Answered step by step

Verified Expert Solution

Question

1 Approved Answer

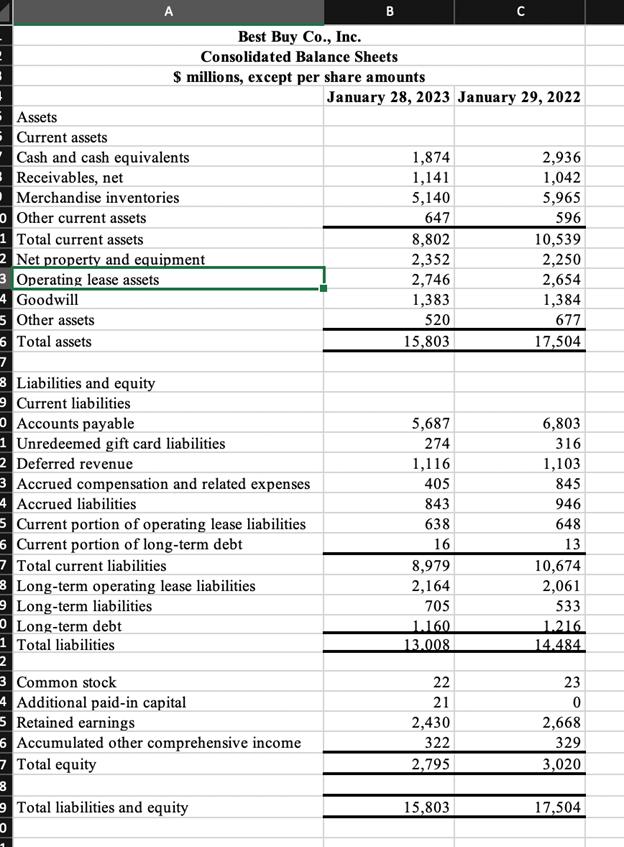

Assets 5 Current assets A Best Buy Co., Inc. Consolidated Balance Sheets $ millions, except per share amounts Cash and cash equivalents Receivables, net

