Answered step by step

Verified Expert Solution

Question

1 Approved Answer

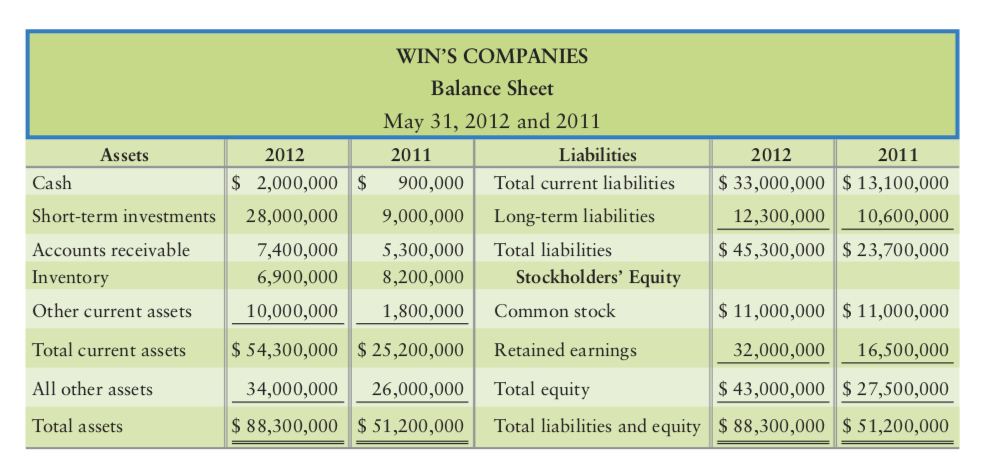

Assets Cash Short-term investments Accounts receivable Inventory Other current assets WIN'S COMPANIES Balance Sheet May 31, 2012 and 2011 2012 2011 Liabilities $ 2,000,000 $

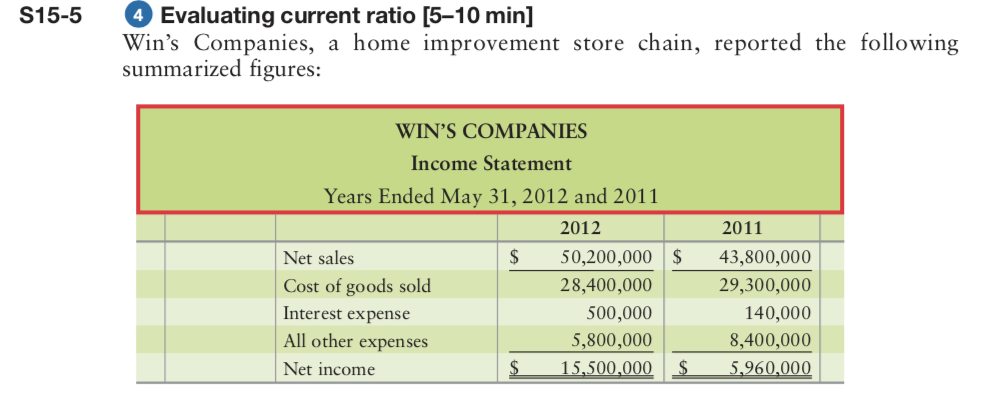

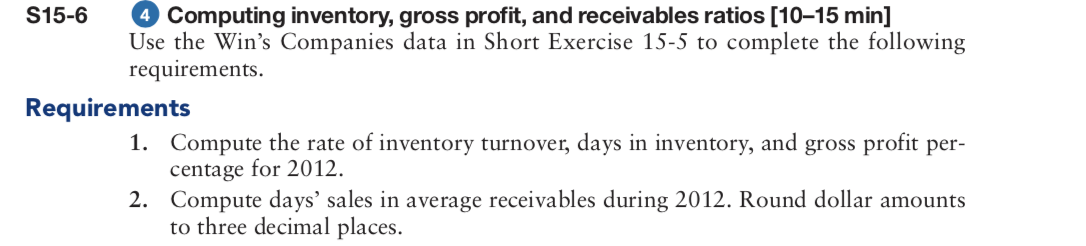

Assets Cash Short-term investments Accounts receivable Inventory Other current assets WIN'S COMPANIES Balance Sheet May 31, 2012 and 2011 2012 2011 Liabilities $ 2,000,000 $ 900,000 Total current liabilities 28,000,000 9,000,000 Long-term liabilities 7,400,000 5,300,000 Total liabilities 6,900,000 8,200,000 Stockholders' Equity 10,000,000 1,800,000 Common stock $ 54,300,000 $ 25,200,000 Retained earnings 34,000,000 26,000,000 Total equity $ 88,300,000 $ 51,200,000 Total liabilities and equity 2012 2011 $ 33,000,000 $13,100,000 12,300,000 10,600,000 $ 45,300,000 $ 23,700,000 $ 11,000,000 $ 11,000,000 32,000,000 16,500,000 Total current assets All other assets $ 43,000,000 $ 27,500,000 $ 88,300,000 $ 51,200,000 Total assets S15-5 4 Evaluating current ratio [5-10 min] Win's Companies, a home improvement store chain, reported the following summarized figures: WIN'S COMPANIES Income Statement Years Ended May 31, 2012 and 2011 2012 Net sales $ 50,200,000 Cost of goods sold 28,400,000 Interest expense 500,000 All other expenses 5,800,000 Net income $ 15,500,000 $ 2011 43,800,000 29,300,000 140,000 8,400,000 5,960,000 $ S15-6 4 Computing inventory, gross profit, and receivables ratios (10-15 min] Use the Win's Companies data in Short Exercise 15-5 to complete the following requirements. Requirements 1. Compute the rate of inventory turnover, days in inventory, and gross profit per- centage for 2012. 2. Compute days' sales in average receivables during 2012. Round dollar amounts to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started