Question

Asset Purchases (assuming no Section 179 or bonus depreciation applies) After reviewing the purchases in 2022 found on Invoices #19, #25, and #28 from Cool

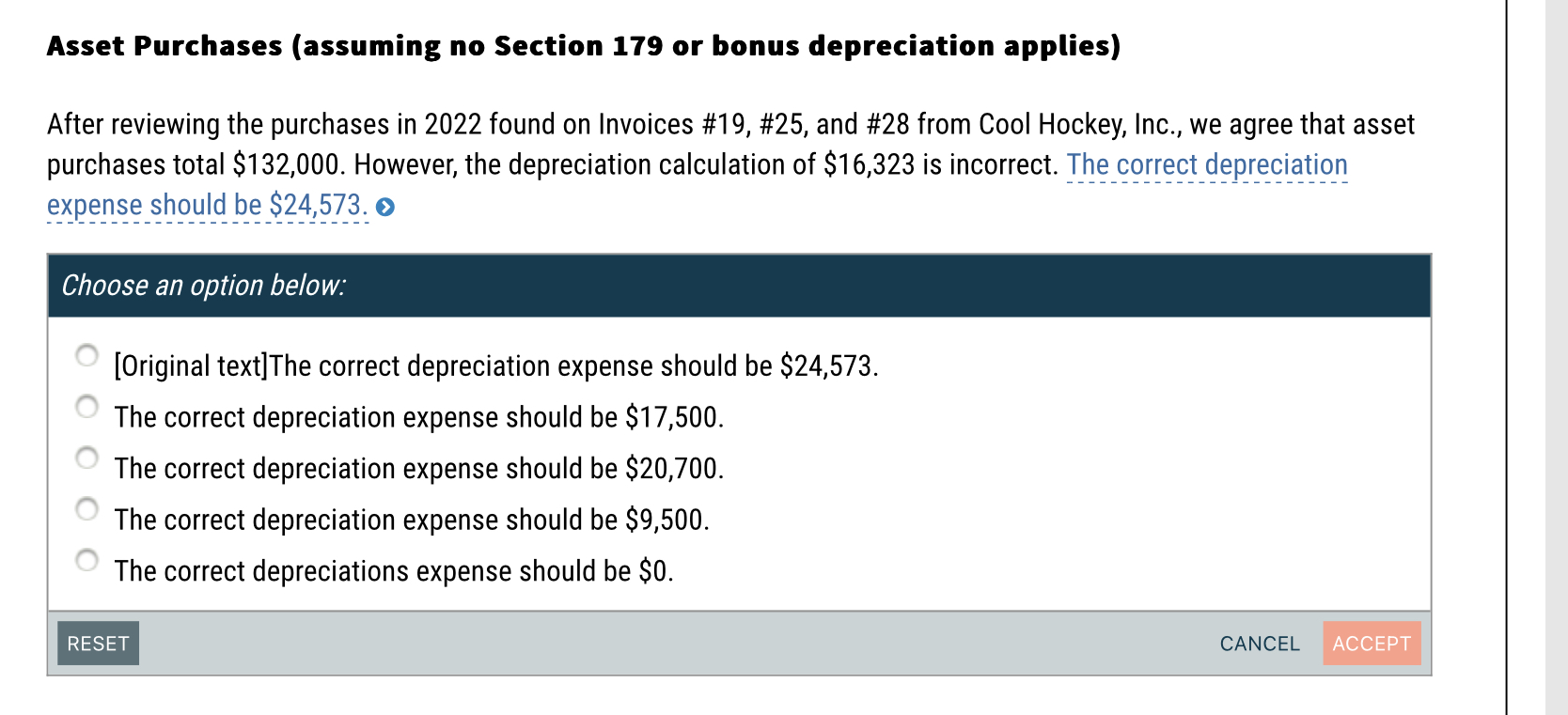

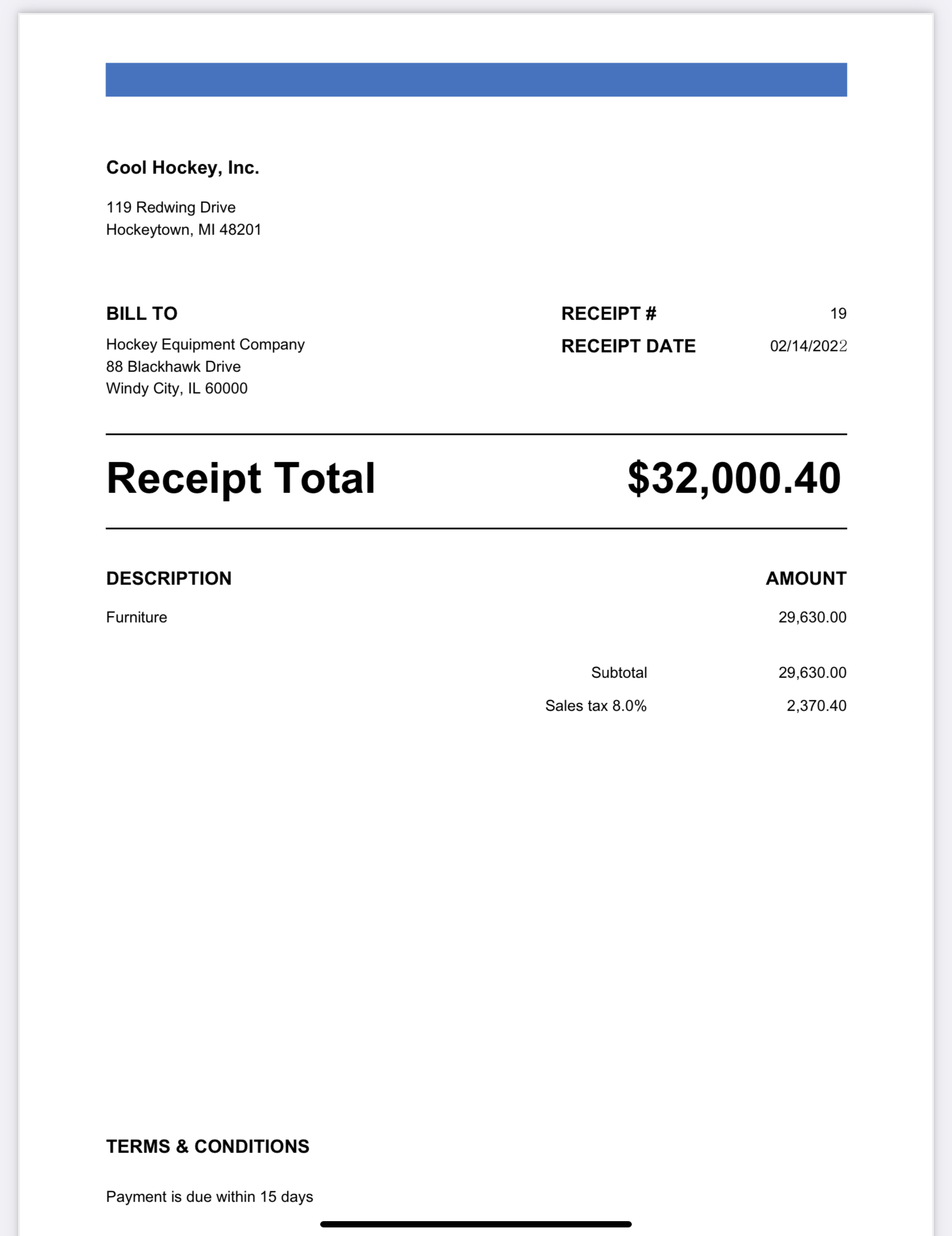

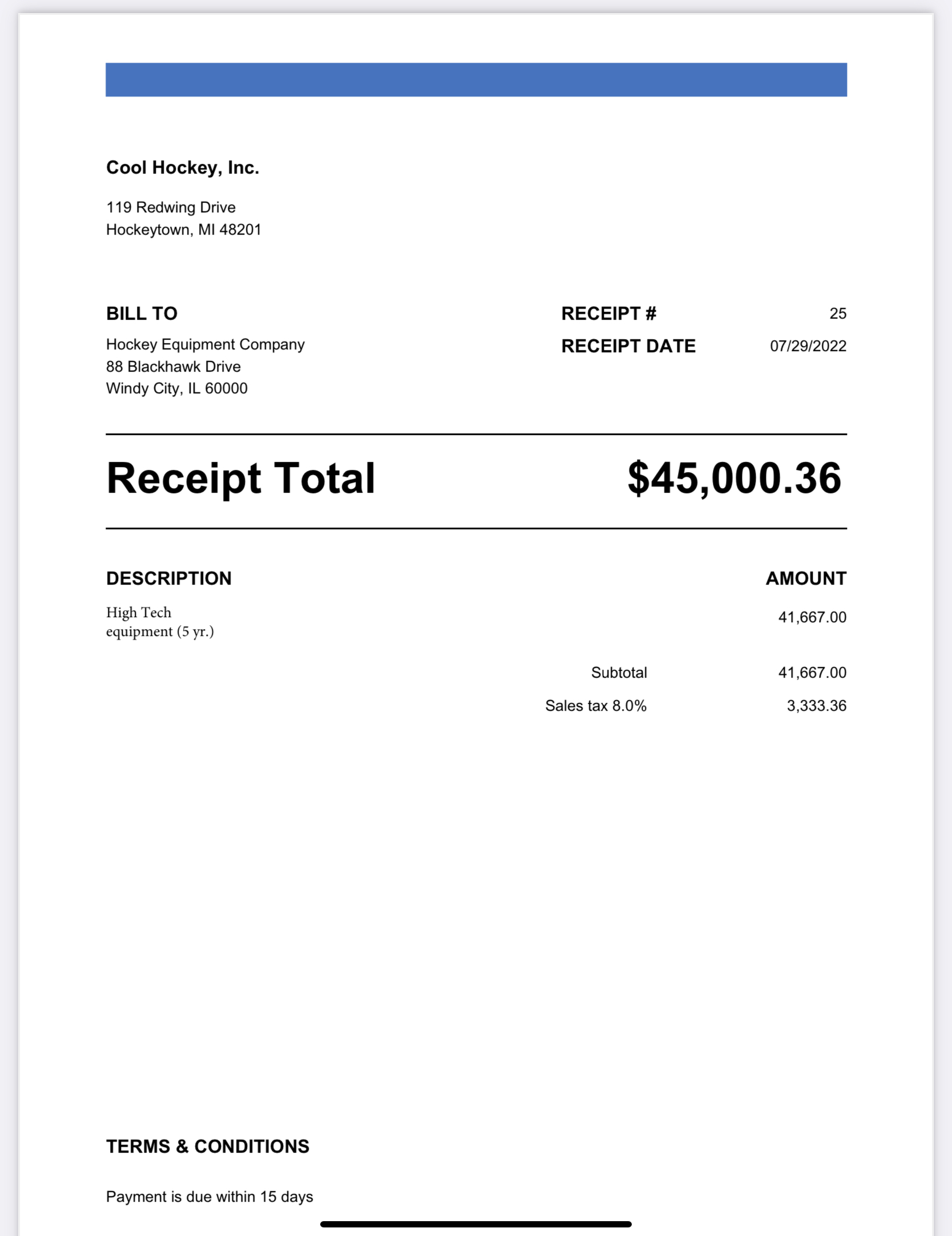

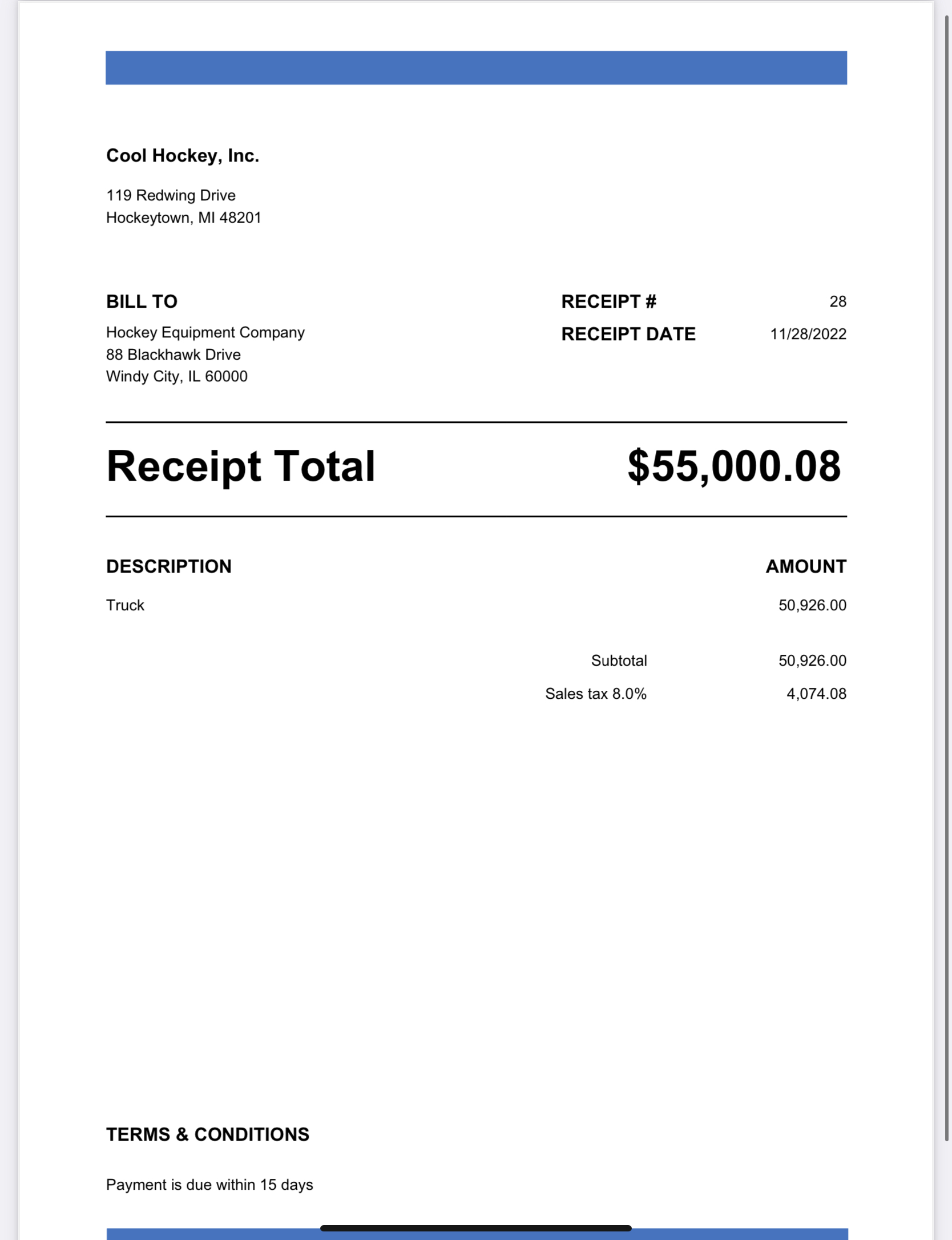