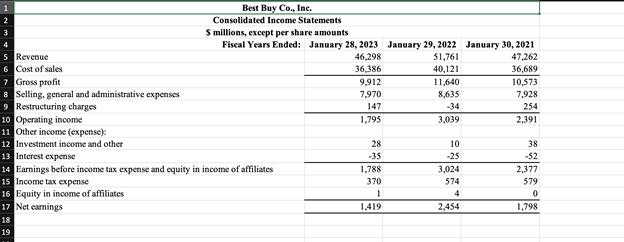

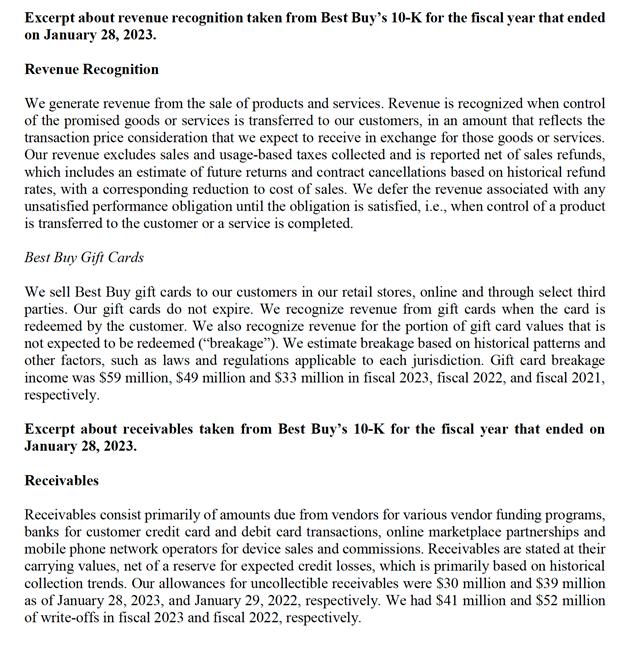

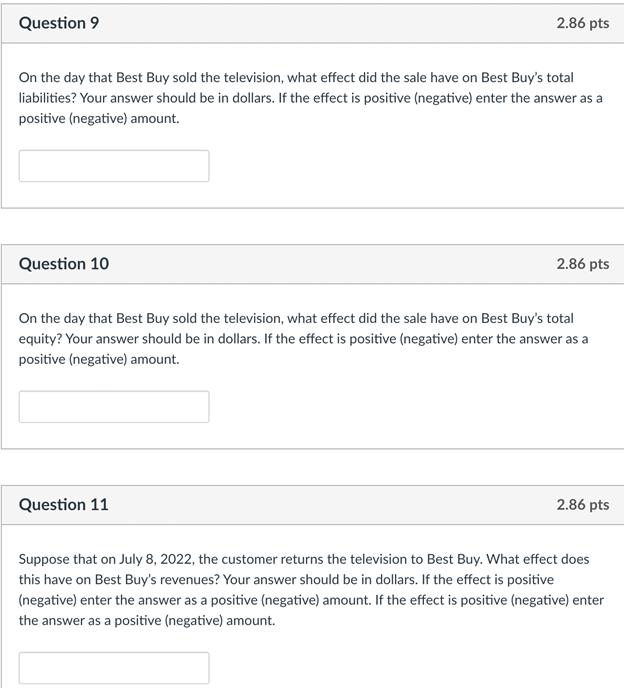

Assets 5 Current assets A Best Buy Co., Inc. Consolidated Balance Sheets $ millions, except per share amounts Cash and cash equivalents Receivables, net O Merchandise inventories 0 Other current assets 1 Total current assets 2 Net property and equipment 3 Operating lease assets 4 Goodwill 5 Other assets 6 Total assets 7 8 Liabilities and equity 9 Current liabilities 0 Accounts payable 1 Unredeemed gift card liabilities 2 Deferred revenue 3 Accrued compensation and related expenses 4 Accrued liabilities 5 Current portion of operating lease liabilities 6 Current portion of long-term debt 7 Total current liabilities B 3 Long-term operating lease liabilities 9 Long-term liabilities O Long-term debt 1 Total liabilities 2 3 Common stock 4 Additional paid-in capital 5 Retained earnings 6 Accumulated other comprehensive income 7 Total equity 8 9Total liabilities and equity 10 January 28, 2023 January 29, 2022 1,874 1,141 5,140 647 8,802 2,352 2,746 1,383 520 15,803 5,687 274 1,116 405 843 638 16 8,979 2,164 705 1.160 13.008 22 21 2,430 322 2,795 C 15,803 2,936 1,042 5,965 596 10,539 2,250 2,654 1,384 677 17,504 6,803 316 1,103 845 946 648 13 10,674 2,061 533 1.216 14.484 23 0 2,668 329 3,020 17,504 2 5 Revenue 6 Cost of sales 7 Gross profit 8 Selling, general and administrative expenses 9 Restructuring charges 10 Operating income 11 Other income (expense): 12 Investment income and other 13 Interest expense 14 Earnings before income tax expense and equity in income of affiliates 15 Income tax expense 16 Equity in income of affiliates 17 Net earnings Best Buy Co., Inc. Consolidated Income Statements S millions, except per share amounts Fiscal Years Ended: January 28, 2023 January 29, 2022 January 30, 2021 46,298 51,761 47,262 36,386 40,121 36,689 11,640 10,573 8,635 7,928 -34 254 3,039 2,391 18 19 9,912 7,970 147 1,795 28 -35 1,788 370 1 1,419 10 -25 3,024 574 4 2,454 38 -52 2,377 579 0 1,798 Excerpt about revenue recognition taken from Best Buy's 10-K for the fiscal year that ended on January 28, 2023. Revenue Recognition We generate revenue from the sale of products and services. Revenue is recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the transaction price consideration that we expect to receive in exchange for those goods or services. Our revenue excludes sales and usage-based taxes collected and is reported net of sales refunds, which includes an estimate of future returns and contract cancellations based on historical refund rates, with a corresponding reduction to cost of sales. We defer the revenue associated with any unsatisfied performance obligation until the obligation is satisfied, i.e., when control of a product is transferred to the customer or a service is completed. Best Buy Gift Cards We sell Best Buy gift cards to our customers in our retail stores, online and through select third parties. Our gift cards do not expire. We recognize revenue from gift cards when the card is redeemed by the customer. We also recognize revenue for the portion of gift card values that is not expected to be redeemed ("breakage"). We estimate breakage based on historical patterns and other factors, such as laws and regulations applicable to each jurisdiction. Gift card breakage income was $59 million, $49 million and $33 million in fiscal 2023, fiscal 2022, and fiscal 2021, respectively. Excerpt about receivables taken from Best Buy's 10-K for the fiscal year that ended on January 28, 2023. Receivables Receivables consist primarily of amounts due from vendors for various vendor funding programs, banks for customer credit card and debit card transactions, online marketplace partnerships and mobile phone network operators for device sales and commissions. Receivables are stated at their carrying values, net of a reserve for expected credit losses, which is primarily based on historical collection trends. Our allowances for uncollectible receivables were $30 million and $39 million as of January 28, 2023, and January 29, 2022, respectively. We had $41 million and $52 million of write-offs in fiscal 2023 and fiscal 2022, respectively. Question 9 On the day that Best Buy sold the television, what effect did the sale have on Best Buy's total liabilities? Your answer should be in dollars. If the effect is positive (negative) enter the answer as a positive (negative) amount. Question 10 2.86 pts Question 11 2.86 pts On the day that Best Buy sold the television, what effect did the sale have on Best Buy's total equity? Your answer should be in dollars. If the effect is positive (negative) enter the answer as a positive (negative) amount. 2.86 pts Suppose that on July 8, 2022, the customer returns the television to Best Buy. What effect does this have on Best Buy's revenues? Your answer should be in dollars. If the effect is positive (negative) enter the answer as a positive (negative) amount. If the effect is positive (negative) enter the answer as a positive (negative) amount.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 9 To calculate the effect on Best Buys total liabilities when the television is sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started