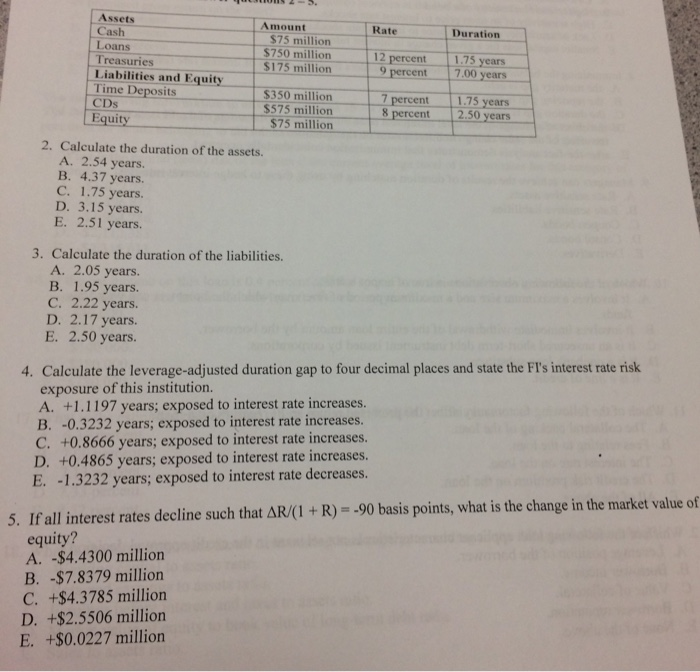

Assets Cash Loans Treasuries Liabilities and Equity Time Deposits CDs Amount Rate Duratiorn $75 million $750 million $175 million 12 percent 1.75 years 9 percent 7.00 years S350 million $575 million $75 million 7percent 1.75 years 8 percent 2.50 years Equity 2. Calculate the duration of the assets. A. 2.54 years. B. 4.37 years. C. 1.75 years. D. 3.15 years. E. 2.51 years. 3. Calculate the duration of the liabilities. A. 2.05 years. B. 1.95 years. C. 2.22 years. D. 2.17 years. E. 2.50 years. 4. Calculate the leverage-adjusted duration gap to four decimal places and state the FI's interest rate risk exposure of this institution. A. +1.1197 years; exposed to interest rate increases. B. -0.3232 years, exposed to interest rate increases. C. +0.8666 years; exposed to interest rate increases. D. +0.4865 years; exposed to interest rate increases. E. -1.3232 years; exposed to interest rate decreases. AR/(I + R)-90 basis points, what is the change in the market value of 5. If all interest rates decline such that equity? A. -$4.4300 million B. -$7.8379 million C. +$4.3785 million D. +$2.5506 million E. +$0.0227 million Assets Cash Loans Treasuries Liabilities and Equity Time Deposits CDs Amount Rate Duratiorn $75 million $750 million $175 million 12 percent 1.75 years 9 percent 7.00 years S350 million $575 million $75 million 7percent 1.75 years 8 percent 2.50 years Equity 2. Calculate the duration of the assets. A. 2.54 years. B. 4.37 years. C. 1.75 years. D. 3.15 years. E. 2.51 years. 3. Calculate the duration of the liabilities. A. 2.05 years. B. 1.95 years. C. 2.22 years. D. 2.17 years. E. 2.50 years. 4. Calculate the leverage-adjusted duration gap to four decimal places and state the FI's interest rate risk exposure of this institution. A. +1.1197 years; exposed to interest rate increases. B. -0.3232 years, exposed to interest rate increases. C. +0.8666 years; exposed to interest rate increases. D. +0.4865 years; exposed to interest rate increases. E. -1.3232 years; exposed to interest rate decreases. AR/(I + R)-90 basis points, what is the change in the market value of 5. If all interest rates decline such that equity? A. -$4.4300 million B. -$7.8379 million C. +$4.3785 million D. +$2.5506 million E. +$0.0227 million