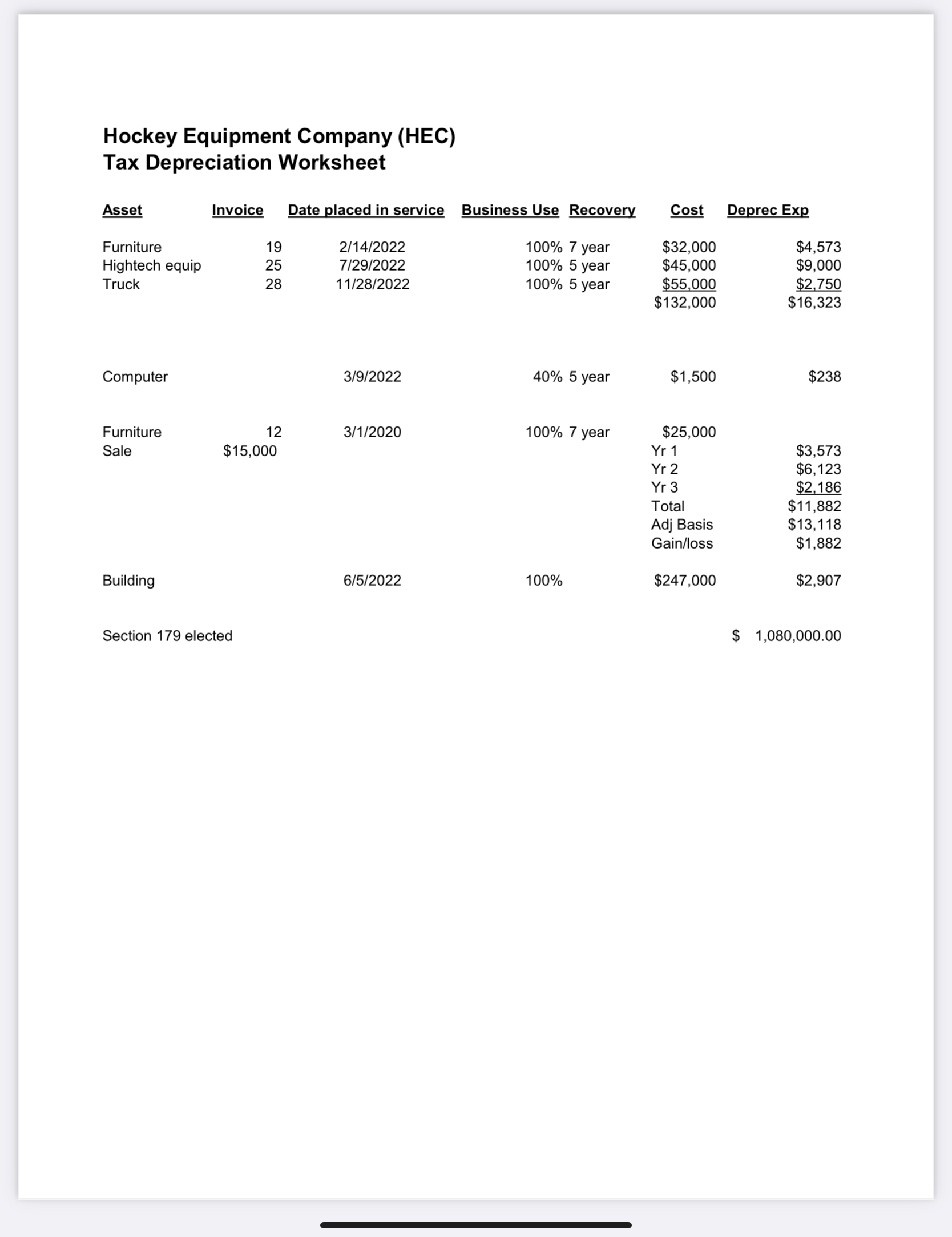

Asset Purchases (assuming no Section 179 or bonus depreciation applies) After reviewing the purchases in 2022 found on Invoices #19, #25, and #28 from Cool Hockey, Inc., we agree that asset purchases total $132,000. However, the depreciation calculation of $16,323 is incorrect. The correct depreciation expense should be $24,573. 0 Choose an option below: [Original text]The correct depreciation expense should be $24,573. The correct depreciation expense should be $17,500. The correct depreciation expense should be $20,700. The correct depreciation expense should be $9,500. The correct depreciations expense should be $0.

Asset Purchases (assuming no Section 179 or bonus depreciation applies) After reviewing the purchases in 2022 found on Invoices #19, #25, and #28 from Cool Hockey, Inc., we agree that asset purchases total $132,000. However, the depreciation calculation of $16,323 is incorrect. The correct depreciation expense should be $24,573. 0 Choose an option below: [Original text]The correct depreciation expense should be $24,573. The correct depreciation expense should be $17,500. The correct depreciation expense should be $20,700. The correct depreciation expense should be $9,500. The correct depreciations expense should be $0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started