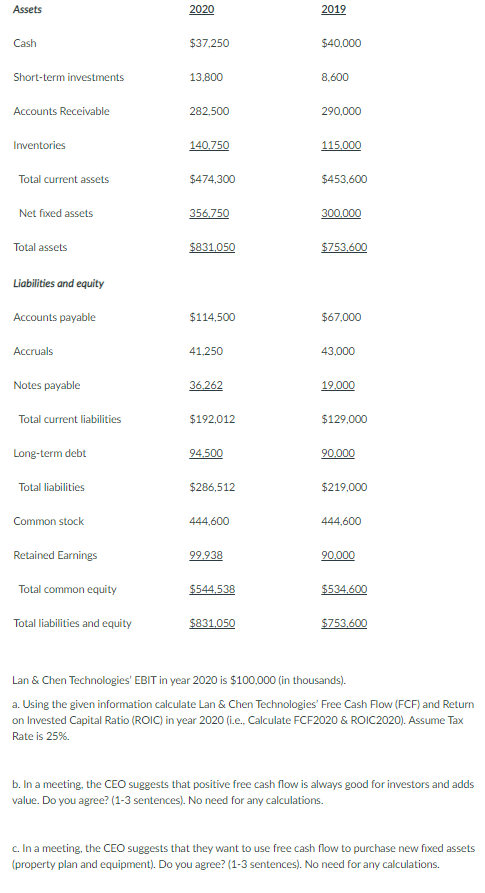

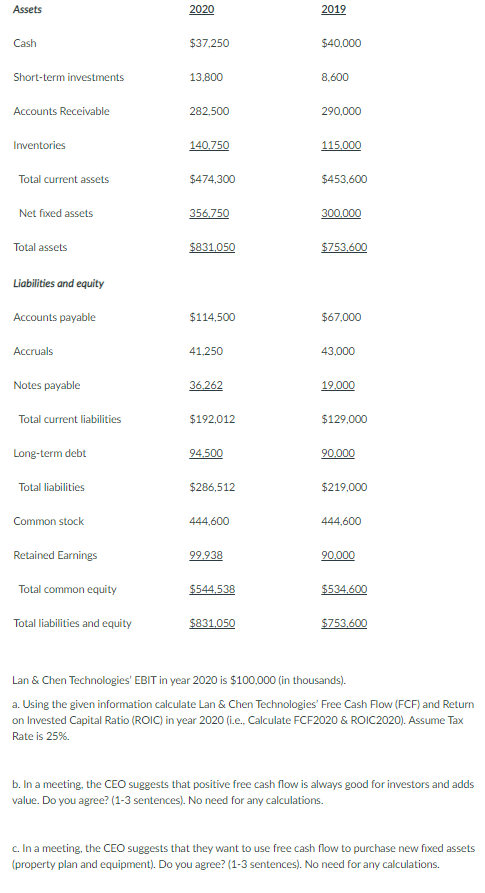

Assets 2020 2019 Cash $37,250 $40,000 Short-term investments 13.800 8.600 Accounts Receivable 282,500 290,000 Inventories 140.750 115.000 Total current assets $474.300 $453,600 Net fixed assets 356.750 300.000 Total assets $831,050 $753,600 Liabilities and equity Accounts payable $114,500 $67,000 Accruals 41.250 43,000 Notes payable 36.262 19.000 Total current liabilities $192,012 $129,000 Long-term debt 94.500 90.000 Total liabilities $286,512 $219,000 Common stock 444,600 444,600 Retained Earnings 99.938 90,000 Total common equity $544,538 $534,600 Total liabilities and equity $831,050 $753,600 Lan & Chen Technologies' EBIT in year 2020 is $100,000 (in thousands). a. Using the given information calculate Lan & Chen Technologies Free Cash Flow (FCF) and Return on Invested Capital Ratio (ROIC) in year 2020 (i.e. Calculate FCF2020 & ROIC2020). Assume Tax Rate is 25%. b. In a meeting, the CEO suggests that positive free cash flow is always good for investors and adds value. Do you agree? (1-3 sentences). No need for any calculations. C. In a meeting, the CEO suggests that they want to use free cash flow to purchase new fixed assets (property plan and equipment). Do you agree? (1-3 sentences). No need for any calculations. Assets 2020 2019 Cash $37,250 $40,000 Short-term investments 13.800 8.600 Accounts Receivable 282,500 290,000 Inventories 140.750 115.000 Total current assets $474.300 $453,600 Net fixed assets 356.750 300.000 Total assets $831,050 $753,600 Liabilities and equity Accounts payable $114,500 $67,000 Accruals 41.250 43,000 Notes payable 36.262 19.000 Total current liabilities $192,012 $129,000 Long-term debt 94.500 90.000 Total liabilities $286,512 $219,000 Common stock 444,600 444,600 Retained Earnings 99.938 90,000 Total common equity $544,538 $534,600 Total liabilities and equity $831,050 $753,600 Lan & Chen Technologies' EBIT in year 2020 is $100,000 (in thousands). a. Using the given information calculate Lan & Chen Technologies Free Cash Flow (FCF) and Return on Invested Capital Ratio (ROIC) in year 2020 (i.e. Calculate FCF2020 & ROIC2020). Assume Tax Rate is 25%. b. In a meeting, the CEO suggests that positive free cash flow is always good for investors and adds value. Do you agree? (1-3 sentences). No need for any calculations. C. In a meeting, the CEO suggests that they want to use free cash flow to purchase new fixed assets (property plan and equipment). Do you agree? (1-3 sentences). No need for any calculations