits before credits Date General Journal Debit Credit January 02 References Journal entry worksheet Record the disposal of Machine B. Note: Enter debits before credits. Date General Journal DebitCredit January 02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts