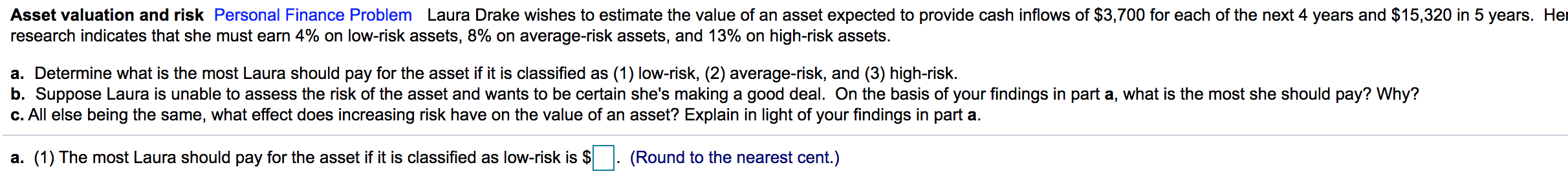

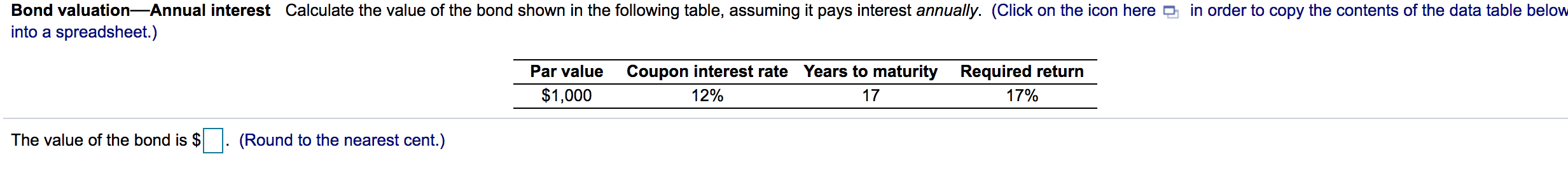

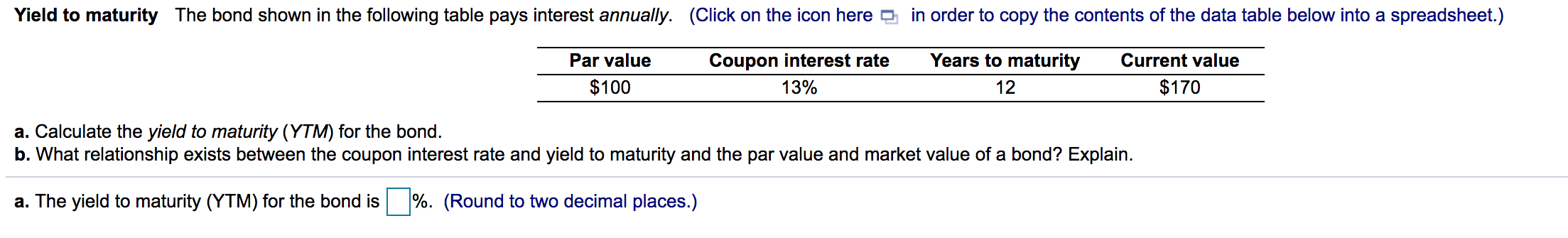

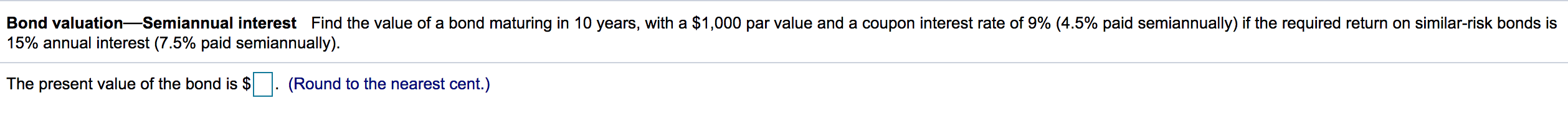

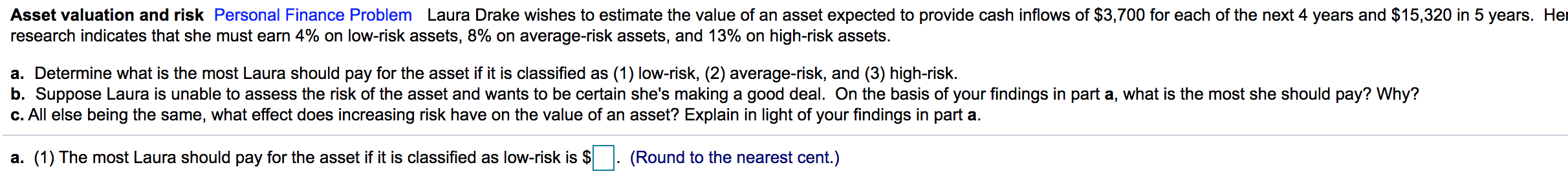

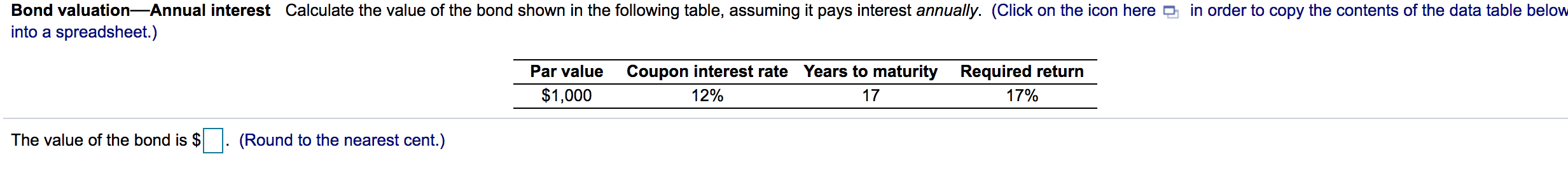

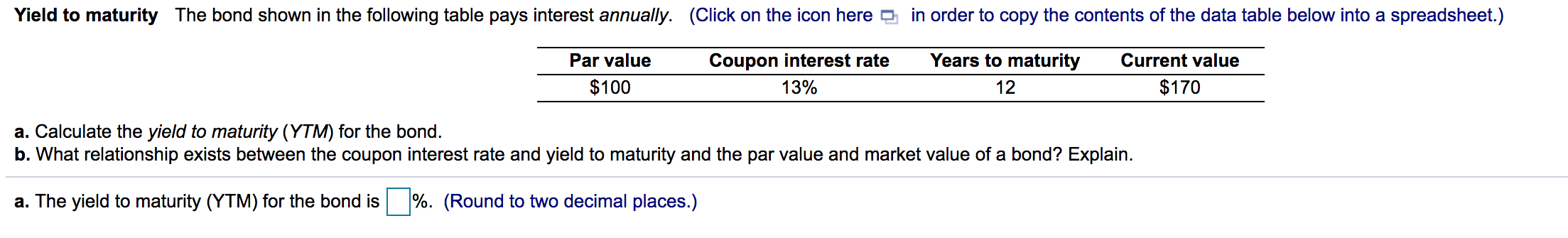

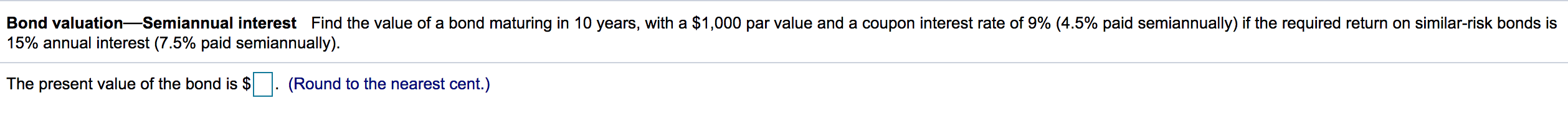

Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $3,700 for each of the next 4 years and $15,320 in 5 years. Her research indicates that she must earn 4% on low-risk assets, 8% on average-risk assets, and 13% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $ (Round to the nearest cent.) Bond valuationAnnual interest Calculate the value of the bond shown in the following table, assuming it pays interest annually. (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Par value $1,000 Coupon interest rate Years to maturity Required return 12% 17 17% The value of the bond is $ (Round to the nearest cent.) Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Par value $100 Coupon interest rate 13% Years to maturity 12 Current value $170 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is %. (Round to two decimal places.) Bond valuation Semiannual interest Find the value of a bond maturing in 10 years, with a $1,000 par value and a coupon interest rate of 9% (4.5% paid semiannually) if the required return on similar-risk bonds is 15% annual interest (7.5% paid semiannually). The present value of the bond is $ (Round to the nearest cent.) Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $3,700 for each of the next 4 years and $15,320 in 5 years. Her research indicates that she must earn 4% on low-risk assets, 8% on average-risk assets, and 13% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $ (Round to the nearest cent.) Bond valuationAnnual interest Calculate the value of the bond shown in the following table, assuming it pays interest annually. (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Par value $1,000 Coupon interest rate Years to maturity Required return 12% 17 17% The value of the bond is $ (Round to the nearest cent.) Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Par value $100 Coupon interest rate 13% Years to maturity 12 Current value $170 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is %. (Round to two decimal places.) Bond valuation Semiannual interest Find the value of a bond maturing in 10 years, with a $1,000 par value and a coupon interest rate of 9% (4.5% paid semiannually) if the required return on similar-risk bonds is 15% annual interest (7.5% paid semiannually). The present value of the bond is $ (Round to the nearest cent.)