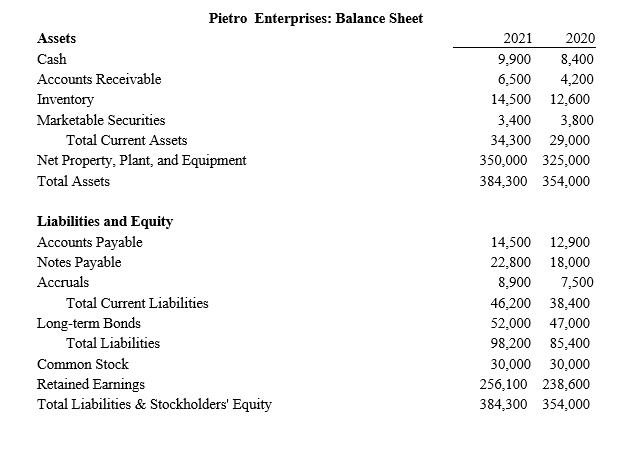

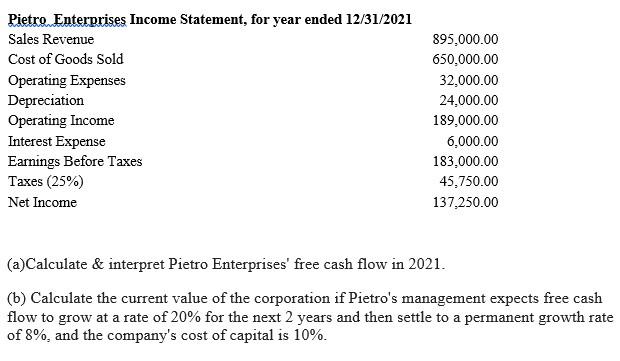

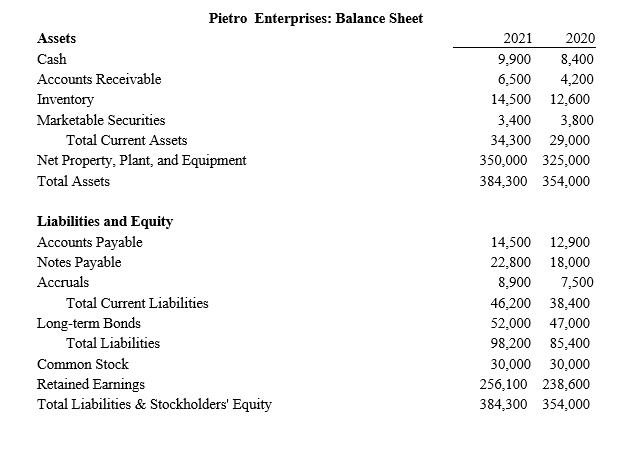

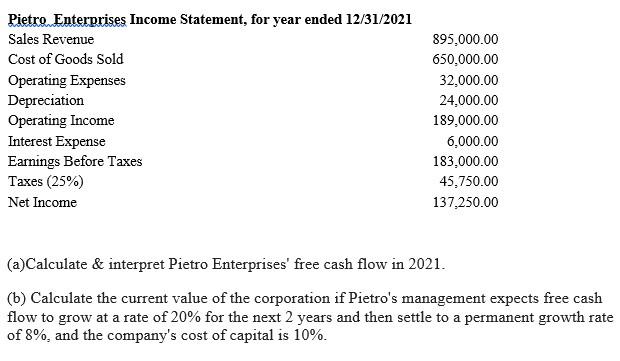

Assets Cash Accounts Receivable Inventory Marketable Securities Total Current Assets Net Property, Plant, and Equipment Total Assets Liabilities and Equity Accounts Payable Notes Payable Accruals Pietro Enterprises: Balance Sheet Total Current Liabilities Long-term Bonds Total Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity 2021 2020 9,900 8,400 6,500 4,200 14,500 12,600 3,400 3,800 34,300 29,000 350,000 325,000 384,300 354,000 14,500 12,900 22,800 18,000 8,900 7,500 46,200 38,400 52,000 47,000 98,200 85,400 30,000 30,000 256,100 238,600 384,300 354,000 Pietro Enterprises Income Statement, for year ended 12/31/2021 Sales Revenue Cost of Goods Sold Operating Expenses Depreciation Operating Income Interest Expense Earnings Before Taxes Taxes (25%) Net Income 895,000.00 650,000.00 32,000.00 24,000.00 189,000.00 6,000.00 183,000.00 45,750.00 137,250.00 (a)Calculate & interpret Pietro Enterprises' free cash flow in 2021. (b) Calculate the current value of the corporation if Pietro's management expects free cash flow to grow at a rate of 20% for the next 2 years and then settle to a permanent growth rate of 8%, and the company's cost of capital is 10%. Assets Cash Accounts Receivable Inventory Marketable Securities Total Current Assets Net Property, Plant, and Equipment Total Assets Liabilities and Equity Accounts Payable Notes Payable Accruals Pietro Enterprises: Balance Sheet Total Current Liabilities Long-term Bonds Total Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity 2021 2020 9,900 8,400 6,500 4,200 14,500 12,600 3,400 3,800 34,300 29,000 350,000 325,000 384,300 354,000 14,500 12,900 22,800 18,000 8,900 7,500 46,200 38,400 52,000 47,000 98,200 85,400 30,000 30,000 256,100 238,600 384,300 354,000 Pietro Enterprises Income Statement, for year ended 12/31/2021 Sales Revenue Cost of Goods Sold Operating Expenses Depreciation Operating Income Interest Expense Earnings Before Taxes Taxes (25%) Net Income 895,000.00 650,000.00 32,000.00 24,000.00 189,000.00 6,000.00 183,000.00 45,750.00 137,250.00 (a)Calculate & interpret Pietro Enterprises' free cash flow in 2021. (b) Calculate the current value of the corporation if Pietro's management expects free cash flow to grow at a rate of 20% for the next 2 years and then settle to a permanent growth rate of 8%, and the company's cost of capital is 10%