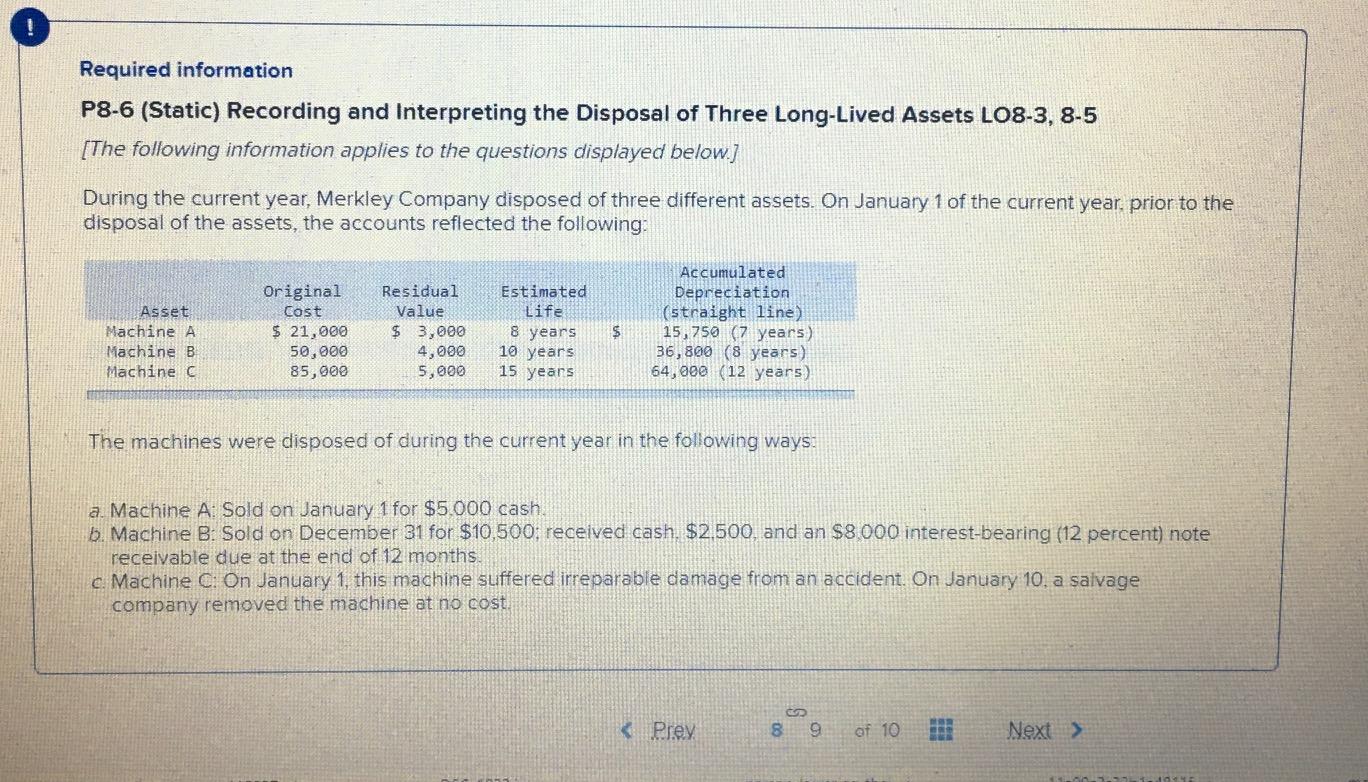

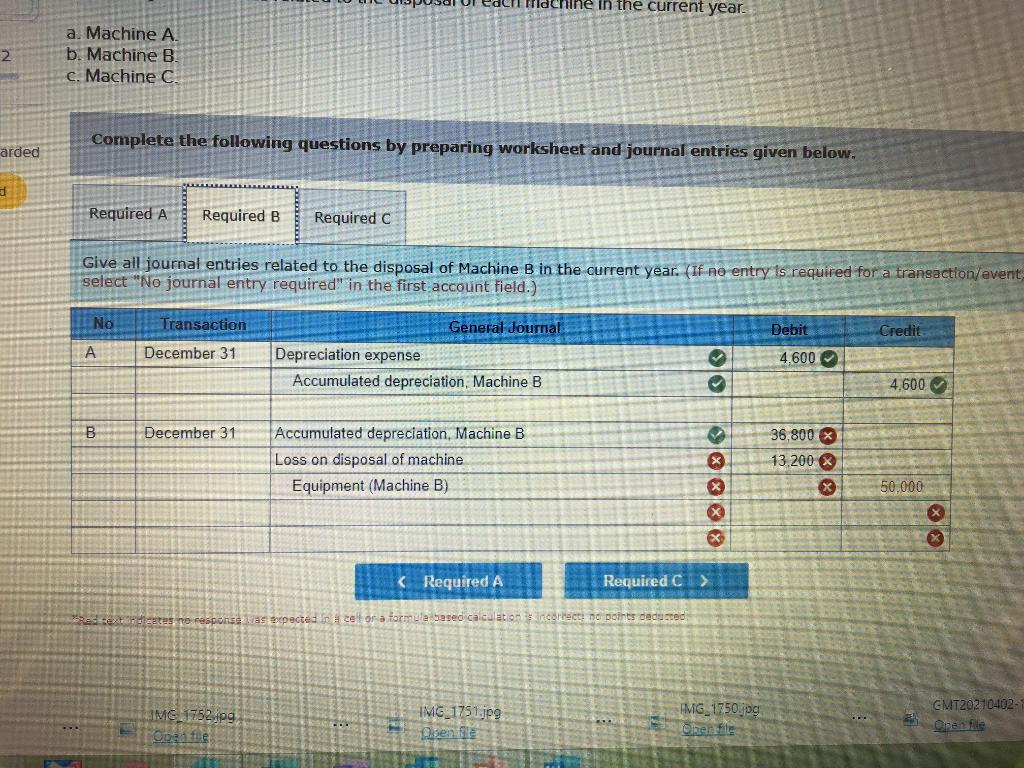

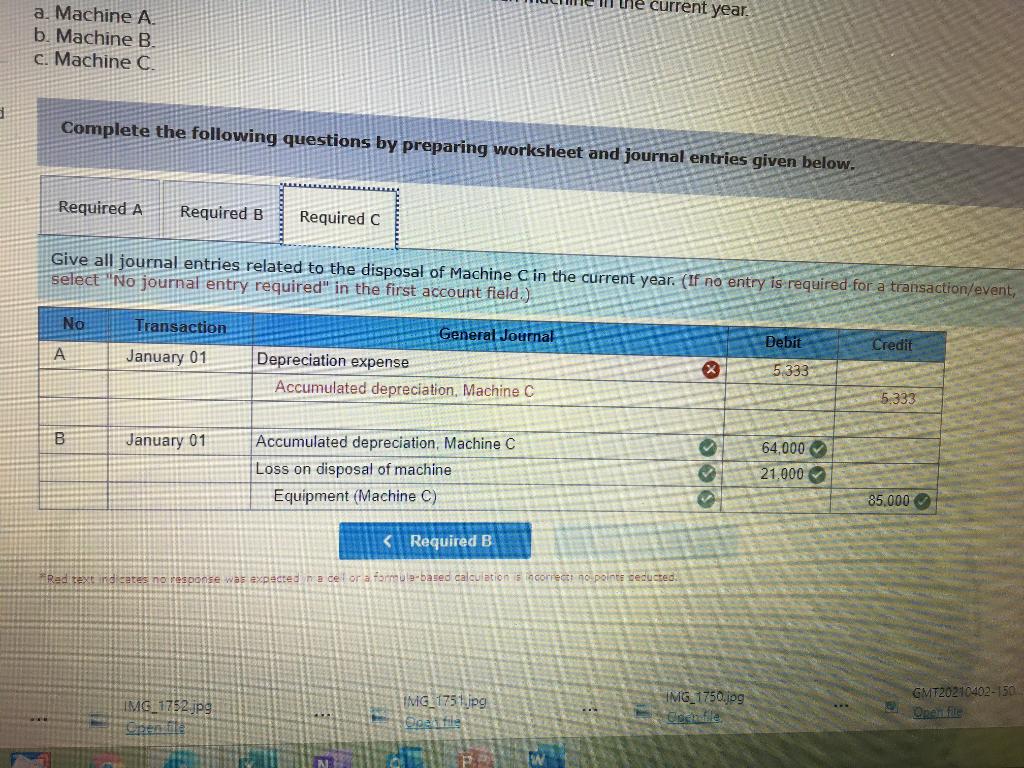

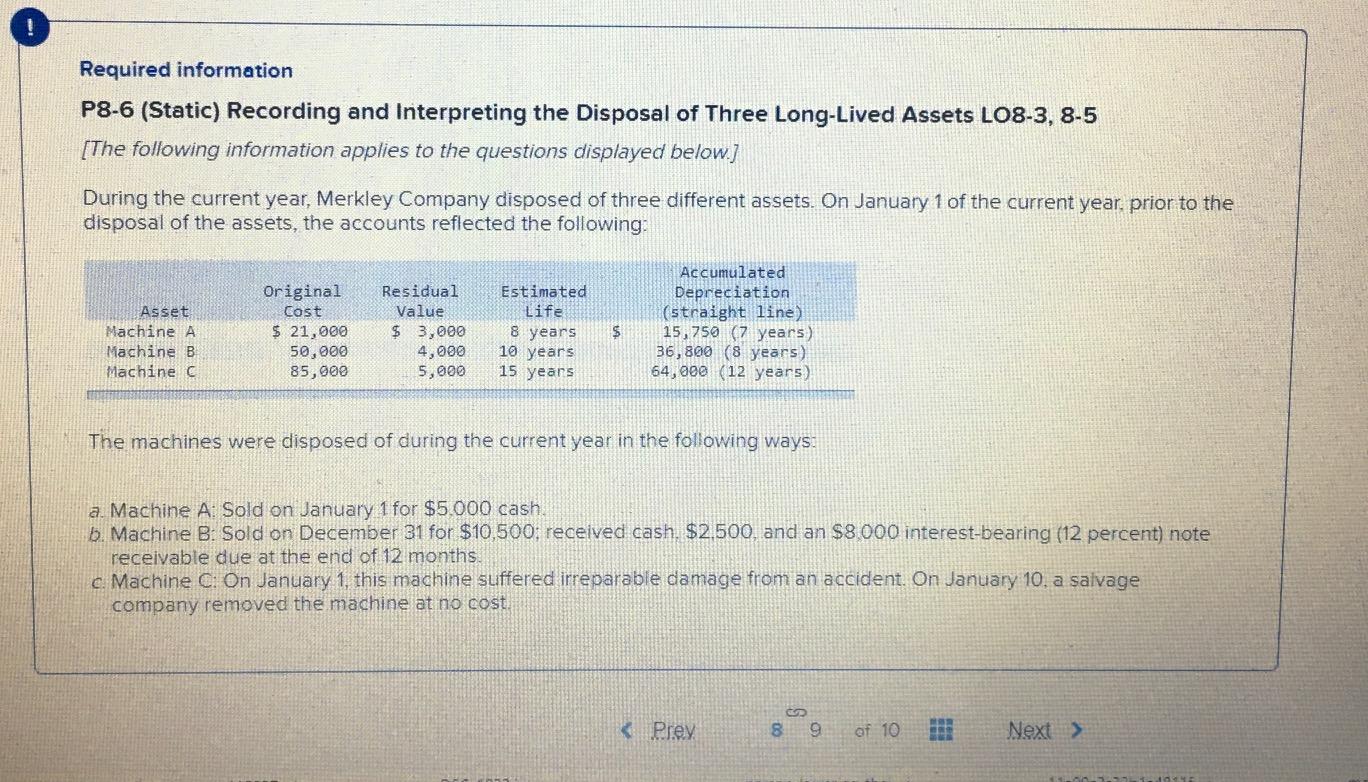

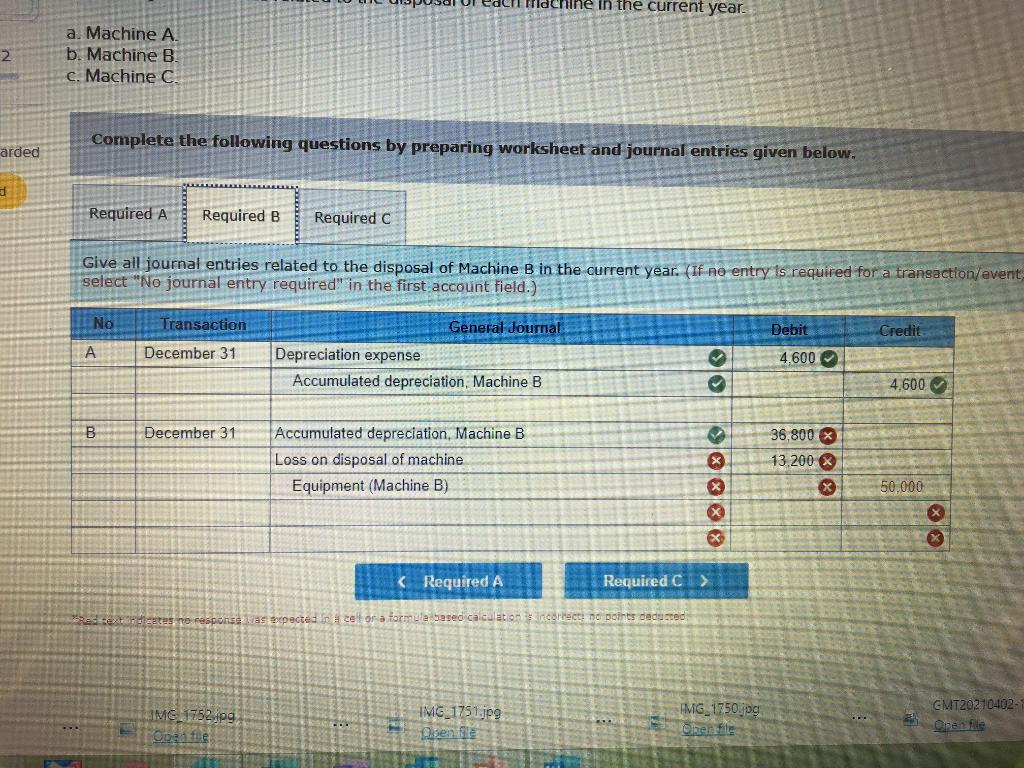

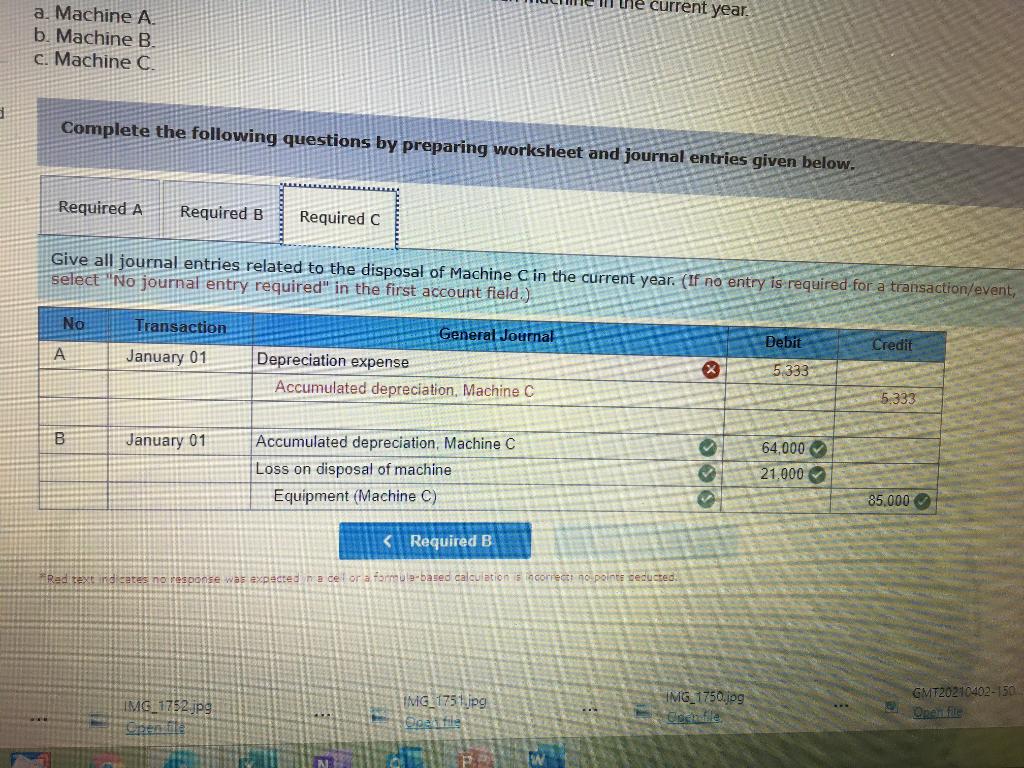

Required information P8-6 (Static) Recording and Interpreting the Disposal of Three Long-Lived Assets LO8-3, 8-5 [The following information applies to the questions displayed below.] During the current year, Merkley Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: