Answered step by step

Verified Expert Solution

Question

1 Approved Answer

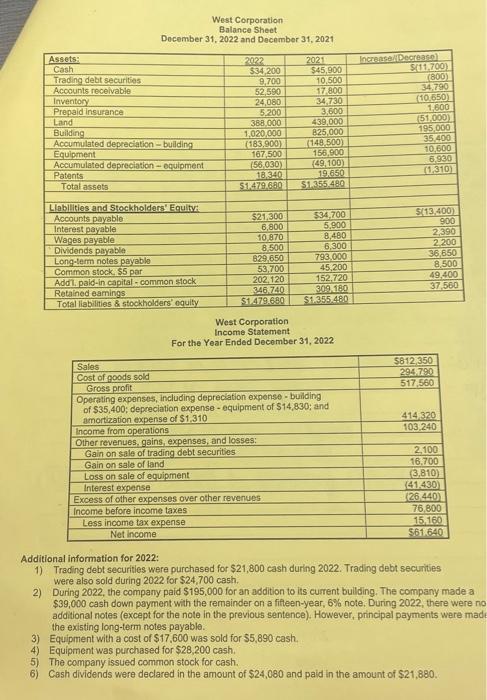

Assets: Cash Trading debt securities Accounts receivable West Corporation Balance Sheet December 31, 2022 and December 31, 2021 Inventory Prepaid insurance Land Building Accumulated depreciation

Assets: Cash Trading debt securities Accounts receivable West Corporation Balance Sheet December 31, 2022 and December 31, 2021 Inventory Prepaid insurance Land Building Accumulated depreciation - building Equipment Accumulated depreciation - equipment Patents Total assets Liabilities and Stockholders' Equity: Accounts payable Interest payable Wages payable Dividends payable Long-term notes payable Common stock, $5 par Add'l. paid-in capital - common stock Retained earnings Total liabilities & stockholders' equity 2022 $34,200 9,700 52,590 24,080 5,200 388,000 1,020,000 (183,900) 167,500 Less income tax expense Net income (56,030) 18,340 $1.479.680 $21,300 6,800 10,870 8,500 829,650 53,700 202,120 346,740 $1,479,680 2021 $45,900 10,500 17,800 34,730 3,600 439,000 825,000 (148,500) 156,900 (49,100) 19,650 $1.355.480 $34,700 5,900 8,480 6,300 793,000 45,200 152,720 309,180 $1,355.480 West Corporation Income Statement For the Year Ended December 31, 2022 Sales Cost of goods sold Gross profit Operating expenses, including depreciation expense - building of $35,400; depreciation expense - equipment of $14,830; and amortization expense of $1,310 Income from operations Other revenues, gains, expenses, and losses: Gain on sale of trading debt securities Gain on sale of land Loss on sale of equipment Interest expense Excess of other expenses over other revenues Income before income taxes Increase/(Decrease) $(11,700) (800) 34,790 (10,650) 1,600 (51,000) 195,000 35,400 10,600 6,930 (1,310) $(13,400) 900 2,390 2,200 36,650 8,500 49,400 37,560 $812,350 294,790 517,560 414,320 103,240 2,100 16,700 (3,810) (41,430) (26,440) 76,800 15,160 $61.640 Additional information for 2022: 1) Trading debt securities were purchased for $21,800 cash during 2022. Trading debt securities were also sold during 2022 for $24,700 cash. 2) During 2022, the company paid $195,000 for an addition to its current building. The company made a $39,000 cash down payment with the remainder on a fifteen-year, 6% note. During 2022, there were no additional notes (except for the note in the previous sentence). However, principal payments were made the existing long-term notes payable. 3) Equipment with a cost of $17,600 was sold for $5,890 cash. 4) Equipment was purchased for $28,200 cash. 5) The company issued common stock for cash. 6) Cash dividends were declared in the amount of $24,080 and paid in the amount of $21,880. PREPARE A STATEMENT OF CASH FLOWS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started