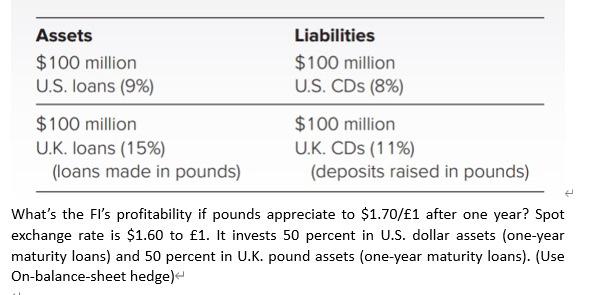

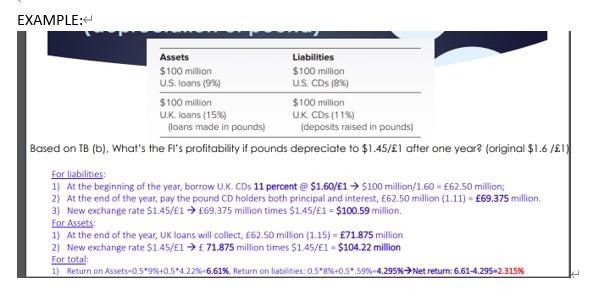

Assets $ 100 million U.S. loans (9%) Liabilities $100 million U.S. CDs (8%) $100 million U.K. loans (15%) (loans made in pounds) $100 million UK. CDs (11%) (deposits raised in pounds) What's the Fl's profitability if pounds appreciate to $1.70/1 after one year? Spot exchange rate is $1.60 to 1. It invests 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound assets (one-year maturity loans). (Use On-balance-sheet hedge) EXAMPLE: Assets Liabilities $100 million $100 million U.S. loans (99) US CDs (8%) $100 million $100 million UK loans (15%) UK CDs (11%) loans made in pounds (deposits raised in pounds) Based on TB (b). What's the fil's profitability if pounds depreciate to $1.45/1 after one year? (original $1.6/21 For liabilities: 1) At the beginning of the year, borrow U.K. CDs 11 percent @ $1.60/E1 $100 million/1.60 E62.50 million; 2) At the end of the year, pay the pound CD holders both principal and interest, 62.50 million (1.11) - 69.375 million 3) New exchange rate $1.45/1 69.375 million times $1.45/1 = $100.59 million, For Assets 1) At the end of the year, UK loans will collect, 62.50 million (1.15) = 71.875 million 2) New exchange rate $1.45/E1 71.875 million times $1.45/1 = $104.22 million For total 1) Return on Assets=0.59%4051.22% 6.61%. Return on abilities: 0508%+0.5 59% 4.295%Net return: 6.61-4.295-2 315% Assets $ 100 million U.S. loans (9%) Liabilities $100 million U.S. CDs (8%) $100 million U.K. loans (15%) (loans made in pounds) $100 million UK. CDs (11%) (deposits raised in pounds) What's the Fl's profitability if pounds appreciate to $1.70/1 after one year? Spot exchange rate is $1.60 to 1. It invests 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound assets (one-year maturity loans). (Use On-balance-sheet hedge) EXAMPLE: Assets Liabilities $100 million $100 million U.S. loans (99) US CDs (8%) $100 million $100 million UK loans (15%) UK CDs (11%) loans made in pounds (deposits raised in pounds) Based on TB (b). What's the fil's profitability if pounds depreciate to $1.45/1 after one year? (original $1.6/21 For liabilities: 1) At the beginning of the year, borrow U.K. CDs 11 percent @ $1.60/E1 $100 million/1.60 E62.50 million; 2) At the end of the year, pay the pound CD holders both principal and interest, 62.50 million (1.11) - 69.375 million 3) New exchange rate $1.45/1 69.375 million times $1.45/1 = $100.59 million, For Assets 1) At the end of the year, UK loans will collect, 62.50 million (1.15) = 71.875 million 2) New exchange rate $1.45/E1 71.875 million times $1.45/1 = $104.22 million For total 1) Return on Assets=0.59%4051.22% 6.61%. Return on abilities: 0508%+0.5 59% 4.295%Net return: 6.61-4.295-2 315%