Original Cost $ 21,000 50,000 85,000 Asset Machine A Machine B Machine C Residual Value $ 3,000 4,000 5,000 Estimated Life 8 years 10 years 15 years Accumulated Depreciation (straight line) 15,750 (7 years) 36,800 (8 years) 64,000 (12 years) $ The machines were disposed of during the current year in the following ways: a. Machine A Sold on January 1 for $5.000 cash. b. Machine B: Sold on December 31 for $10,500; received cash. $2.500, and an $8.000 interest-bearing (12 percent) note receivable due at the end of 12 months. c Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10. a salvage company removed the machine at no cost. Ildchine in the current year. 2 a. Machine A. b. Machine B. c. Machine C. Complete the following questions by preparing worksheet and journal entries given below. arded Required A Required B Required c Give all journal entries related to the disposal of Machine B in the current year. (If ne entry is required for a transaction/event select "No journal entry required" in the first account field.) No Debit Credit Transaction December 31 General Journal Depreciation expense Accumulated depreciation, Machine B 4.600 4.600 B December 31 Accumulated depreciation Machine B Loss on disposal of machine Equipment (Machine B) 36,800 x 13,200 X X X 50.000 x Sed templates no response was repected in color a formula base calculations correcting points de IMG_1752.jpg CMT20210402 IMG_1750.jpg IMG_1751.jpg Doen ile the current year. a. Machine A. b. Machine B. C. Machine C. 1 Complete the following questions by preparing worksheet and journal entries given below. Required A Required B Required C Give all journal entries related to the disposal of Machine C in the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction January 01 Debit Credit General Journal Depreciation expense Accumulated depreciation, Machine C 5333 5,333 B January 01 Accumulated depreciation, Machine C Loss on disposal of machine Equipment (Machine C) SS S 64,000 21.000 85.000